It seems that the gambling craze in DeFi is slowly dying down. Investors are looking into more sustainable options and PolyCub may just be a very serious contender in that niche. Today I want to look into the good, the bad, and the ugly of PolyCub as a DeFi platform and as an investment.

Thanks to the earnings report we now have a lot of information to work with.

The Good

The good is actually "the amazing" because it seems that what everyone got wrong in DeFi, PolyCub did right. To see how much better Polucub is as an investment compared to similar platforms in the space we need to look at the revenue streams because at the end of the day, the value of a business will be determined by the revenue it generates. Simple as that.

Revenue Streams

PolyCub has the following revenue-generating tools:

- Multi-Token Bridge Wrapping Fees

- Internal Arbitrage

- Oracle Staking

- Protocol Owned Liquidity

Excluding PoL revenue, PolyCub has generated a total of $10,934.58 USD in fees throughout the month of July. If this would be the average revenue for every month of the year we would land at roughly $120K in yearly revenue. For a $700K market cap project, this is exceeding all expectations.

The simplest method of evaluating a business that I know of is multiplying the yearly revenue by 10. If this metric makes sense to you then we can conclude that PolyCub as an investment is severely undervalued.

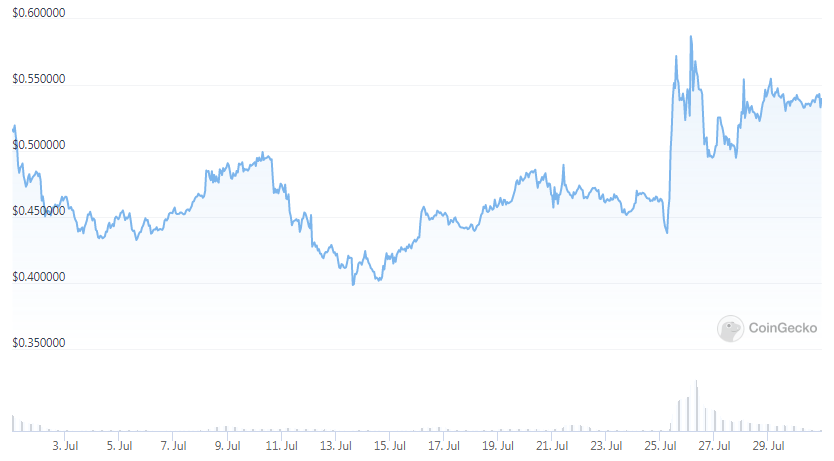

Now, what if I told you that this wasn't even a good month for PolyCub? As we already know bridging and wrapping fees generate most of the revenue but when are bridges used the most? During price volatility of course. And how did Hive perform during the month of July?

Very boring if you ask me. If you were an arbitrager looking to bank some quick profits by moving assets to and from Polygon, July wasn't a very active month for you. Yes, there was some price action but the real revenue is generated when we see swings that crypto markets are used to seeing.

All in all, this seems to be a humble beginning for PolyCub because we are yet to see a real surge of demand for PolyCub-related products.

Buybacks and Emissions

I have to admit that I was skeptical about the deflationary tokenmics model that was tested with PolyCub. It just seemed odd to distribute most of the supply in such a short time period but it has created an environment where "sustainable yield" can even be discussed.

We are down to 20% APR for xPC stakers which seems reasonable considering the fees PolyCub generates. New investors don't need to worry about inflation because most of the supply is already in circulation while the early birds get to reap higher rewards before the word about a sustainable DeFi platform is out.

I'm glad I was proven wrong on this one.

Most similar projects always face issues such as a lack of demand or a lack of liquidity for their token. Again, PolyCub solved both of these problems by turning the tokenomics model on its head and creating constant demand through buybacks. With minimal inflation, this should create a net positive price action in the very near future.

Yield Governance

Thie thing I love about Hive and Hive-related projects, in general, is that they always use what works in the outside world and try to improve upon it. That is why PolyCub stakers can earn even more revenue through yield governance.

