Decentralized Finance has been one of the most useful products of blockchain technology. Thanks to its ease of use, simplicity, and security, many people prefer the DeFi tools to conduct their finance - related actions on chain.

Though swaps, liquidity pools, staking, and several other actions are pretty useful, the lending mechanism of the protocols might be one of the groundbreakers! Without going to any banks, you can easily borrow some money if you already have enough collateral to provide.

I am assuming that you are holding 1 Bitcoin, 1 Ethereum, and some altcoins. However, you need to pay for an expenditure with some cash. The best thing about the lending protocols is that you are provided a health rate that decides on how much worth of coins can be offered to you.

In the case that you provide 1 Bitcoin, and 1 Ethereum, you have 61,000 + 3400 = $64,400 crypto assets. For many protocols, you can get up to 70% - 80% of the collateral sum. So, by holding your coins, you can get up to $45K - $48K for sure.

Yet, this can be highly risky as the cryptocurrencies are highly volatile and your money can be liquidated if your collateral value drops drastically. In such a case, your health rate should never be 50% to be on the safe side. OR, if you are a risk taker, then you need to provide some stablecoins as collateral so that you can hedge the risks with another asset that does not fluctuate in value.

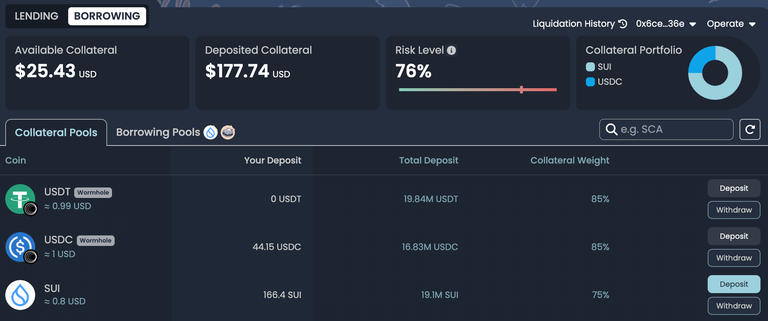

For instance, I have borrowed some stablecoins on SUI and I used them to buy more SUI at lower prices. Then I provided the newly bought SUI as collateral, as well.

As you can see above, borrowing can also have some incentives. My borrowed coins yield some positive APR whereas the cheap purchase already enabled me to make some gains in my position.

I borrowed $112 worth of USDC and USDT. This is my debt to be paid.

I collateralized $177 worth of USDC and SUI. You will notice that there is some stablecoin in the portfolio to hedge the risk.

The borrowed stablecoins already bring me SUI & SCA coins with positive APR. Even though I was not earning, I would hold stablecoins as collateral because they make me feel safer while carrying the position.

So, rather than selling coins for some cash, borrowing stablecoins to buy whatever is needed can be a good strategy to leverage your earnings. However, the health rate should never reach a risky level as you may face losing all your assets.

What do you think about lending and borrowing as DeFi solutions?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha