Comdex is a project I have been invested in since its launch. The Harbor protocol is a stablecoin protocol being built on Comdex, with a design modeled after the Maker DAO project with the DAI stable. For Comdex, the stable token will be CMST, and the MAKER equivalent governance token will be HARBOR.

It has been announced that the HARBOR token will be airdropped to many different Cosmos eco-system communities (almost all it seems) including of course CMDX stakers.

Today I finally got around to using the testnet for Harbor Protocol to see how it will work.

Getting started.

- First thing to do is to visit the Harbor testnet site.

- Connect your Keplr wallet, during which the Comdex testnet chain will be added if you have not already done that.

- Once connected, then you can visit the Comdex discord to request some testnet funds.

- Visit the "Request-faucet" channel and type the command $testnet (your wallet address).

- The faucet should send 50 CMDX (on testnet, not real money) to your wallet.

- It is also possible to request some other currencies, like OSMO and ATOM. (again testnet, not real)

Once the funds are in your wallet, you are good to go.

Mint.

With a little testnet CMDX in my wallet, (50 to be exact) I head off to the mint page to use it to mint some CMST stablecoin.

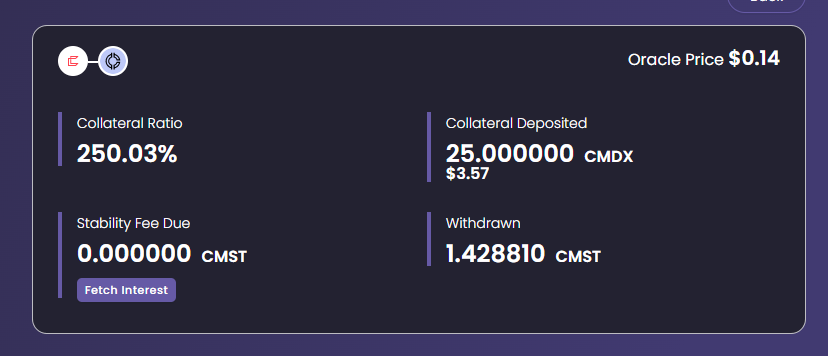

Unsure of what I was doing, I decide to start with the first vault shown above.

I found it very easy to deposit my 25 CMDX into the vault and mint my first testnet CMST.

I then go back, and use the second vault to deposit another 24 CMDX and mint some more. Each vault has a slightly different fee structure, and minimum collateral ratio, so when this moves to mainnet it will be up to you what strategy you take.

Earn.

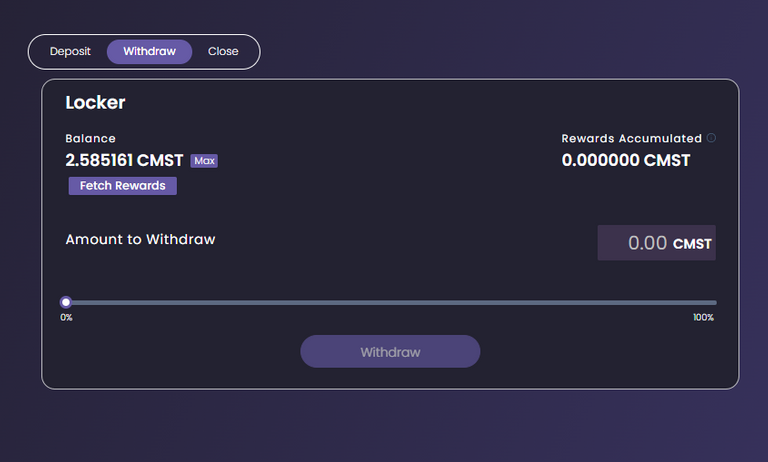

Next, I head to the Earn tab where you can deposit CMST into the locker to earn interest.

The deposit failed the first couple of times, and I had to mainly edit the gas amount to be able to push the transaction through. Anyway, with that done, my 2.5 roughly of freshly minted CMST is now deposited into Earn interest.

Then I click on the "withdraw tab" to see what it looks like.

