Hyperinflation is a problem that countries face when the prices of goods and services increase at an alarming rate. This inflation leaves the citizens with less purchasing power and can even lead to the demise of the economy. In this post, I will be discussing the story of hyperinflation in Zimbabwe, how they got to the point of having a 100 trillion Zimbabwean dollar note and what the consequences have been.

Perspective

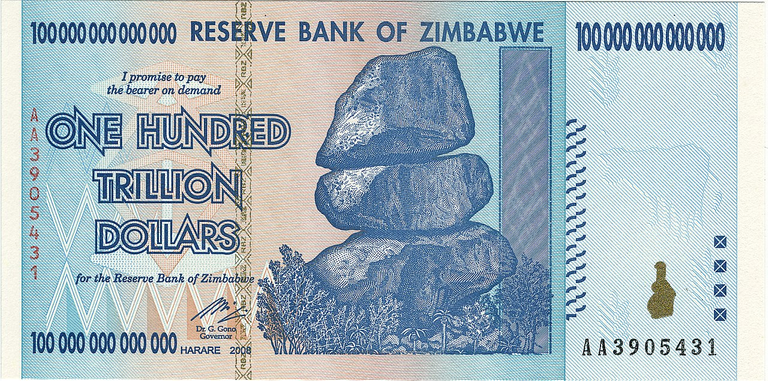

In Zimbabwe, hyperinflation reached unprecedented levels, with the country’s currency becoming virtually worthless. The Reserve Bank of Zimbabwe introduced a 100-trillion-dollar note in 2009 – that’s $100,000,000,000,000! To put that into perspective, if you had one trillion dollars and spent one dollar every second, it would take you over 31 years to spend it all. And yet the value of the dollar was so low that this amount of money could barely buy a loaf of bread.

By Reserve Bank of Zimbabwe - Self-scan by (Marianian) followed by minor Photoshop enhancements to improve appearance and reduce size. Second version scan by (Camp0s) with original color preserved. Transferred from en.wikipedia to Commons by User:Avicennasis using CommonsHelper., Public Domain, Link

So how did this happen?

Well, there are a variety of reasons, but the main one is that the government simply printed more and more money. This might seem like a good idea – after all, everyone likes having more money – but it doesn’t work in practice. You see, when there is too much money chasing too few goods, prices go up (this is known as inflation). So while everyone might have more money, their money is worth less and less.

This process can quickly spiral out of control and lead to hyperinflation. When this happens, people start to lose faith in the currency and stop using it altogether. This is exactly what happened in Zimbabwe – people started using foreign currencies such as the US dollar or South African rand instead.

Other factors that likely contributed to Zimbabwe’s hyperinflation include:

The country’s inability to produce enough food to feed its population. This led to widespread hunger and malnutrition, which put additional strain on an already strained healthcare system.

Sanctions imposed by Western countries in response to human rights abuses by the Zimbabwean government. These sanctions made it difficult for Zimbabwe to trade with the rest of the world and further hampered its ability to generate revenue.

Widespread corruption within the Zimbabwean government. This meant that much of the country’s limited resources were squandered or stolen instead of being used to improve the lives of its citizens

It all started in the late 1990s. Zimbabwe was going through a period of economic turmoil. The country had been hit hard by sanctions from the West, and its currency was in decline. In order to stabilize the economy, the government started printing more money. This led to a rapid increase in prices, and soon, inflation was out of control. The government tried to control it by setting prices for goods and services, but this only made things worse. Businesses stopped investing, and people started hoarding food and other essentials. The situation quickly spiralled out of control, and by 2009, inflation was estimated to be around 100 billion per cent per year. The economy collapsed, and life became incredibly difficult for ordinary Zimbabweans.