This is a win-win situation both for those that lock their tokens and the token itself. Locked tokens are essentially removed from the market and relieve sell pressure while the platform rewards them for that through extra revenue and a unique revenue-sharing model.

If we were to scatter through every DeFi project known to man we would still struggle to find a well-rounded platform like PolyCub. Very few of them have the ability to brag about their yearly revenue because it would hardly justify their current market caps.

The Bad

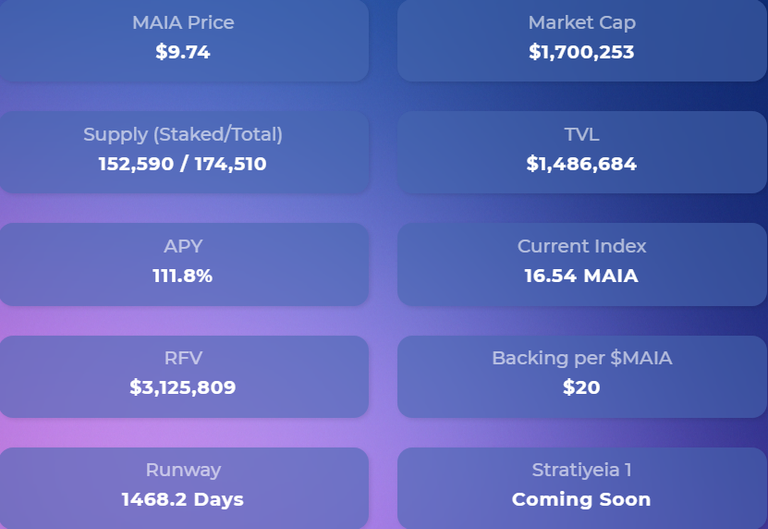

There are very few negative aspects to PolyCub but if you are like me, you will always find something to complain about. For example, I would personally love to see more transparency when it comes to protocol-owned liquidity.

We know that PoL is partly (or fully?) used to fund the multi-token bridge but I haven't found an exact number and type of tokens that are held in the PoL. Having that displayed on the website would probably be very useful for everyone.

Here is an example of a similar project from the Metis ecosystem.

When you know how much the assets backing your token are worth you can determine if the investment is worth it or not.

