All successful investors mention the importance of holding a well - diversified portfolio which consist of assets that can help you leverage your potential gains / losses according to the risk you accept to take. For someone who is eager to chase incredibly high returns in a very short time, almost all - in crypto sounds like a great idea whereas for a person who cannot bear red candles, the government bonds, gold, and very limited stock investment might be a good fit.

For investment, the return is a big issue to be discussed. When we start talking about the return, the phenomenon of time comes along with it. In the cases that the return is considered without the time spent, the realized revenue may not be as high as the numbers seen on the screen.

In line with the risk, the return has to be high in the "planned" period of time so that we can boldly claim that we have positive net return in our investments.

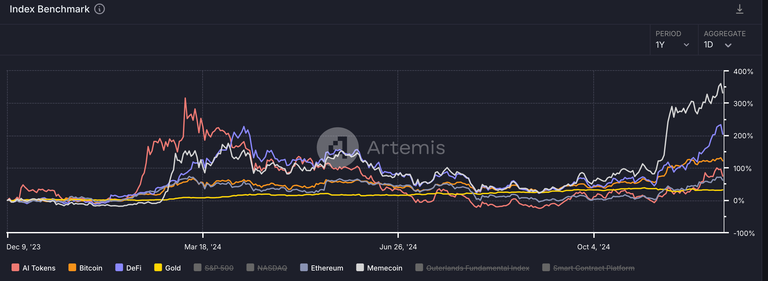

When we have a look at the return on investments in a year, it is clear that the crypto market has been hlghly rewarding to those who enjoyed the high risk vs high return reality. Since October 2023, the market started to recover from the local all time low levels, and in 1 - year timeframe, the result is not surprising.

The astonishing spike in the chart indicates the performance of memecoins in a year. I think there is nothing to discuss when we see the unrivalled performance of the meme projects. Yet, as I highlighted earlier, it might be the end of meme era since they became too expensive to convince newbies to buy right now.

Under any circumstance, the return of crypto has outperformed gold and many other assets in 2024. This is what we call a bull market.

Once the stock markets considered, they could not surprise us a lot apart from the performance of NVIDIA which carried both markets to higher levels with the hype around it. The safest harbour among all the option, Gold has had a great year with its uptrend.

In this chart, I clearly see that those who did not choose to take too much risk and watch the charts every day also made 32% revenue with Gold. This is the least stressful and one of the most satisfying returns because of the place it has in the portfolio. If the safer side of portfolio brings more than 30% in a year, than this is a great year with decent returns for sure!

Still, Ethereum has not reached its potential compared to three - digit performance of all other categories. AI had its cycle completed earlier, in Q1 2024, and the downtrend is an indicator of the flow of money to the other categories.

What do you think about the current risk vs reward returns of investments?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha