Correlation analysis determines if there is a relationship between the price of LEO and that of AVAX. This analysis is considered for the previous three months (June – September, 2022. I shall consider this under the following subheading.

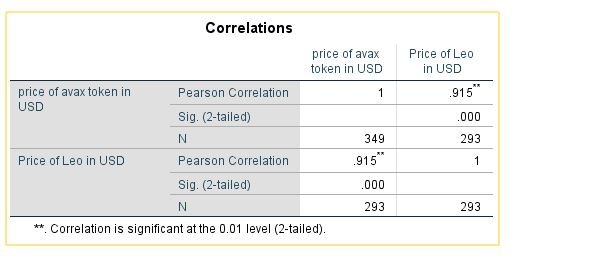

Result of Correlation Analysis

The result of correlation analysis shows that there was a positive relationship between the price of LEO and that of AVAX for 2022.

However with a coefficient of 0.915, the relationship seems to be strong.

A positive relationship indicates that as the price of AVAX is in a bull, the price of LEO will likely be in a bull and vice versa.

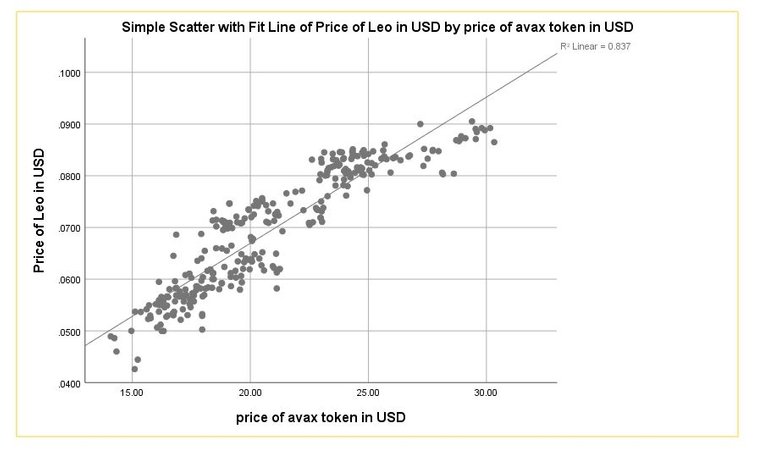

Scatterdot Diagram

The scatterdot diagram shows that the analysis of correlation result seems to be true and can be used in prediction. Considering the line of best fit which helps to estimate the price of LEO when that of AVAX is known.

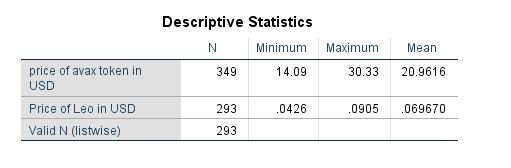

Maximum, minimum and mean Price of both Assets

The maximum, minimum and mean price of both assets is been summarized in the table below. It can be seen that during that period in time, the highest price of AVAX was $30.33 and that of LEO is $0.0905.

Conclusion

There seem to be a positive relationship at a high strength between the price of AVAX and that of LEO.

Other images includes

Data view

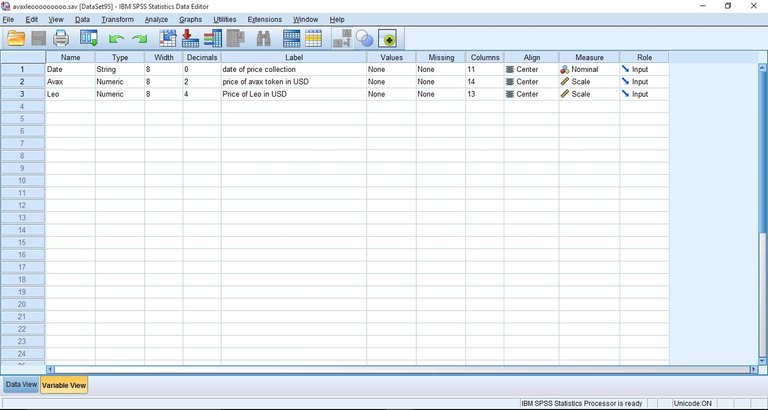

Variable view mode

Posted Using LeoFinance Beta