The story of hyperinflation in Zimbabwe is a cautionary tale of what can happen when a government prints too much money. It’s also a reminder

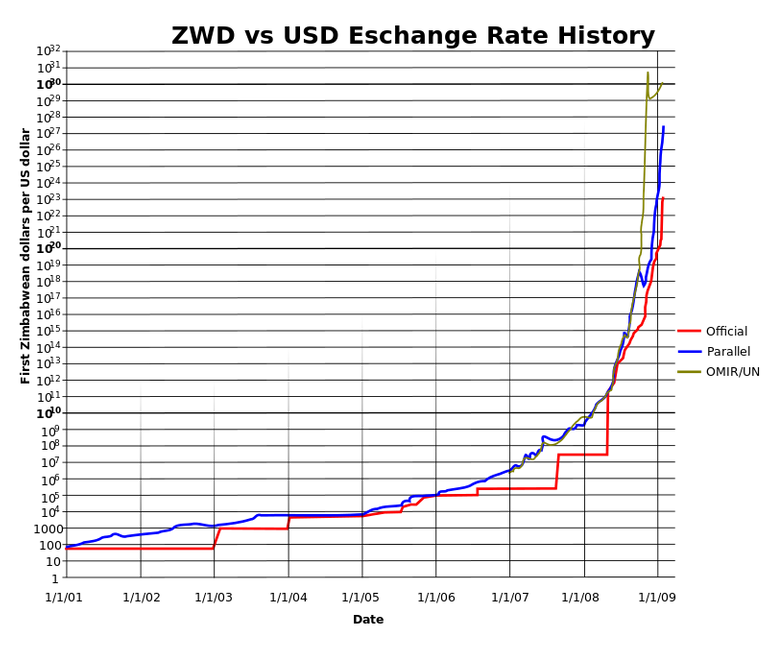

Devaluation of Zimbabwean currency

By RicHard-59 - Own work based on File:ZWDvUSDchart.png, CC BY-SA 3.0, Link

In 2009, the Reserve Bank of Zimbabwe (RBZ) completely abandoned its currency and introduced a multi-currency system consisting of the South African rand, the Botswana pula, the pound sterling, the euro and the United States dollar. This was in response to the severe hyperinflation that had rendered the Zimbabwean dollar unusable. The country's inflation rate reached an unprecedented 79.6 billion per cent in mid-November 2008.

The central bank said at the time that it would print denominations of up to 100 trillion Zimbabwe dollars (then, this was worth about just US$40 on the black market) and introduce them gradually over several months to ease a cash crunch.

But by late September 2009, with prices still soaring and basic goods increasingly scarce, officials announced that they would allow shops to start pricing goods in foreign currencies instead of local ones.

The change meant that even people who had stashed their savings under their mattresses were now effectively broke, as their money became worthless overnight.

The Consequences of Hyperinflation in Zimbabwe

Before we get into the gory details of how Zimbabwe’s hyperinflation unfolded, it’s important to understand what hyperinflation actually is. Hyperinflation is defined as “an inflation rate of 50% or more in a single year.”

While this may seem like a high bar, it’s important to remember that inflation is cumulative; meaning that if prices go up 5% one month, they will need to increase by only 4.7% the following month to meet the criteria for hyperinflation.

Now that we know what hyperinflation is, let’s take a look at how it unfolded in Zimbabwe.

Zimbabwe experienced its first bout of hyperinflation in the early 2000s, fuelled by an unsustainable fiscal deficit and money printing by the Reserve Bank of Zimbabwe (RBZ).

The government was spending more than it was bringing in through revenue, and so it turned to the central bank to print more money to cover the shortfall.

This influx of new money led to higher prices for goods and services, which in turn led to even more money printing as the government tried to keep up with rising costs.

The situation spiralled out of control, with prices doubling every 25 days by late 2007.

How Zimbabwe recovered from Hyperinflation

By See File history below for details. - Own work.Based on: www.flag.de;See also:, Public Domain, Link

In 2009, Zimbabwe's central bank allowed its citizens to trade in foreign currency. This effectively ended the country's hyperinflation crisis, as the local currency was no longer being used. The government also implemented a number of other reforms, such as introducing a new currency, cutting public spending, and privatizing state-owned enterprises. These measures helped to stabilize the economy and bring inflation under control.

Conclusion

The story of hyperinflation in Zimbabwe is a cautionary tale for other countries. It shows how quickly things can spiral out of control when the government doesn't take measures to prevent it. The 100 trillion Zimbabwean dollar note is a physical reminder of just how bad things can get. Hopefully, other countries can learn from Zimbabwe's mistakes and avoid going down the same path.

Check out my recent posts:

Written by @gamsam

All images used are taken by me and copyright free

Posted Using LeoFinance Beta