The high interest rate for $HBD staked in Savings has persisted for several years, and I believe it is time to reconsider it. I don’t see it beneficial to the ecosystem, even though many users take advantage of it. No wonder, you can hardly get any better investment option considering the risks and potential profit. Let me explain my concerns.

20.00% APR as a Red Flag

Imagine knowing nothing about Hive. Someone suggests buying $10,000 and vesting it in Hive Savings. Leave it untouched for a year, and you can withdraw $12,000 the next February. Sounds great, huh? However, most people, including me, would turn skeptical. A typical conversation might unfold like this:

“20% profit on staked coins? Would it be used for trading or something?”

“No, and that's a unique feature of Hive – you retain control with your keys, unlike traditional crypto staking on exchanges. You can withdraw anytime with a 3-day waiting period and earn interest for the period your money was vested.”

“But how does it offer interest? Wouldn’t HBD lose value as it's emitted to cover the savings interest?”

“Quite unlikely. The Hive ecosystem has tools that have successfully kept HBD pegged to USD for years. I can share some posts that explain that with you.”

“Don’t bother, dude. I’ve seen many crypto scams, and 20% APR for nothing looks precisely like one.”

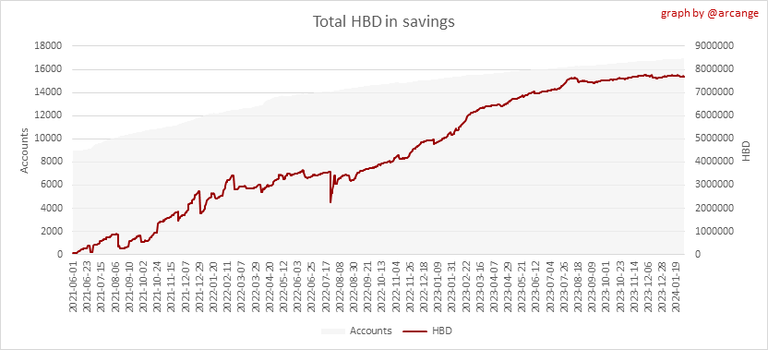

Most people outside Hive think this way – the high interest has been around for a while, and you don’t see crowds buying HBD and staking it. Instead, current users stake their HBD rewards rather than building their HP stake.

Driving Users From Active Participation on Hive

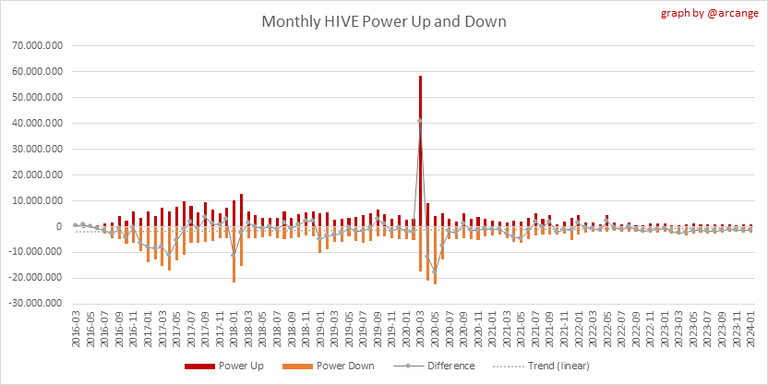

I try my best to curate content I relate to. I spread votes across the network, maintaining CSI over 25. My current curation APR hovers around 9%, and I believe that since the reward curve is flat now, people who actively vote and interact with others would have more or less the same rate. The current HP APR is around 3%. In other words, selling $HIVE for HBD and putting it into Savings brings way higher profit than staking HP and curating content.

Yes, you can argue that HP allows you to participate in Hive governance. But does it really? With my 66.5k HP, I am among the 300 richest users. However, my witness or proposal votes don’t matter much. The success of both witnesses and proposals depends on whale votes. To get to the top 20, a witness needs about 60M HP. Pushing a proposal through requires over 28M HP. When the top few whales decide to support somebody or something, they can hardly fail. I am not complaining about that. I respect whales and hope they're doing their best, just like I try to. The point is that participation in the governance is a bit of an illusion for a common Hivean with thousands to tens of thousands of HP. And under current circumstances, it is more efficient to vest HBD and give up on governance.

Loosening the Bonds

I believe the best possible life cycle of a Hivean spans from a hard-working newbie who does their best to establish themselves within communities of their interest (be it cooking, gaming, traveling, finance&crypto, or anything else) to a renowned curator who keeps posting. Whoever stays for several years should build up enough HP to have significant voting power, create social bonds across the network (and, preferably, borders), and help others grow. Your HP stake should motivate you to do your best, as blooming Hive is in your best interest. Eventually, you’d earn more from curation than from content creation. If you keep withdrawing HP and staking HBD instead, you don’t really care what happens as long as the pegging mechanism works.

If Hiveans quit building up their HP stake, they keep being dependent on curating projects rather than on other users. I appreciate what such projects do. They upvote me sometimes, but I’d appreciate it even more if thousands of independent single curators upvote and interact with others. Having fun.Creating bonds. Bonds mean loyalty and empower the network. They provide a human touch. Sure, you can do so with 5k HP and 3K HBD in savings, but if you had 20K HP instead, you’d make the upvoted authors significantly happier. Also, you might feel more responsibility for your votes and overall behavior.

Hindering HBD's Adoption as a Currency

I see a potential for HBD to become a widely used currency. Given the general volatility of cryptocurrencies, many are not yet practical for day-to-day transactions. Let's consider a hypothetical scenario: we agree on a three-month job rewarded with 10,000 Hive due on the last day of each month. It could result in a payout ranging from $2,000 to $5,000. This uncertainty is less than ideal, especially when this job would be my primary income source. Opting for a fixed $3,000 payment in HBD is a straightforward solution. It works the same for small businesses accepting crypto.

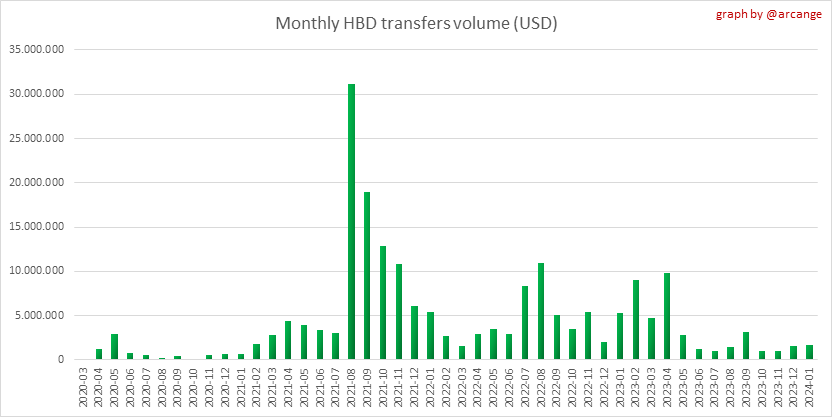

However, the high interest rate hinders such practical usage. Many perceive HBD primarily as a passive income-generating asset, discouraging its use for daily transactions. I don’t say this mindset applies to everybody. I am ready to work for HBD or pay somebody in it basically anytime, but you don’t see many payments happening nowadays. Although HBD transactions do take place, their volume does not grow.

Posted Using InLeo Alpha