The Ugly

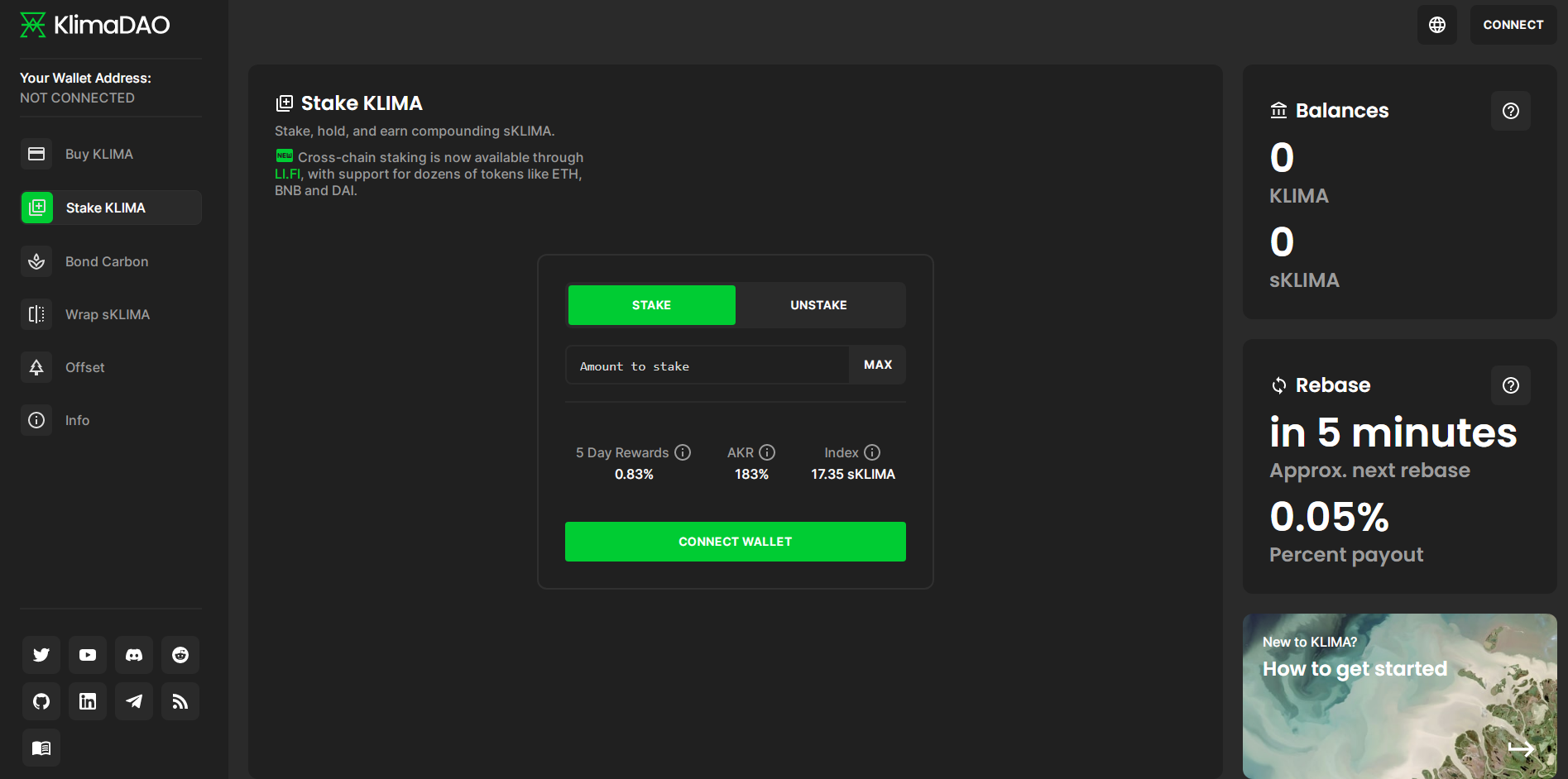

My final PolyCub rant will have to be about the UI. All of the amazing features of the platform that I mentioned above don't have the representation they deserve in a visual sense. With the current performance, PolyCub is competing with some "mainstream" projects that are basically underperforming when compared to PolyCub revenues.

