Bitcoin has tested $65,000+ once again and the altcoins turned green in line with Bitcoin's positive sentiment. The spot Bitcoin ETFs clearly show an increasing interest on Bitcoin and the anticipation of profits in Bitcoin trades.

The end of selling pressure by the German government and the loss of importance of Mt. Gox risk, the recent data and the global factors are enough to change the sentiment.

When we compare the price actions in altcoins with previous bull markets, we can easily notice that the correlation between the performance of altcoins and Bitcoin has been decreasing. It is noticeable from the rise of Bitcoin domination and the stability of Market 3, altcoins without ETH market cap, even in the first glance.

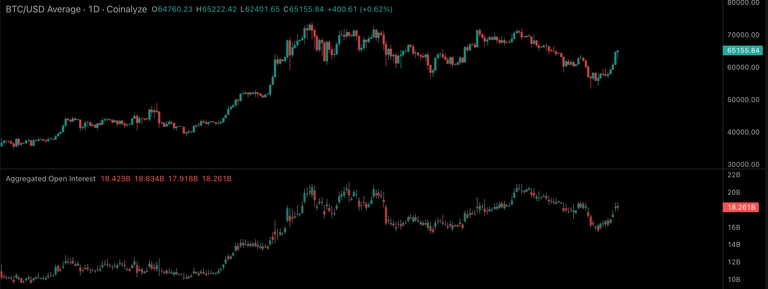

Open Interest Carries Crypto

The chart below shows the strong correlation between the open interest, the margin and future positions, and the price of Bitcoin.

When the price tends to go up, the same action is clear on Open Interest data, as well.

It is no surprise to see that these orders drive the positions that affect the direction of the market.

What about the spot appetite to buy Bitcoin?

Just have a look at the trend that started on March 11.

It was the all - time - high price of Bitcoin and the highest point reached in the Cumulative Volume Delta (CVD( index of the spot trades. Basically, the downtrend indicates that some whales are leaving their spot positions on a certain asset. In our case, Bitcoin traders do not enter a new position in the market dıe to some risks that they do not want to take.

Yet, when we examine the price action of Bitcoin with both Open Interest and the CVD data, it is obvious that the market makers are pushing the price higher with Open IIneterest that may directly impact lots of things.

What to Expect?

I think neither the uptrend nor the downtrend will take too long. The investors are aware of the fact that the interest rate cuts are coming soon. When the FED of the U.S. initiates the interest rate cuts in September, the rush into the risky assets will go up as well. This time will be the only opportunity for altcoins to outperform Bitcoin and Ethereum with their high risk / high reward mentality.

Eventually, We are in the middle of short positive trend that may get supported by the retailer investors, too. If the market sustainably turns green, then we can be convinced to the start of a mega bull market.

Before 2025, this uptrend by $68K - $69K will not be so surprising to see. Besides, the market will need another narrative that can trigger the selling pressure on the market while it can be a good source of FUD / FOMO as there will be a demand for that.

Simply, the continuum of the bullish trend may happen for a short time. When the trend is over, we may see double - digit negative returns. Testing below $52K would not surprise me this time!

What do you think about the open interest and the spot CVD data of Bitcoin?

Share your thughts below 👇

Hive On ✌️

Posted Using InLeo Alpha