In a space that no longer than 4 years ago was filled with ICOs that never went beyond the white or even blue paper level, talking about sustainability may be something premature.

We also had our share of projects whose purposes were short terms and dishonest to start with, to put it mildly.

Luckily the bear market flushes many of them away, but they'll resurface in a different form during the next bull market.

Going beyond these types of projects, we find failed tokenomics. They are not made purposely flawed, but the developers either miss the business and economic insight to see the poor design out of the gate or the experience to have done this before.

In many cases, it's a matter of experimenting with something completely new that no one has tried before. It's not like they have models they can apply. Most of the trailblazers in the crypto industry define the models themselves for others to use.

And we know every experiment has a high rate of failure before a breaking success happens (if it does).

These have been the early years in crypto, with some successes and many failures. And it's normal to be this way.

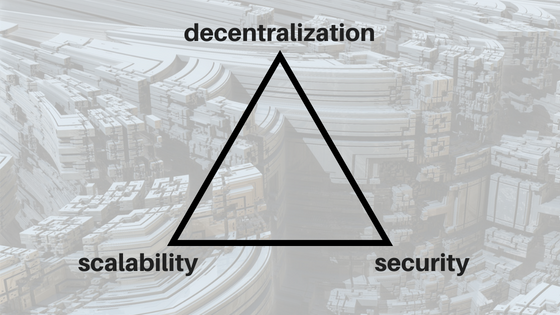

There is a famous trifecta that every blockchain tries to solve:

It is said that any of the two can be accomplished but at the expense of the third. Or, you can score well on all three, like Hive does, without having a "perfect score" at any of them.

Hive is not as secure as bitcoin, for example, but it is way ahead in terms of scalability and it is probably more decentralized if we count that only a few mega-miners control most of the hash rate of bitcoin.

But let's move to where I really want to get.

And that's sustainability.

I wonder if that trifecta triangle should be a star, after all, and add sustainability to it.

Let's say, hypothetically, we get a blockchain that scores "perfectly" (we would have endless debates about how to measure and compare them) in all three areas - decentralization, scalability, and security. What happens if that blockchain is unstable and no fix is found? What happens if its tokenomics makes it so? What happens if/when costs become higher than rewards? It becomes unsustainable.

After asking those questions above, I realized the trifecta should remain like that because the sustainability problem morphs into one of the other elements of the trifecta.

When the blockchain becomes unstable, that's a security problem. When tokenomics fails, that is both a security problem and it becomes a decentralization problem because I assume part of the node operators will stop running them. If costs become higher than rewards then we get a decentralization problem.

But that doesn't make sustainability in the crypto sphere any less important. Just think about it: the longer a blockchain produces blocks, the higher it grows in size. This alone is a challenge for every blockchain after a number of years of existence. So far Hive seems to handle this issue very well, including by using compression of the blockchain data that is mostly text-based and has a very good compression rate. After hard fork 26, peers will be able to communicate between them in a compressed form too if I understood well.

And I've only talked about sustainability at the base layer. But this is something that concerns second layers too, as well as platforms/projects having their own tokenomics.

Posted Using LeoFinance Beta