Evmos has had a glitchy and problematic launch. The initial launch was aborted after a few days, with the chain halting and an upgrade failing. There was also issues with claiming the airdrop, and just a UX that left much to be desired. During an extended outage, the team worked on improvements and got the chain sorted out better, and it relaunched a few weeks ago.

EVMOS Staking APR.

The Inflation rewards for staked EVMOS have recently been activated. With high token emissions, and a low rate of staking currently, the APR is huge. The first two days of returns for staking EVMOS have been well over 1000% APR. Up until the start of token emissions, the use cases for EVMOS in the first few weeks since relaunch have been focused on its place in Dex's built on EVMOS, and as Gas for transactions.

The start of inflation and the enormous early APR has seen a scramble for EVMOS tokens, and the price has surged in the last couple of days. EVMOS has pushed quickly in to the top 100 by market cap on Coingecko, and with its token hovering around $3 means its market cap is around $600 million. Indeed, the last couple of days for EVMOS have been a real bright spot for weary Cosmonauts, who have endured months of declines across the board, and the recent demise of LUNA and UST being the icing on a very nasty cake.

What goes up...

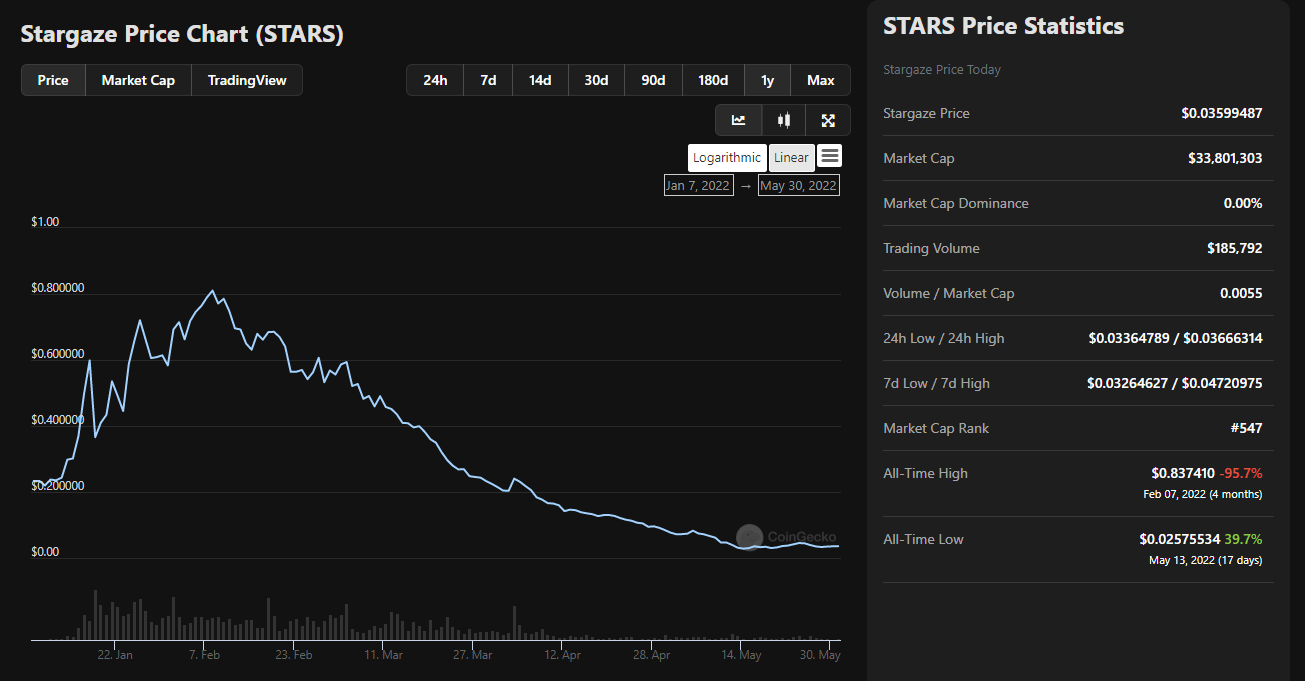

The big question for EVMOS is: will it's price performance look like OSMO, or some other Cosmos airdrop assets like STARS as just one example.

So, for OSMO there was an extended period where high staking rewards were absorbed for quite a while by use case, as a key coin for Liquidity mining on the platform. Eventually, the price faded from its $10 high during the recent market drops, to its current price around $1.40.

Here is the chart for STARS - the token for the Stargaze NFT chain. This pattern is repeated across many of the Cosmos eco-system projects that launched late last year or early this year. It started off well, price rose for a bit while staking rewards were huge. Then the decline set in as people waited for the main products to launch, and sold those high staking rewards into other tokens. This pattern repeats over and over for similar projects.

Personally, I think EVMOS may do well for a while. There are more ways to use it, right from the start. People will be buying to chase the crazy APR, and the rewards will decline as more and more supply gets staked. But EVMOS will also be in demand for LPing, primarily in the Dex's built on it, but also in other Cosmos Dex's like Osmosis. The market is also in a different phase than when many of the other Cosmos chains launched.

It will be interesting to see how it goes over the next few weeks. I'm expecting it to be strong for a couple weeks, and then decline for a while till it finds its balance between staking APR, and LP demand.

What is Live?

So far, the airdrop still has issues. Usage varies between those coming from Cosmos, and Ethereum users. Being an EVM, Metamask is the primary way of interacting with Evmos. The primary Dex so far seems to be Diffusion, a clone of Uniswap V2. There is also Cronus available. Many more projects are starting up, or branching out.

To use the EVM requires an Ethereum wallet like Metamask, causing complications for Keplr users from the Cosmos eco-system. Claiming the airdrop at Evmos - mission control requires importing your claim to Metamask. Those of us that used a work around to claim via Keplr during the first aborted launch of EVMOS are having issues with this. I still have no idea how to claim the last 25% of mine for example. Not sure of how to stake using Metamask either, although I have not looked to be honest, as I had mine staked on Keplr.

My thoughts.

The UX is clunky, and certainly not smooth sailing yet. The project is ambitious, but has a relatively small team behind it as I understand things. Building an EVM, with seamless link to the Cosmos via IBC will be a fantastic outcome. For now I have EVMOS that I claimed earlier staked. Personally, while the price is good, and staking rewards are crazy, I am using those rewards to rebuild some other positions on Osmosis. I've had a play with Diffusion, and it works fine. But I've seen too many Cosmos projects launch with lots of hype, and then decline for the next 6 months. The chart for STARS is repeated by so many similar tokens.

Short term, I'm selling staking rewards. Once the decline in price has kicked in, then I'll probably swap to staking/accumulating to build up a position for the next bull market. I'm not loving the UX, and still trying to figure out stuff. But I am very hopefully that it succeeds as it feels like an important addition to the Cosmos.

Have you checked if you are getting the airdrop yet? Free money and an insane 100% + APR is worth a look. Let me know your experience in the comments below.

Thanks for reading,

JK.

If you enjoyed this post, here are some more you may like:

Posted Using LeoFinance Beta