The presidential election in the U.S. is over with the triumphant return of Donald Trump. Some of the markets welcomed him such as crypto, stocks, and U.S. bonds but there are also others that have been heading down since the morning like precious metals and the European Zone.

The new era has officially started under Trump's management. Now, as investors, we need to consider the policies of the new president and the way the central banks are controlling the economies with their monetary policies.

The growing risk of inflation has been replaced by a recession that may occur all of a sudden while everyone is living in the allusion of hopium. The history has a lot of lessons to be taken regarding the policies of central banks. However, we may not notice the indicators until the recession hits the economies and the markets.

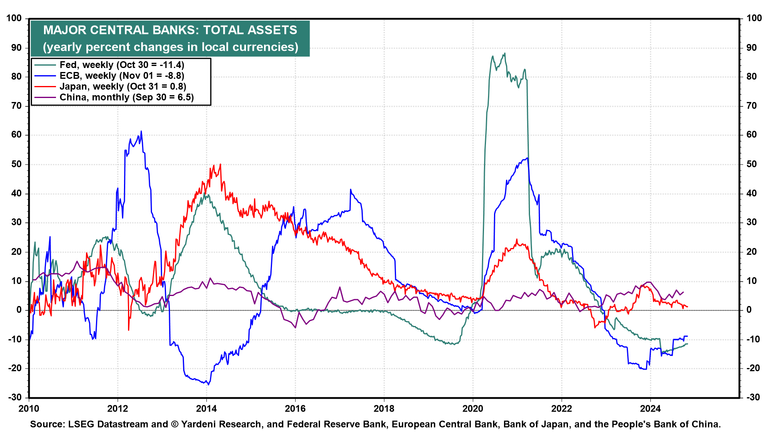

The downtrend in central bank policy rates became obvious on the charts over time. Apart from the interest rate hikes in Japan, the whole world seeks opportunities to boost economies and grow global trade.

The total assets chart also signs an uptrend as the quantitative easing gears up.

Keep in mind that there are trillions of dollars in the least risky assets and, when the rates become not satisfactory, the risk appetite of these investors start to increase to beat the inflation rate and protect their purchasing power.

The markets are getting greedier due to fundamentally strong reasons like the elimination of the risks of inflation in the short and medium terms. It is the end of the strong fiat money era once again. Knowing this fact very well, people will start to trade and invest in stocks and cryptocurrencies if they believe that they are still undervalued!

What do you think about the new era for the markets?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha