Digital currencies known as stablecoins are tied to a stable asset, such as gold or the United States dollar, but mostly, USD and EUR. The purpose of these cryptocurrencies is to offer both the stability and dependability of a conventional currency and the advantages of traditional cryptocurrencies, such as security and centralization. Yes, Centralization of the assets is one of the strong hands of top stablecoins, check out the top 10 coins.

USDC and USDT in the Hall!

However, there are a number of reasons why stablecoins should not be trusted. First one is:

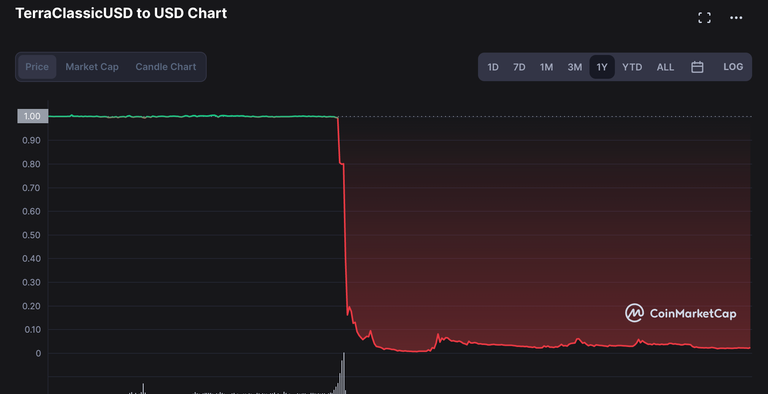

LUNA was the first stablecoin victim with massive impact on the crypto market. It was stable but it did not last too long.

Stablecoins aren't as stable as their name implies, first and foremost. Stablecoins' value is affected by asset volatility (wanna know how, check out algorithmic stablecoins that are not over-collateralized) because they are tied to a specific asset. A stablecoin whose value is based on the dollar, for instance, will also lose value if the value of the US dollar suddenly decreases. This indicates that while stablecoins may provide some stability in the short term, they are not a dependable investment for the long term.

These stable(!) types of money printed by some entities like Circle and Bittrex lack the same level of decentralization as conventional cryptocurrencies. Stablecoins are typically issued and managed by a central authority, such as a bank or corporation, because they are tied to a specific asset. This indicates that this central authority, which is susceptible to manipulation and corruption, is responsible for the stability of stablecoins.

Are Stablecoins Inherently Secure?

Stablecoins are typically backed by a reserve of that asset because they are pegged to a specific asset. However, the central ownership of these reserves makes them susceptible to theft and mismanagement. Stablecoins are also vulnerable to the same cyber threats as conventional cryptocurrencies, such as phishing and hacking.

Despite the fact that stablecoins may provide some advantages, such as stability and dependability, they are not as secure, decentralized, or stable as conventional cryptocurrencies. Stablecoins shouldn't be trusted as a safe way to spend money or invest our money for these reasons.

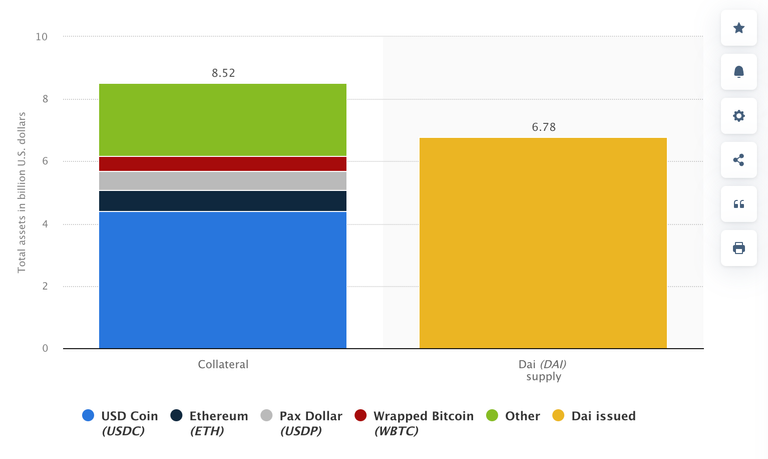

Into DAI & HBD?

In the bear market, both of these stablecoins were steedy while USDC and USDT are under threat because of the cold war. To avoid all the damages, safer shelters are needed.

What's the solution?

= OverCollateralized Stablecoins

HBD is allowed to reach 10% of HIVE and DAI is backed by 8.5m though there are lower number of DAIs printed. It is not a secret or rocket science, you need to see your money is collateralized safely.

See what happens to USDN of Waves and UST of LUNA.

- You need to take action with overcollateralized stablecoin if something terrible happens!