Collaterlized Lending? Before we go into what it’s all about let’s establish a foundation where we can build on by talking about what

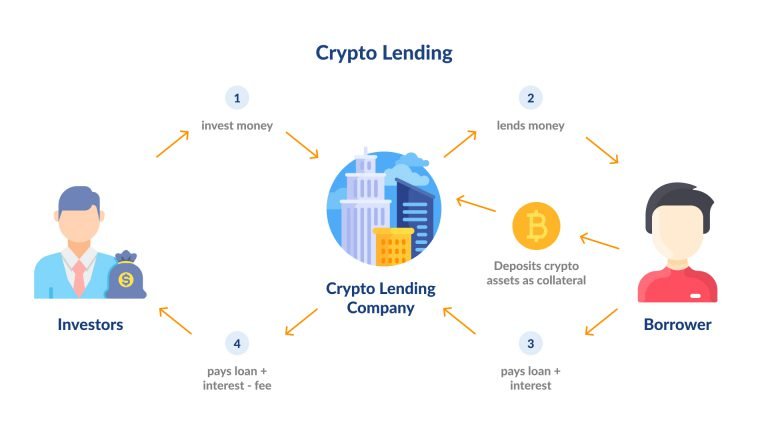

Collateralization Means. According to investopedia which provided a detailed explanation of what collateralization is all about, as the use of valuable assets to secure a loan. If it happens that the borrower defaults on the loan the takes possession of the assets, the lender sells it off to offset the loan.

They are two sides approach towards the above subject which it provide the lender an assurance at sufficient level as against default risk and secondly helps the borrower gain access to loans amidst their low credit score. With that said let’s now move on to what Collaterlized Lending means which I feel the above definition has done justice to this, but if we are going to relate this to crypto it simply means taking a loan as against one’s digital assets be it a stable token.

Defi which is an acronym for decentralized finance which was released back in 2020, with the recent update which is the Defi 2.0 happens to resolves some limitations and problems in the first phase of defi. The Defi 2.0 will also be able to adapt to some new government regulations which they are trying to introduce which is the KYC and the AML.

Some of the limitations which affects the decentralized finance ecosystem is the scalability, liquidity, security, centralization and Oracle.

Taking PolyCUB & xPolyCUB as a case study as regards the collaterlized lending, staking of xPolyCub in other to earn about +2000% plus on APY. PolyCub which is referred to as the bitcoin of Cub finance with the same tokenomics and minting of it is likewise to bitcoin in it’s early days, collaterlized lending is a new feature in the polycub ecosystem which it’s users can stake their xPOLYCUB tokens into the loan contract and take loans from the liquidity protocol in the exchange as against their xPOLYCUB staked.

Posted Using LeoFinance Beta