The decisions on the spot Ethereum ETFs are still pending, with final deadlines for the SEC today and tomorrow for two of them.

There is a pretty comfortable majority thinking they will approve them, given the change in approach. VanVick and Fidelity already have tickers listed on the DTCC but inactive, waiting for the approval (something that happened exactly the same way prior to the approval of the spot Bitcoin ETFs in January, except they were temporarily active, probably by mistake).

I also believe they will be approved, but it's not much time until we'll have the official answer.

In the meantime, I read what was the amendment required by the SEC for the spot Ethereum ETF applications. Their requirement was that the underlying Ether coins of the ETF will not be staked, thus not participating in the Ethereum governance, I add.

That's obviously a great provision that makes taking over control of the Ethereum governance unlikely through the spot Ethereum ETFs.

However, even if Ether from ETFs isn't staked, it is still kind of locked into the ETFs, subject to operations with the shares into the funds. But I believe governance concerns were not what prompted this requirement. It's a great one, nonetheless.

If we expect these funds to grow - and we do - on top of the staked Ether, there will be another category of Ether in the ETFs which may create liquidity issues on Ethereum.

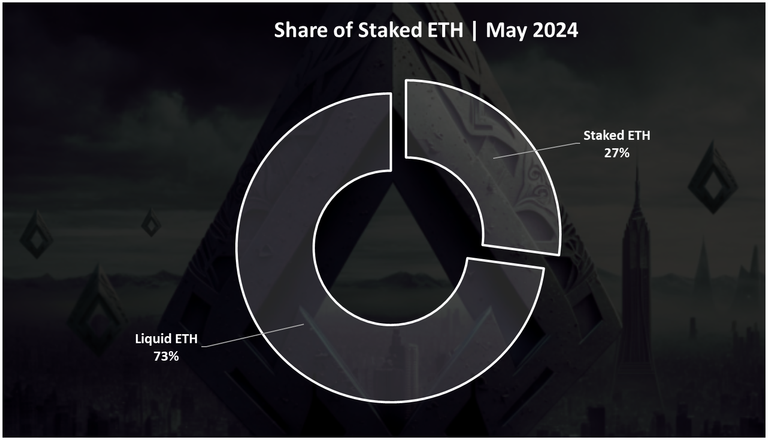

If we check @dalz's report on Ethereum staking levels from about a week ago, we see 27% of all Ether is staked, as in this chart I borrowed from his post:

What this chart doesn't say, but other charts say on dalz's post, is the trend of growing staked ETH compared to liquid ETH.

From another useful post of dalz from the beginning of the year, we learn that after switching from POW to POS, Ethereum became deflationary for the first time in 2023, a trend that is likely to continue, if nothing changes.

That means that the supply of ETH is shrinking as time goes by, instead of expanding. Couple that with an increase in staking, the likely large chunks of ETH that will be swallowed by the spot ETFs, and Ethereum may turn from a liquid coin to one with liquidity issues. And that is an issue for spot ETFs because they need liquidity to operate without creating serious volatility when they go in or out. I believe a similar discussion can be made on spot Bitcoin ETFs at some point.

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha