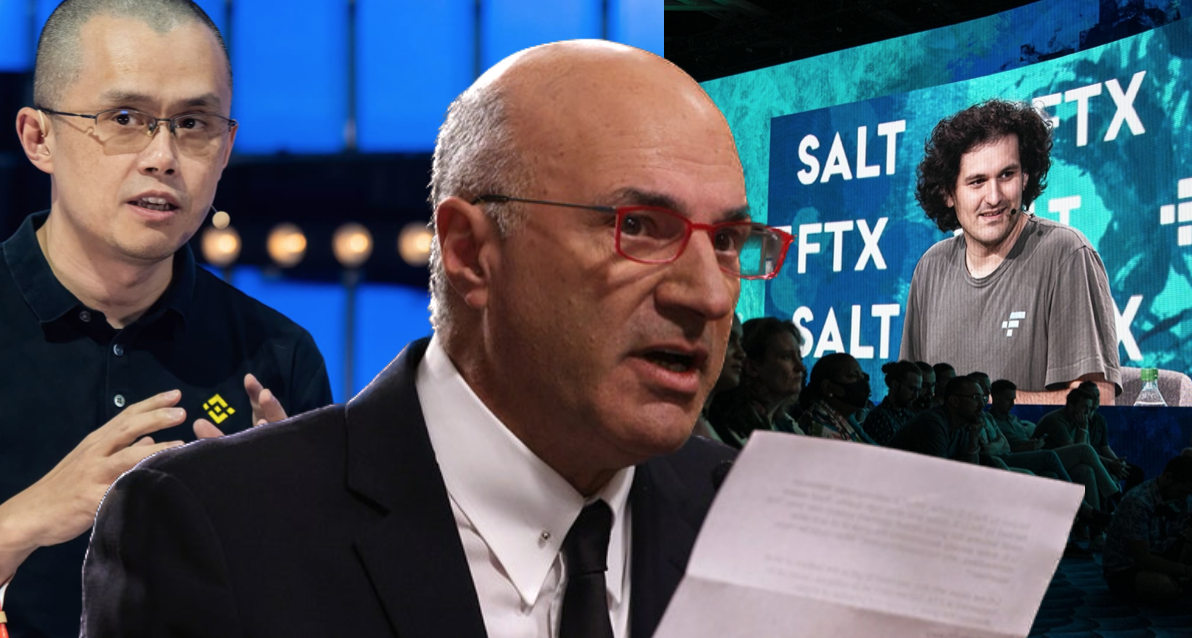

FTX drama continues. In the recent developments Sam Bankman-Fried has been arrested in Bahamas at request of US government. Criminal case against SBF by US attorneys at SDNY has become public, SEC filed civil lawsuit and multiple US government agencies have been collaborating with the investigation to the fraudulent activities by SBF, FTX, and Alameda Research. Since the beginning of this drama, many have expressed their opinions about what have happened and many stories revolved around SBF himself. Kevin O'Leary's take on the character of SBF and FTX collapse has been softer than others. While many called SBF a criminal, a conman, a scammer, O'Leary has maintained an opinion that SBF didn't have ill-intent and perhaps made mistakes. During a congressional hearing today, O'Leary suggested that Binance and its CEO CZ may have been the reasons behind the collapse of FTX.

O'Leary described the FTC collapse events as a result of two major crypto exchanges competing against one another, and one destroyed the other. While O'Leary repeatedly outlined that this was his personal opinion, he said - "One put the other out of business". The relationship between CZ and SBF, be it rivalry, personal animosity, or business partnership, has been discussed in public in the early days of the FTX collapse. It is not secret, one of the main events leading up to FTX bankruptcy filings was CZ's tweet expressing an intention to sell FTT tokens held by Binance.

Binance had about half a billion dollars worth of FTT tokens. After an article was published showing FTX finances may have solvency problems, CZ was among some who questioned their investment and/or involvement in FTX. That was a bad news for FTX as such sell off would hurt the price of FTT. SBF in return, offered that Alameda Research would be willing to pay a good price for Binance's FTT tokens. CZ declined the offer and tweeted he that prefers selling in an open market.

