In what could be described as a dull market lately, the recent performance of Akash's token $AKT is capturing attention. As long time followers would be aware, I have posted on and off about Akash for years now. It was my first investment of any significance outside of HIVE, and marked my entry into the Cosmos eco-system. So this is a token I have had a soft spot for a while, and still hold (not enough) till this day.

Image Source: Coingecko

Why is Akash rising?

There are a combination of factors (as I see things) contributing to Akash's strong performance lately.

Tokenomics. The Akash token has been through its cycles, and is widely distributed. The good thing is it is not a high inflation token. Compared to many of its Cosmos eco-system peers, its staking yield around 9% is much lower than average. I see this as a good thing as it means all the inflation farming has moved on, and the token is now in the hands of holders rather than farmers. In fact, AKT may be in a position as the beneficiary of other tokens high inflation. Farmers may be dumping the speculative, high inflation yields and using those funds to build their position in AKT. This is just speculation on my part.

No more unlocks. Akash's seed rounds and early token locks to early investors and other backers are all unlocked and over with. This is another positive in my view, as it means that there is not a potential overhang of large numbers of AKT that could be dumped on the market, depressing the price. There could still be big holders selling, of course, but with unlocks finished (the last was March this year), Akash looks in better position than many other Cosmos tokens.

Builders keep on building. Throughout the bear market, the team behind Akash have kept building. The founder Greg Osuri remains 100% committed to the project, and inspires confidence. But more than that, the project has continued to deliver updates and progress, despite the poor market conditions. The cycle is crypto is that the stars during a bull market are generally built during the depth of the bear market.

The A.I. Narrative. I think this is the big thing driving Akash in the current market. Crypto has had its big narrative drivers. The DeFi wave was a big one, as was the NFT craze. We have had Meme coin crazes at times, and who can forget the little period were all you ever heard about was the Metaverse. Does anyone actually use a Metaverse yet? Anyway, if you are looking for a "narrative" to invest into, it is hard to go past the A.I. trend at the moment. Likely much more of a permanent move than a transitory period like the previously mentioned phases. Akash has positioned itself as an A.I. play.

Trust and Transparency. Akash is completely open sourced and decentralized. It's main product currently is in fact dedicated to the idea of decentralization, being a marketplace for cloud computing resources. It is a project that lives and breathes the true crypto principles I believe. @forexbrokr wrote an excellent post a few weeks ago, comparing Akash with the number one ranked AI coin, Render $RNDR. I highly recommend Forexbrokr's post for more detail on the comparison between the two.

Image Source: Pixabay

Akash's AI credentials.

The main development that places Akash into the AI narrative is GPU's. GPU's are shaping up as the main form of computing power for AI, certainly for AI generated images and and the like. Just like Akash built a marketplace for cloud compute, they are building a similar market for high end GPU's.

Akash introduced the world to an open-source marketplace for compute. Today, the network is taking the next significant step by launching a testnet for the first open-source marketplace for high-density GPUs — enabling anyone around the world to access a wide range of powerful GPUs for training, pre-processing, fine-tuning, and running inference.

The above quote is from a post entitled Building the Supercloud for AI posted on Akash's blog in June. As with other decentralized options being built, like our own "On-chain content platform" HIVE, a proper, decentralized alternative to the concentration of power that letting Google or Amazon monopolize cloud services is a desperately needed thing.

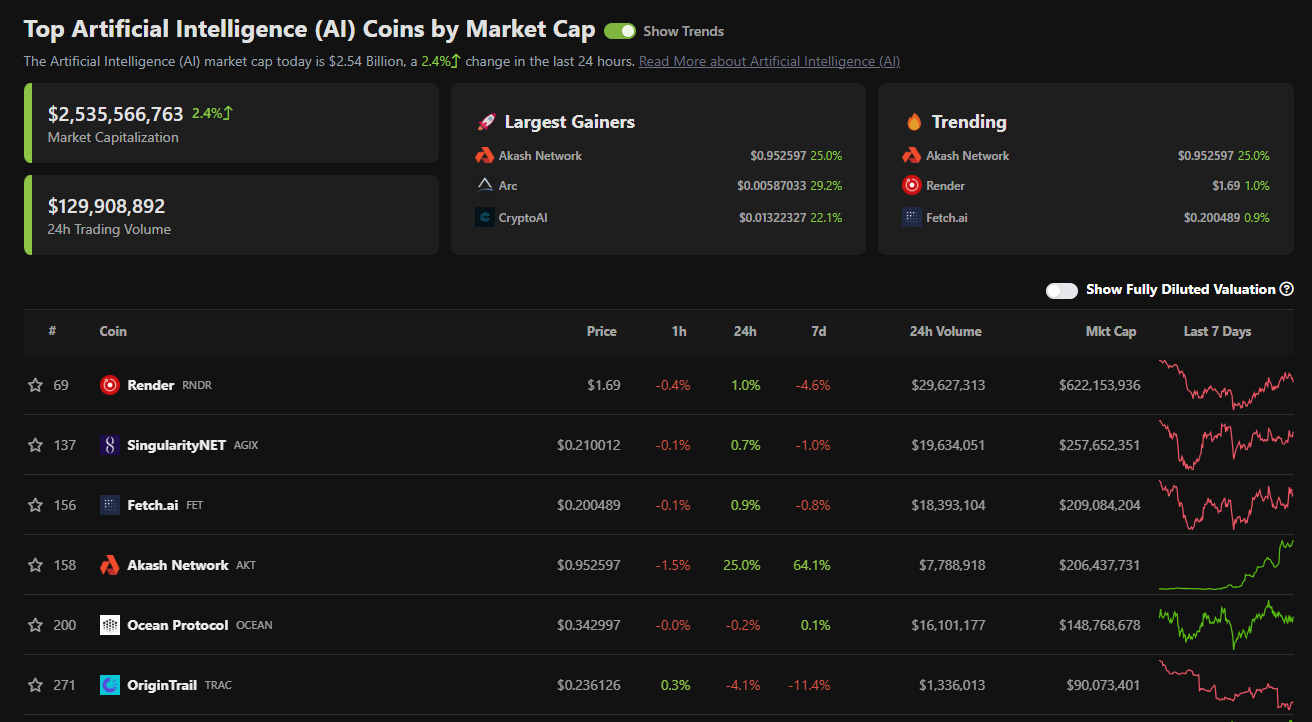

Here is the top AI coins by market cap, according to Coingecko:

Image Source: Coingecko

As you can see, Akash has moved to position 4 in this ranking, and is close to Fetch.ai. A 3x from here would move it past $RNDR into top spot, and again I refer to the post by @forexbrokr linked above.

Let me finish with some Hopeium. 🚀

On the 5th of February, 2021, I wrote a post that has possibly been my most viewed post from outside of Hive. Akash (AKT) could go to $250 by 2025. We are about half way through that time period, and obviously have a long way to go.

Just for reference, a $250 token price, would give a Fully Diluted Valuation for Akash of just under $100 Billion. Yes that is a big number, and today it would put AKT in third place by market cap, behind $BTC and $ETH, and above $USDT. Unlikely, but this could be a very different comparison if the next bull market arrives.

How many coins have gone over $100 bill market-cap at the height of the last bull markets?

If the GPU marketplace gains significant market share, what does that do for $AKT?

Is my (fairly extreme) price of $250 still in play?

What do you think? Let me know in the comments below.

Cheers,

JK.

If you enjoyed this post, here are some more recent articles of mine you may like:

artificial intelligence

Posted Using LeoFinance Alpha