You just bought your first cryptocurrency; it feels great, I know. Makes you want to buy even more, sometimes the same token; other times a different one. That’s probably not you, you might have bought your first crypto many years ago. Regardless, the feeling is basically the same. Being in a space of over twenty-five thousand cryptocurrencies, promising ones; it is hard to just stay glued to one cryptocurrency. Maximalists think the opposite, but that’s fine anyways.

Love happens many times, naturally. Whatever makes you like a cryptocurrency project can happen all over again, as many times as possible and in different ways. You’d end up investing in a couple of projects. one term for this – Diversification.

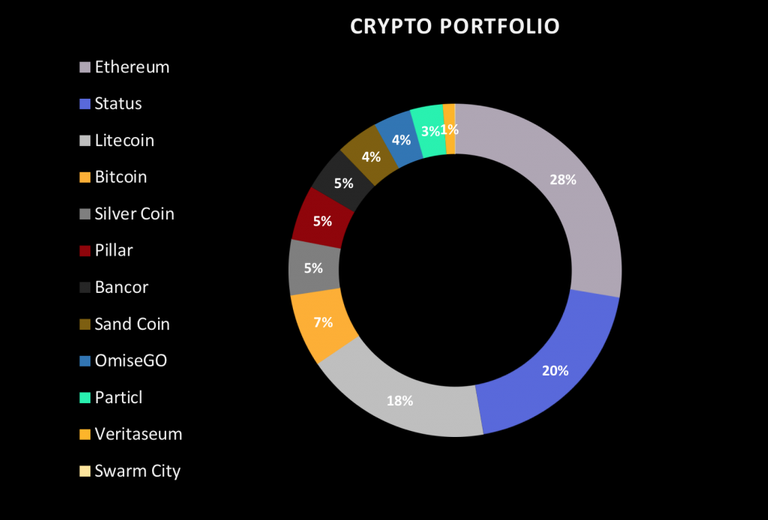

Majority of cryptocurrency investors prefer to split their funds across a number of crypto assets. Personally, I do this too. For several reasons, a diversified portfolio is a common practice in the cryptocurrency space. Why pick one when you can actually get as many as possible? You know who has a different answer…

A number of reasons would make an investor diversify. A gamer and a believer in Artificial intelligence will probably put his money on two projects related to this, maybe some Axie Infinity and SingularityNet tokens. If you fancy crypto as a portable payment medium, you’d probably add some ripple and stellar to your portfolio. This may go on as long as your cravings and sentiments.

Apart from personal interests and minimizing risks, certain ethics held up by a project is enough to attract an investor’s attention to the extent of investing in them. Projects with a certain level of decentralization and encouragement for community involvement tend to attract a good number of investors. In contrast; centralized projects are also attractive to some. Whatever serves your taste the most. Investors love to put their money where their mouth is. But this could happen more than once and diversification may come in as a result. Diversification isn’t all shade of good anyways.

Thousands of cryptocurrency projects, each one with plans of ‘taking over the world’; even baseless meme tokens plan to be the new world currency; even though they don’t even run on their own blockchain. Every cryptocurrency project is painted with buzz words and sounds all cool. It’s hard not to fall in love too many times. But resist the urge to go with these feelings.

Most times they result in you splitting your funds to satisfy your ragging love for several projects. An overdiversified portfolio might sound like a hedge against the volatile cryptocurrency space. But it’s not. In a space as wild as this, spreading your investment could turn out to be just another way of increasing your risk level; especially when this diversification is (almost) based on hypes and external suggestions.

Capitalizing on a few credible investments have proven to be yieldful; in fact, maximalists hardly get it wrong. The strong conviction that keeps one glued to just one project is most times a result of extensive research and belif, this works better than sporadic investments driven by little knowledge. Your investment in over fifty cryptocurrency projects still stands more chance of failure than an investment in ten well studied projects or even less.

It’s a nice approach to have your eggs spread through a number of baskets. Diversification might simply be a representation of your convictions and personal interests. However, spreading your investments irregularly stands more chances of backfiring than not. Every cryptocurrency project is shiny and ‘full of potential’; most times this turns out differently. Diversification, just like any other strategy works when done well. But here’s a suggestion, “don’t overdo it”

Have our next publication delivered to your mailbox

Cryptocurrency Scripts is transforming into a community of enthusiastic cryptocurrency and blockchain believers! Join the Adventure!

Would you love to read similar articles?

Have our next publication delivered to your mailbox

Follow us on Twitter

Follow us on Medium

Follow us on Publish0x

Follow us on Facebook

Posted Using LeoFinance Beta