The banks are playing a critical role in the financial system for both borrowers and lenders to grow the economy through production. When everything is in line with the major aim of these middlemen between lenders and borrowers, there would not be any problem in transactions.

There are some fundamental operations of banks that are pillars of the economy.

- Methods of payments

- Mortgages to home-buyers

- Loans to businesses

- Interest to savers

- Looking after the savings (from Economicshelp)

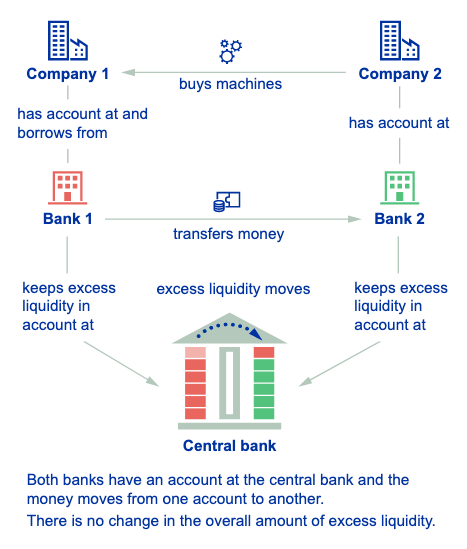

Also, according to European Central Bank, Banks & Central Banks work in such a way:

Question: Do Banks Have the Same Duties in Good and Bad Times?

Though there are different types of banks and services, they are designed only for good days. WHY?

When you want to get your money back from the bank, they will ask you to inform the branch bank 3-7 days before the day and they will insist you not to withdraw your money from their bank as they make money with your money.

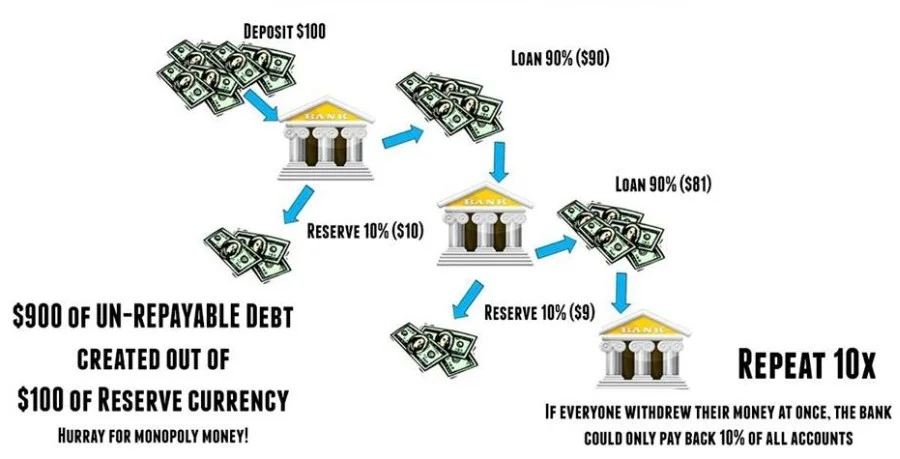

In fractional reserve banking, every single dollar can create new dollars through loans. Thus, the bank wishes to generate more money for them and share some of their earnings with you as a "share".

Okay, but why do not banks in Sri Lanka or China follow the same steps?

In Bad Times, Banks are Used to Keep "Real Money" in Systems

Unfortunately, we can clearly see that banks are used as a vehicle to prevent people accessing their money in the system so that they do not withdraw money and make the system slow down or halt.

As we mentioned, Fractional Banking Reserve System is designed for good times. Interestingly, the only plan for bad times is keeping the "real money" in the system with tricks and authority!

I think this popular illustration explains the case neatly. When you want to access your own 100 Units of money, you are putting the whole system into a risk as the rest is printed out of thin air.

Fact: Crypto Outperforms in Bad Times

Honestly speaking, as long as stablecoins are not targeted and destroyed in crypto ecosystem, I give 0 possibility for crypto ecosystem to collapse or die etc. Since the very beginning, stablecoins are the weak spot (They are pretty functional, though).

I have just a limited portion of my savings in my bank account. Also, I have an automated payment order to buy GOLD regularly with my balance. If I feel insecure like in Sri Lanka or China, I'll move all savings to crypto + some cash for emergency. Software and Harware wallet can be used easily in 2022.

Banks are here to stop you in bad times.

Food Crisis, Global War, Pandemic, Hyper Inflation, Global Warming...

Sorry but I do not need a middleman to suffer more.

Posted Using LeoFinance Beta