Back forth between CZ and SBF didn't stop there. For a moment it seemed FTX could be saved, when both announced some kind of deal is being prepared between the two and Binance may end up acquiring FTX. This was a non-binding letter of intent by Binance, and they wanted to do their due diligence before jumping into this deal. Soon after, it was announced again that Binance did their DD and decided to stay away from FTX as possible. That kind was the beginning of the end of FTX.

While these events may have served as a catalysts for things that followed and lead to FTX bankruptcy, I disagree with the way Kevin O'Leary's conclusion that Binance took FTX out of business, intentionally. It was FTX that didn't have its customers' money and assets when they demanded to withdraw. It was FTX who broke the promise of not using its users' funds for trading or other purposes. It was FTX that failed to defend its token.

What I don't understand is why SBF offered CZ to buy FTT tokens over the counter. If they had the means to buy, wouldn't they be able to defend the sell pressure in the market with the same money with buy orders? Short term price drop of FTT would probably benefit them more in a long run. By now it is clear, they didn't have the ability or funds to do so.

CZ is a well-know figure in crypto world. But he too has shown disregard to the true decentralization, displayed dishonesty and have used customer funds in borderline criminal manner. I still remember the time when Binance used its user assets to stake and gain governance influence to help with an attack on network. There was also a time when CZ suggested rolling back blocks in bitcoin network. CZ or any other centralized exchange founders and leaders are not true crypto leaders and don't even come close to Satoshi's vision or character. In my opinion, they all are continuation of traditional financial system.

I do not agree with Kevin O'Leary assessment of this situation as one competitors putting another out of business. Intentionally or not. In this situation, it seems CZ did what any responsible CEO of an exchange would do, decided to get rid of toxic assets. This in fact, protects the investors of the company. I would think O'Leary as a successful business person who runs multiple companies would understand this simple concept. He probably does. Perhaps there is a strategy and motives for taking such a position for O'Leary, because ever since this drama started he continued sort of taking SBF's side and echoing the narrative that this was a mistake and not necessarily fraud. In one of the interviews, O'Leary even suggested that he would hire SBF, because he believe SBF is one of the greatest traders of our times.

There has been a lot of information revealed about FTX, Alameda Research and how they run their business. Until yesterday, it wasn't clear what is true, what is false, and what is just opinions. Yesterday, the current CEO of FTX and person in charge of bankruptcy process, John J. Ray testified in another congressional hearing and revealing a lot of interesting information that confirms there clearly was a fraudulent activity in FTX and Alameda Research. The level of fraud is just mind boggling. This not only demonstrates the level of greed by the FTX and Alameda, but also the greedy investment practices by some well-known entities and people.

Kevin O'Leary is known for his role as a shark in a TV show, Shark Tank. He has built a reputation to be the shakiest of them all, who is most of the time very stingy with his investment in business who make a pitch in the show. The show is entertaining, but other than that I don't see much of a value in it. Half of the deals done in the show probably don't even go through. But the point is, Kevin O'Leary has build the persona who questions everything in business and determining if it would be successful or not, and in determining if it would be a good investment or not. When it came to a real life deal, FTX, he has failed. As did many others as well. Now, he admits that he hasn't done his research and just trusted SBF.

However, it seems O'Leary didn't invest a lot in FTX compared to what he has gained as paid spokesperson for FTX. According to him, he has earned 15 million dollars for promoting FTX, and 3 million more to cover taxes. But he only invested a million in FTX, and had about 10 million dollars worth of assets in multiple FTX wallets. If he lost 11 million and made 15 million, it seems he still ended up in positive, unlike many ordinary users of FTX. I wonder how many people he influenced to use FTX that ended up losing their funds. I don't understand paid promoters. Especially those who are already rich, and claim to understand business. Why not promote something they truly believe in? At least that would be honest, even if it failed.

They main lesson from FTX drama we all can learn is that centralized exchanges have nothing to do with decentralization and decentralized systems. They are driven with greed and whatever their founders and CEO's say in public doesn't necessarily reflect what they do in practice. But also, we see lessons that listening to and taking financial advice from paid promoters is a bad idea. They promote anything without any research as long as they pay. At least people like Kevin O'Leary disclose that they are being paid, when they promote these products. There are many so called influencers who don't even mention that they are being paid to promote the products, platforms, or services.

Posted Using LeoFinance Beta