Real yield has taken over DeFi and protocols are racing to fall into this category for very obvious reasons. As I already wrote in my 2023 DeFi predictions article, common sense is back on the menu and investors now want to know where the yield is coming from.

Here are a few names that are already catching everyone's attention.

Radiant Capital [Arbitrum]

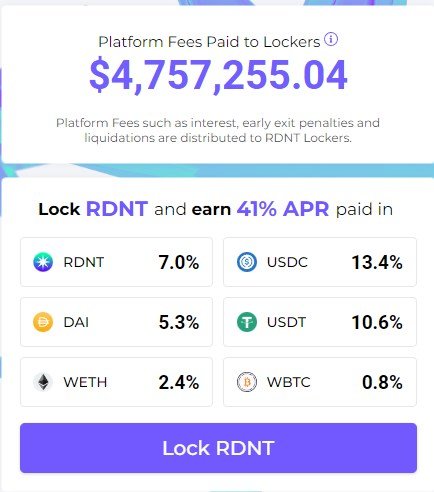

Radiant is an omni-chain lending protocol that shares revenue with token holders. There are two ways of earning on Radiant: by providing liquidity or by locking RDNT tokens. As a liquidity provider you are paid on RDNT at a fluctuating APR while locking RDNT yields a lot more rewards paid out in many different currencies.

Locked RDNT is subject to a 4 week lock (28 days) and will continue to earn fees after the locks expire if you do not withdraw.

At the time of writing, Radiant Capital is paying a 41% APR on locked RDNT.

Perp 88 [Polygon]

Decentralized perpetual exchanges are also getting their 5 minutes of fame in DeFi and they deserve all of it. These are the game-changers we are all waiting for. Products that can truly compete with centralized exchanges and offer a far better user experience. My favorite one so far is Perp 88, among a few others.

With Perp88 you can either earn protocol fees by providing liquidity or trade BTC and ETH perpetual contracts with up yo 88x leverage. When you provide liquidity you need to purchase the PLP token which is basically an index of many different currencies such as BTC, ETH, USDC... This token only represents your LP value and can only fluctuate in price if the prices of underlying assets start changing. If BTC goes up the value of your LP also goes up and vice versa.

The current APR is not very attractive but with more activity the yield should be a bit more appealing. Perp 88 is still a very unknown name on Matic.

If you do decide to give it a shot you can use the referral code JERRYF for trading fee discounts and other benefits.

GMX [Arbitrum]

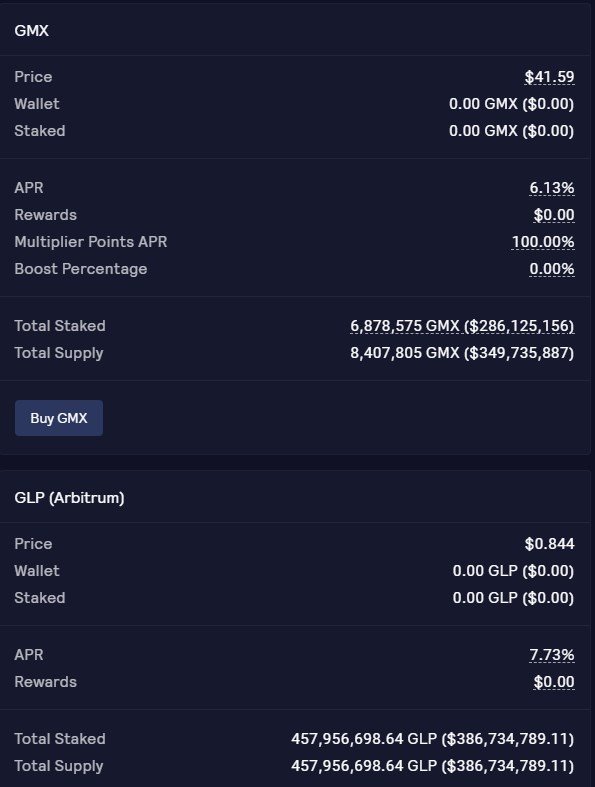

GMX uses the same fee distribution model as Perp88 but it has two tokens. GMX is the native token and GLP is the LP token that also represents the underlying LP funds. The word about GMX is already out and the APR isn't as high as it was a few weeks ago. Still worth considering for those that want a low-risk return on their idle crypto funds.

BeeSwap [Hive]

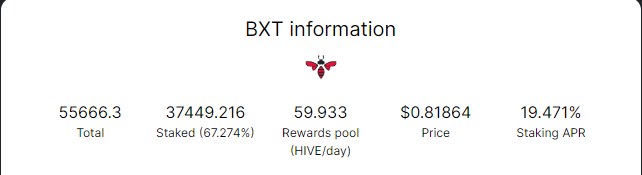

I can't allow myself to talk about real yield without mentioning BeeSwap again and again. While DeFi bros were fighting over whose food token is worth more real yield was pioneered on Hive through BeeSwap. Yes, the APR is low once again but for a ~$50K market cap project, is 20% APR really that bad?

Unlike many other DeFi projects, BeeSwap allows you to withdraw your tokens in just 3 days. If you are on Hive, I just can't recommend it enough.

Posted Using LeoFinance Beta