The question can be answered by performing a simple statistical analysis of both assets. It helps to conclude in the decision of investing in HIVE and LITECOIN at same time.

Correlation analysis measures the level of relationship between the price of HIVE and that of LITECOIN.

The following shall be shall be treated in the course of study

Result of correlation analysis

Scatter dot diagram of HIVE and LITECOIN

Maximum and minimum prices of HIVE and LITECOIN

Data and variable view

Conclusion

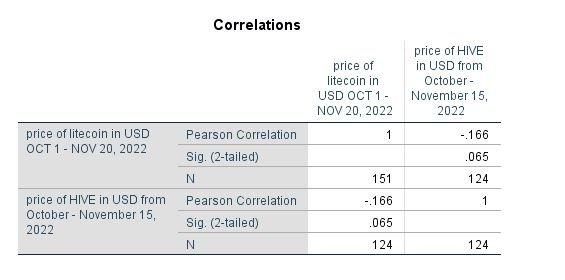

Result of correlation analysis

The result of analysis between HIVE and LITECOIN is presented below.

It indicates a coefficient of –0.166.this is a representation that the relationship between both assets is negative and can’t be useful for investment.

When a relationship is negative indicates that as the price of LITECOIN pumps that of HIVE will dump and if there is a dump in another, there will be a pump in the other too but the rate at which this happen is a major area of concern which will take us to view the scatter dot diagram.

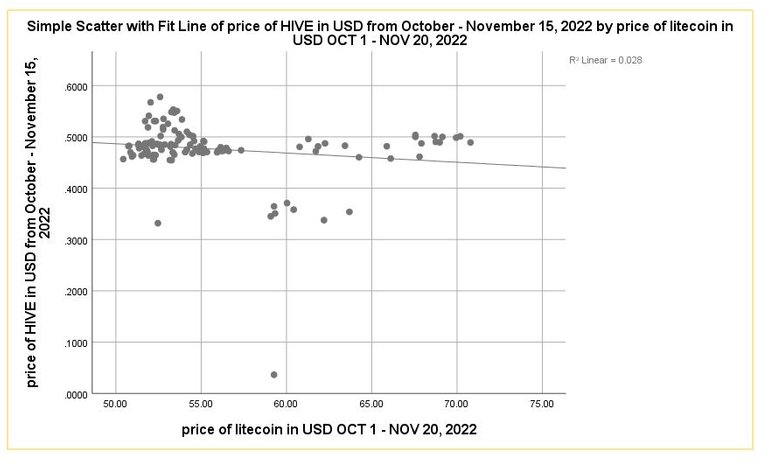

Scatter dot diagram of HIVE and LITECOIN

The scatter dot diagram will give detailed explanation to which rate at which the relationship between LITECOIN and HIVE occurs, it’s very practical.

Visualize any point on the LITECOIN axis and trace it to the line of intersection to the HIVE axis.

You find out there will be a value which almost lies at same point with little difference for every price of LITECOIN. This indicates a weak level of correlation. Hence it is not advisable to invest in LITECOIN and HIVE in your portfolio to take out profit because as the price of One pumps the other will experience a dump.

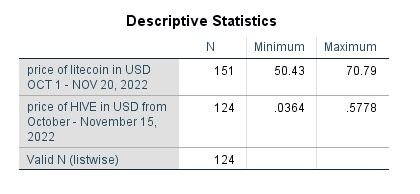

Maximum and minimum prices of HIVE and LITECOIN

The maximum and minimum price of both assets can be seen in the table below.

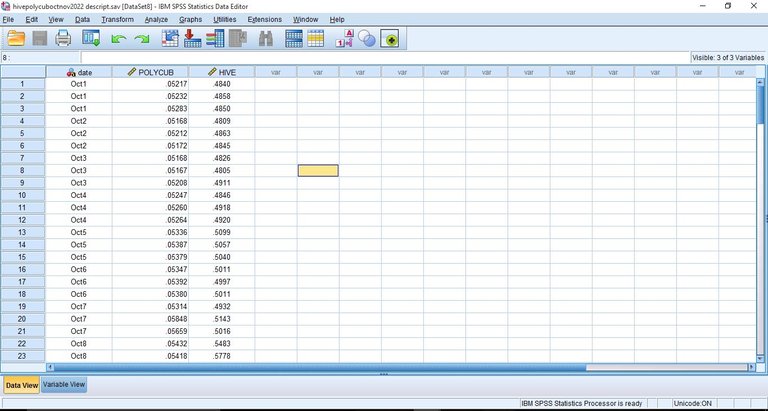

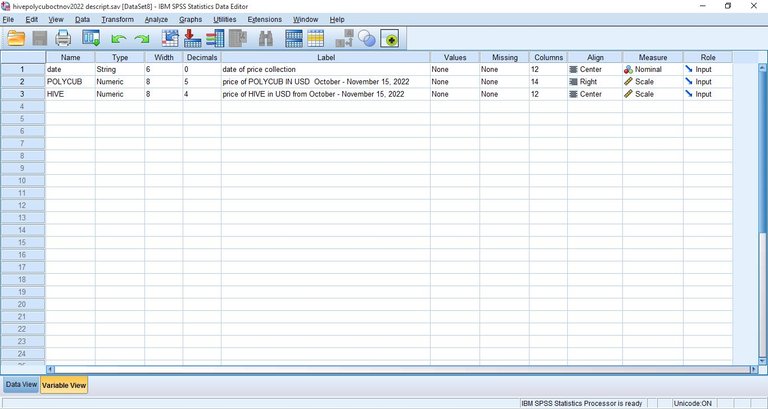

Data and variable view

Data and variable view of price entry between both assets can be seen below.

Data view

Variable view

Conclusion

This article has been able to examine if there is any form of relationship between HIVE and LITECOIN price, the result shows that there is a weak form of relationship which cannot guarantee investment decision plan.

Note

This article covers the period between October to November, 2022.

Thanks for reading.