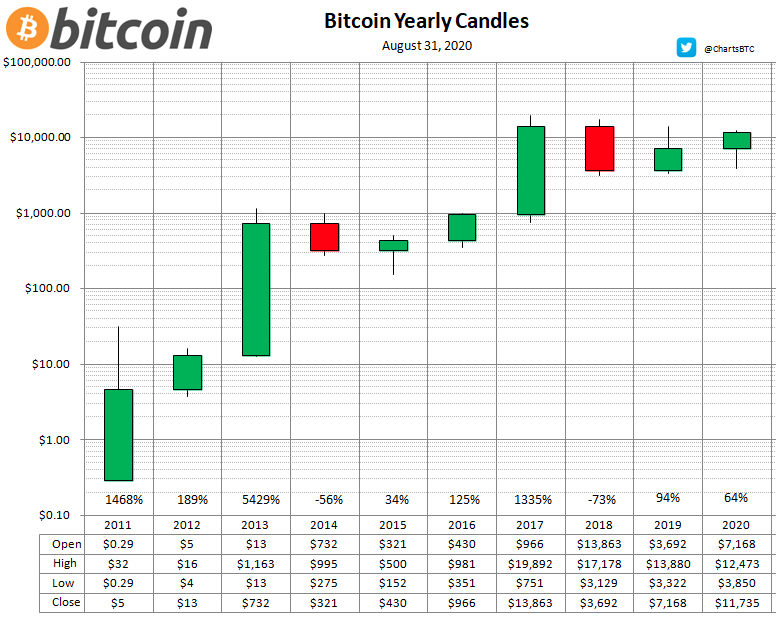

The chart you see above is created by @chartsBTC on Twitter from a year ago. When I first saw this chart, I simply got obsessed by how clear and predictable it was. It was telling a story of Bitcoin and how its price pattern over years performed. If it was a predicting indicator, indicator can't go any better than this. If you look closely, and if you haven't noticed yet, the chart was suggesting 2021 was going to be epic for bitcoin.

Wow. Just wow. It has been a great 2021 for bitcoin. I think it is important to emphasize what bitcoin has accomplished and delivered in price appreciation promise to all its hodlers. Now, the top line of the chart displays 100k. We haven't got to those levels yet. But getting to almost 70k is more than impressive. If I wasn't a believer in charts, now I am if done right.

Of course, charts are not fortune tellers, patterns may not play out as expected. Yet, I still find this chart exciting for the future of the Bitcoin. We often think of crypto asset values in their prices in the market and how they are performing. For any investor, small or big, prices do matter as they have direct impact to their financial state. However, prices are not necessarily the sole criterion in defining the success of the asset.

Bitcoin has been successful. Yes, its exponential growth as an investment instrument did bring it fame, recognition, and respect worldwide. In my opinion though, its most important impact has been in bringing awareness about the nature of money, fiat, central banks, and financial systems to masses. Even the skeptics of Bitcoin have a better understanding of money today than they did a decade ago. Any explanation of Bitcoin without mentioning the nature of money is not complete. In fact, Bitcoin makes the most sense once the basics of traditional financial systems and their impact to people's financial well-being is understood.

A while back, the times when spam emails also had some substance, I received a spam email about Federal Reserve. It was an article explaining how US Dollars wasn't issued by the US Government but the private institution called Federal Reserve. How, US Government issued notes would say United States Note, instead of Federal Reserve Note, etc. While I found the article to be interesting, I didn't pay too much of an attention. I only remembered it when I dove into understanding money years later.

I am not really concerned whether Federal Reserve is a government institution or a private entity. They do a great job of confusing things. What is important though how they operate, what they do, and what impact is has on people's finances and personal wealth.

Bitcoin has arrived at the right time with a right solution. It has come as a response to the global financial crisis of 2008. The financial crisis that started with housing collapse in the US, brought down banks, large insurance companies, and more. Many large companies were bailed out, but the US government and the Fed. But the impact of the crisis on ordinary people, their savings, their pensions, their houses, and impact on small and large businesses was devastating. Many businesses went bankrupt and to this day have not recovered.

The very institutions that were in charge of preventing such situations failed miserably either due incompetence, greed, or broken system. Bitcoin offered an alternative. It has identified a few flaws in the traditional system and attempted to create an alternative to traditional financial system and money. The problems it identified are as such:

- There is unlimited supply of money. While currencies were backed by gold in the past, that has changed. Now currencies had no limit to print them.

- Unpredictable inflations. Central banks can print money as much as they want whenever they want.

- Centralized rights to print money. Only designated Central Banks can print the money and regulate the finances.

- These central entities has proven to be incompetent or the system was broken.

As an alternative the traditional financial systems, Bitcoin introduced a system where nobody should trust any one entity, there is a cap on the total supply of the money, and inflation is predictable and all participants of the economy are well aware of it. Most importantly, everything is recorded on the public ledger which provide the complete transparency. It is quite possible if Bitcoin came some other time it would have been as successful and popular.

Amazing thing about Bitcoin is not only this new money, the new way of transacting with one an other, but also the wave of decentralized projects that came after it being inspired by it. In a sense the decentralization of Bitcoin goes beyond Bitcoin itself. Monopoly of printing money has come to an end. Today anybody can print money. The question is if this money or project can solve problems and attract people to participate in these economies.

Decentralization requires participation. With participation we get conflicts and cooperation. With decentralization we can attract conflicts of ideas, interests, and goals. At the same time we can bring like minded people together, create collaboration, and cooperation.

Hive would never be possible without Bitcoin. What Hive is taking on to solve might be a bigger problem than what Bitcoin was trying to solve. Not only Hive offers more efficient financial system, easy for ordinary people to understand and participate, but it also attempts to deliver the original promise of the internet. Internet is a decentralized system. Big money and big tech figured out a way to centralize it, and capitalize on human interactions, online activities, data, and feeding advertisements. By doing this these big money and big tech entities play a zero sum game. They let people do the all the work - create content, socialize online, share data, engage on various digital activities. All while the big monopolies make the ad revenues, sell user data and eyeballs. On top of this all, they also manage to collect fees for services. lol.

With decentralized blockchain tools like Hive, today it is possible to challenge these monopolies. We are still at early stages. There is more building to do. At the very least we provide alternatives to traditional web services, tools, and networks. With participation these decentralized system will grow and offer a better future, and a better alternative.

Posted Using LeoFinance Beta