So obviously this is where to go in future to claim the interest rewards on this position.

Positions.

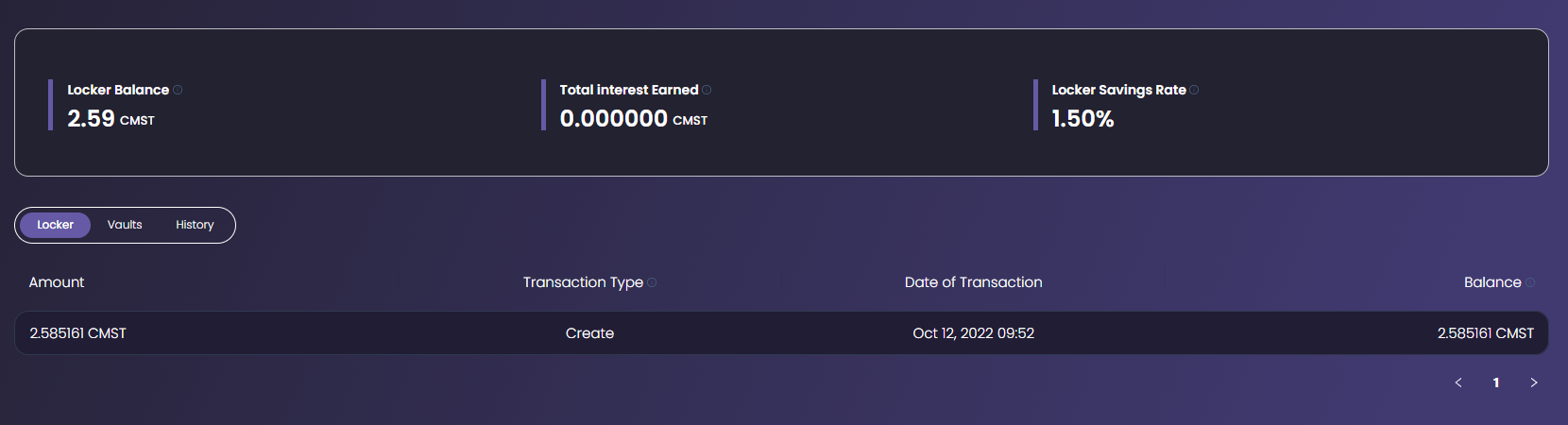

Heading back to the positions tab shows an overview of what positions I currently have open.

This obviously shows the deposit of CMST I made into the Locker.

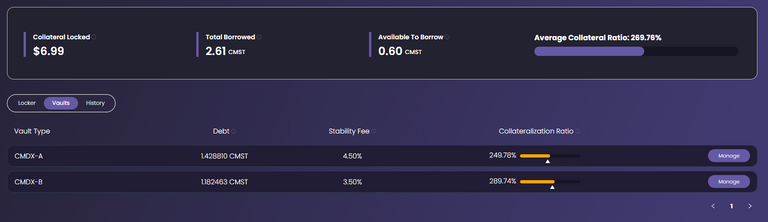

And the vaults tab shows my current collateral positions open, and their ratios and so on here. It also shows how much I have borrowed, and what I could add to borrowings to hit my minimum collateralization across the vaults.

Other stuff.

Lastly, I take a look at the other tabs on the home page, being the "Auction" and "More" tabs.

Auction is obviously where tokens will be sold off if peoples assets get liquidated.

