Something is brewing in the markets and the calm before the storm is foreboding. We will see the final rate hike of the year in only two weeks as the federal reserve banishes inflation back to where it once came. Housing prices have begun to collapse nationwide as buyers struggle to meet lending requirements or simply refuse to pay the additional interest.

Lest we forget the source of inflation- loose monetary policies followed by trillions in USD stimulus to the global economy. Many developing nations are suffering greatly from the fallout as the USD is still the global reserve currency and backbone of international monetary exchange.

Love it or hate it the dollar is a tool which must be wielded carefully. Cash is king, until it isn't anymore and risk-on traders re-enter the game.

2023 will surely be rough as there is no clear end in sight for the bleeding. I would presume it will be a long and arduous road back to safety for the retail sentiment. Buy people always forget and the new investors will eventually pile back in, one day.

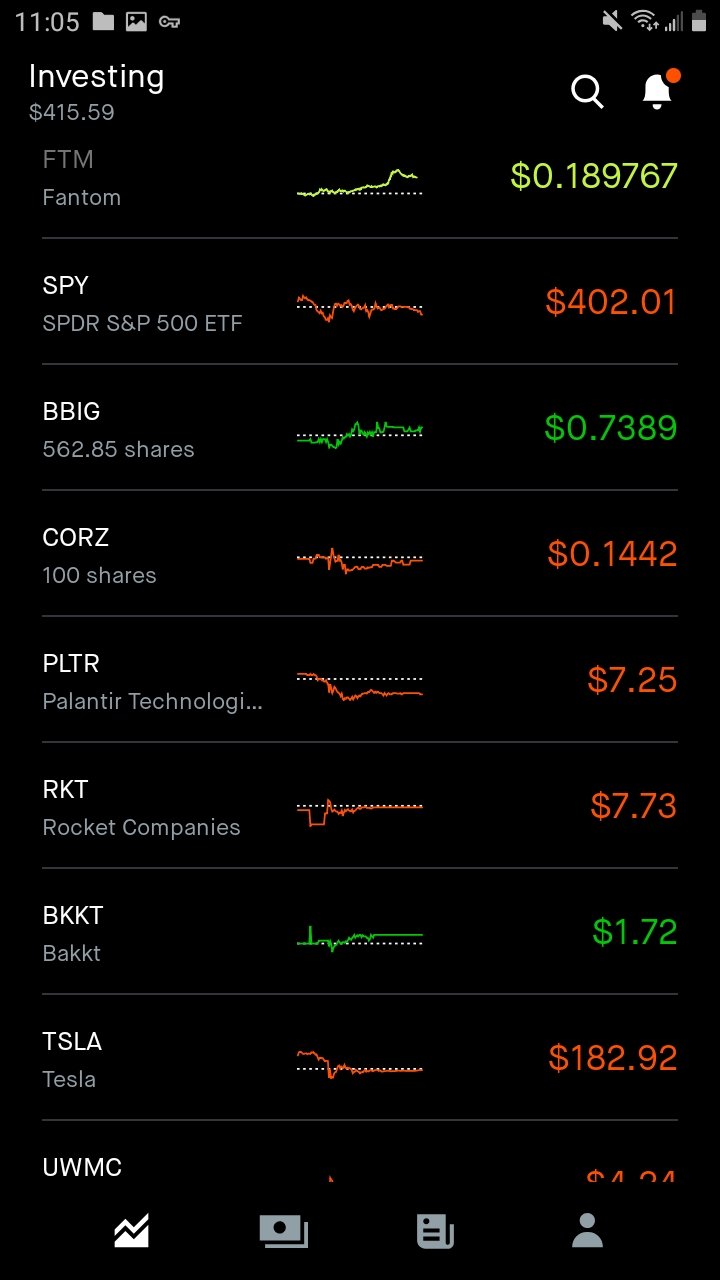

I did nothing but watch my portfolio bounce up and down for the entire week. Waiting for my covered calls to expire next month and for my stocks to increase in value. Until then Im considering doing a weekly update to save time and effort.

$BBIG has been grinding lower each week since the market has been slowing and there isn't much to do but hold. $CORZ is taking a beating on expected bankruptcy but these kinds of trades can always jump unexpectedly and surprise people, so worth a shot.