Brazil, for almost half a year, has had the highest inflation adjusted yield in the world. The private bank bonds have insurance so this is a relatively safe investment, even though it sounds too good to be true.

The official yield, set by the central bank, is at around 12% a year, and possibly going up to over 13% a year this month. Brazil was the first country to start raising interests, which lead to an increase in the value of our currency.

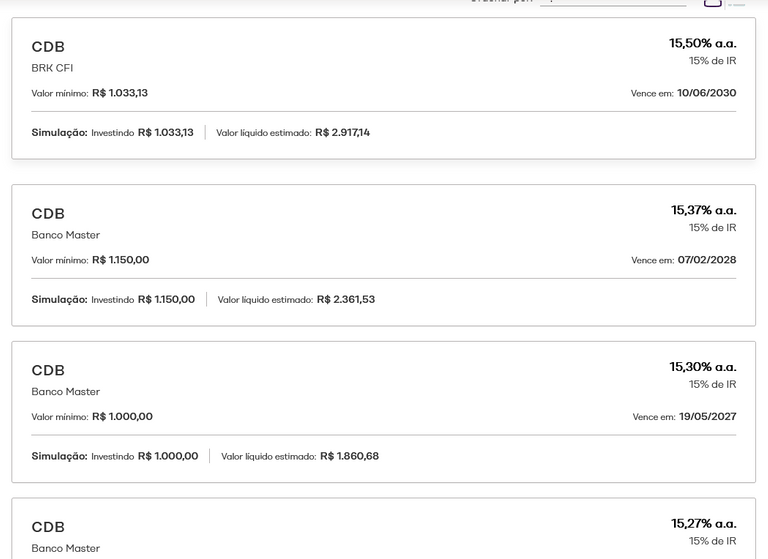

The USA and some European countries are also starting to raise their interests, but our central bank is not slowing down. To stay ahead, some smaller banks offer a higher yield, some are going above 15% a year. Those banks need to offer more because everyone is saving and expecting to take government bonds for a higher yield, so banks need to raise their interests to "stay ahead".