KlimaDAO UI

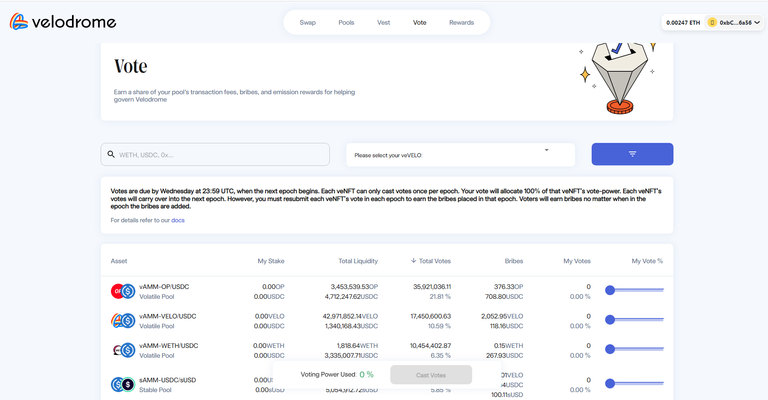

Velodrome UI

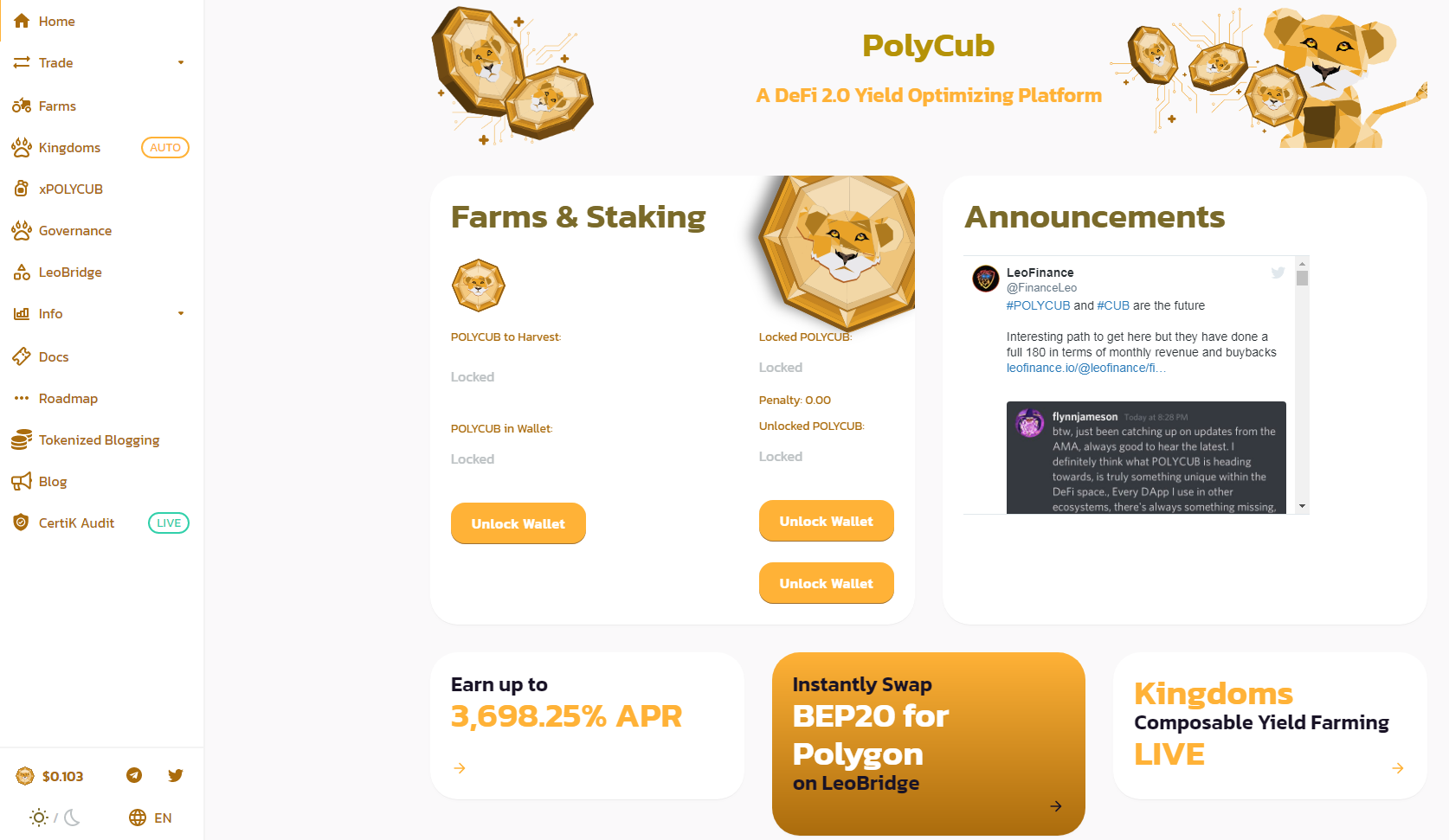

PolyCub UI

My point is fairly simple. If we are improving on the existing financial mechanics that are pioneered in the DeFi space I think we should also take some lessons from a visual standpoint and try to appeal to a broader audience.

We all know that our PolyCub investments are safe and probably one of the best long-term bets we have taken but if you just came across this platform with no prior knowledge of Leo Finance, how everything ties in together and how the growth of one platform incentivies the growth of another, would it seem like a reasonable investment or would it just be dismissed as yet another Biance Smart Chain copy-pasta DeFi farm?

The first impression is key in crypto and DeFi. If you disagree with me on this, I would love to know why so be sure to leave a comment below.

Posted Using LeoFinance Beta