I thought this is a very useful list-type post, especially for people who don't have time to dive into all the options.

Let's get to it.

1. Splinterlands in-game Pools

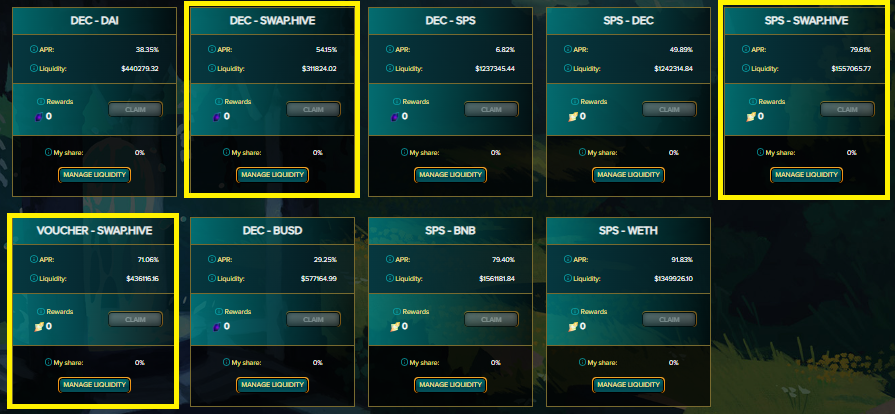

There are no less than 3 Splinterlands-related diesel pools containing SWAP.HIVE, that have in-game rewards:

- DEC-SWAP.HIVE (APR: 54.15%, rewarded token: DEC)

- SPS-SWAP.HIVE (APR: 79.61%, rewarded token: SPS)

- VOUCHER-SWAP.HIVE (APR: 71.06%, rewarded token: SPS)

As you can see there are some pretty impressive APRs.

The DEC-SWAP.HIVE and SPS-SWAP.HIVE diesel pools also have small BXT rewards associated with them, plus the transaction fees on all diesel pools.

Pros:

- Solid project paying the liquidity providers rewards (Splinterlands)

- higher-liquidity, low-spread Hive-Engine tokens received as rewards (DEC and SPS)

- holding a liquid HIVE derivative

Risks:

- Rewards not received as HIVE, volatility risk may be involved, particularly for SPS

- impermanent loss, the ever-present risk for liquidity pools (although if you want equally both tokens this risk doesn't exist, or if impermanent loss works in favor of the token you want more of, that's a bonus)

- Rewards can only be claimed in-gamed from the Splinterlands interface atm

2. SIM Power

Holding more than 8k SIM Power in the dCity game (could be as easy as holding it liquid in Hive-Engine or in the SWAP.HIVE-SIM diesel pool), makes you eligible to receive HIVE dividends from the game.

The game currently has a 157 HIVE dividend pool daily (250 max, subject to lobby voting).

That pool is divided among all the holders that qualify (that have above 8k SIM Power).

Today the APR was 41.99% and slowly dropping due to the daily raffles going on for SIM Club members, incentivizing more people to join the 1mil+ SIM club.

If that's not a great APR to be paid in HIVE, I don't know what is.

Also, if one has SIM in the SWAP.HIVE-SIM diesel pool, transaction fees can be earned, as well as BXT token rewards. BEE token rewards seem to have finished and are not extended.

Pros:

- Dividend paid as native HIVE

- No action needed, just holding (note: it takes time for the SIM power to increase or decrease as it is a 30-day average)

Risks:

- Potentially, the SIM token, which you need to hold to receive the dividend (the value of your investment could fluctuate a lot).

3. CubFinance

On CubFinance HIVE is present in two farms, in its wrapped form:

- bHBD-bHIVE, with 38% APR (very new farm)

- bHIVE-CUB, with 39% APR

Pros and risks are different between the two farms, depending on what the goal is for someone.

For someone who wants to build up both HBD and HIVE, the APR offered on this liquidity pool is still extraordinary. It's also the more stable pool between the two because bHIVE-CUB has both tokens volatile.

There is of course the question of whether the high APR is sustainable over a longer period of time.

The other benefit for both pools is the fact they are liquid.

On the negative side, and compared to diesel pools, BSC transaction fees eat away from profits. Rewards are paid in CUB, so increasing positions requires selling CUB into the two tokens of the liquidity pools (or adding directly to the pool as one-sided CUB, in the case of bHIVE-CUB, because PancakeSwap permits auto swapping from one token to have both tokens)

4. PolyCub

- pHIVE-POLYCUB, with 11.95% APR

The APR has dropped significantly for this farm on PolyCub, as the inflation on the platform dropped. We will see how that compares with bHIVE-CUB as more time passes. Right now the latter is 'hotter' because it's newer.

5. dLease

I admit I haven't checked this platform in quite some time. It seems its current interest rates for leases are on average 12-14%, but I saw a few at over 16% when I checked it today, which is pretty nice for something paid directly in native HIVE, daily.

6. Delegation to @leo.voter

This pays a 16% APR in LEO. Whether you want to keep the LEO and use it in its ecosystem or turn it to SWAP.HIVE, that's up to you, but the APR is one of the best and has been constant for a long time.

7. BROfund

I found it a little difficult to calculate the APR on this one because you have more parts interacting.

First, you can receive BRO tokens for your delegations to @brofi. About 0.03 BRO daily per 1k HP delegated, with BRO at 7+ HIVE.

Then you receive HIVE dividends weekly from BRO, based on your BRO holdings. If you have HP delegated and BRO keeps compounding, these dividends grow too.

And sometimes, but not always, your posts are voted by their account with a weight corresponding to your BRO holdings.

Since it has both native HIVE rewards and potential upvotes from time to time, I thought it would be a good option to include.

Posted Using LeoFinance Beta