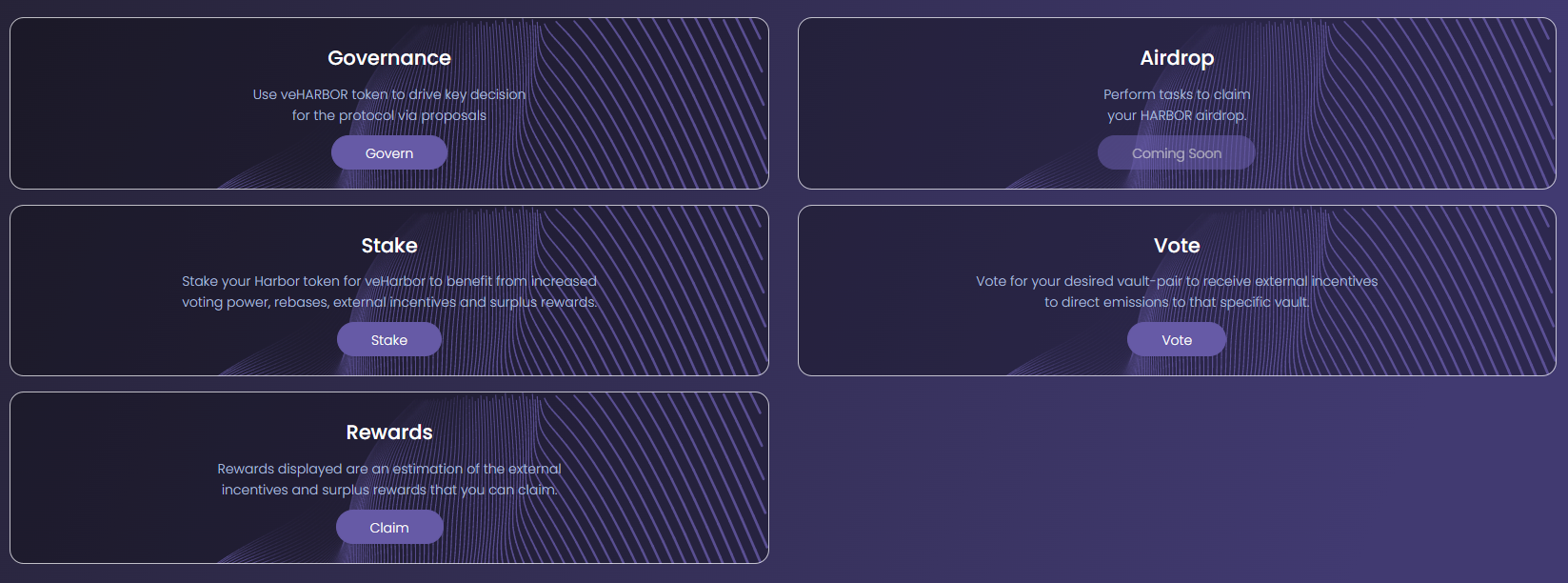

More is interesting. All the functions for the HARBOR token seem to live here, staking, governance and so on.

My thoughts.

Having never used a crypto borrowing platform before, this all gelt fairly straight forward to me. Depositing assets into a vault to mint (borrow) the CMST stablecoin. The interest rate on depositing the CMST into the locker is low - just 1.5% - so if the mainnet is similar then I'm not sure how appealing that will be. But the process was easy.

The appeal of CMST will be beyond just this platform, with other Comdex apps utilizing it, and likely other IBC Dex's and so on over time. Where it will find it's place in the Cosmos will be interesting, with similar options being launched by KUJI with USK and Injective with IST to name just a couple. The competition for adoption will be interesting to watch over the coming months.

I will say to keep your eye out for the HARBOR airdrop. It seem it will go to many many Cosmos eco-system holders, with a particular focus on Governance participants (make sure you vote on proposals). There is also a possibility that participating in this test net may also be of benefit, but I am not sure if that has been confirmed yet.

So there you have it, my first look at the Harbor Protocol testnet. Will I use the mainnet? - most likely. Will I hold my HARBOR airdrop when it happens? - definitely. Am I excited again about Comdex? - getting there. Time will tell, but this little play around has revived my interest to some degree in Comdex. In upcoming posts, I'll take a look at what else is coming from the Comdex team, and have a play with more testnet's.

Thanks for reading, I'd love to see other people share their experiences with the Comdex testnet here on Leofinance. We even have a dedicated Comdex community page which really needs more content. Hit me up if you would like help getting started.

Cheers,

JK.

Incase you missed it, take a look at my post yesterday looking at The new Cosmos whitepaper.

Posted Using LeoFinance Beta