As people first enter the cryptocurrency market there is a whirlwind of new information to take in. Learning new tech, terms, ideas, and even ways of thinking that may be completely foreign to them. For many, this is the biggest deterrent from entering crypto. If they can just get off their position of zero and begin to learn about the market. Usually, after that, there is no turning back. They have fallen deep down the rabbit hole. But, for those people who are just entering the market, Bitcoin is almost always the first cryptocurrency that is recommended to them.

After all, Bitcoin was what started everything. The king of crypto. The most decentralized and secure blockchain on the market and also the hardest form of money. If there is any crypto that could be considered “real money,” it’s Bitcoin. Passionate fans of Bitcoin believe that it is the only crypto that you should be buying. That the name of this game is to accumulate as much Bitcoin as you possibly can. Claiming that all other crypto is just noise and a distraction.

But as time goes on, the temptation to invest in the altcoin market begins to intensify. A likely reason for that would be people who have recently joined the crypto market. They may feel that they have missed the BTC boat and can find better gains with altcoins. While higher gains can be found outside of Bitcoin. Maintaining them against BTC is a whole different topic. One that I’ll dive into on a different day.

(Outdated Tech)

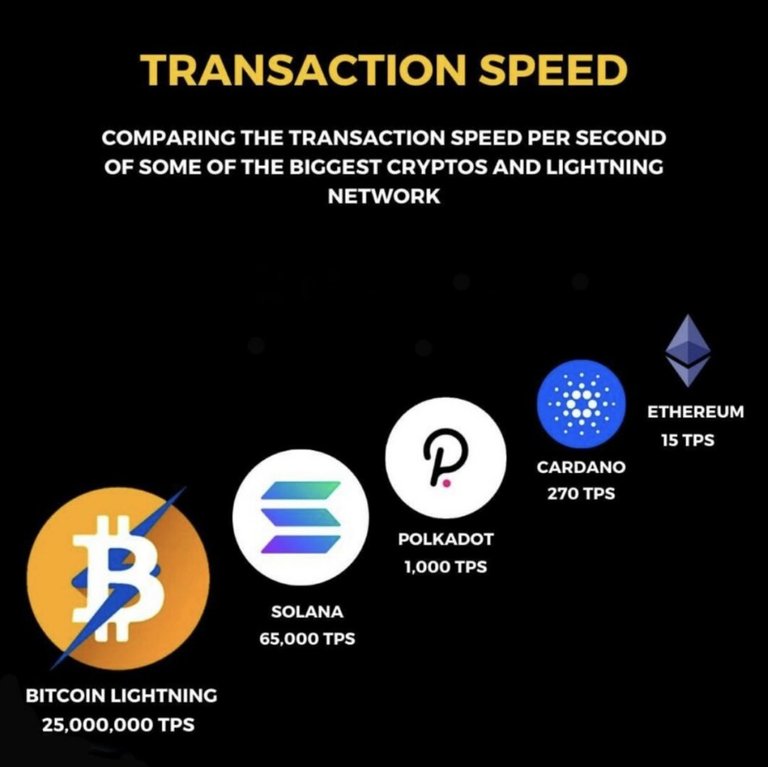

The other key reason why people may begin to drift away from Bitcoin is the technology. Let’s face it, Bitcoin’s Layer 1 is slow and expensive to use. Currently, smart contracts and DeFi are not possible to the full extent that you can find on other protocols such as Ethereum. The lack of tech and Bitcoin’s extremely slow pace of upgrades is what drives many to the newer and shinier projects. You have likely heard about how the new hyped blockchain can process an extreme amount of transactions per second. How fees are next to nothing. How it can scale indefinitely. Those are all in contrast to Bitcoin, which often processes only 3–6 TPS, and has had one meaningful protocol upgrade in the last 3 years. And the next potential big upgrade, Taro, is highly controversial within the Bitcoiner realm.

All of those things may seem like horrible things, but all of these “weaknesses” are actually its strengths.

That’s right, Bitcoin’s lack of tech and upgrades is actually a feature. The truth is that Bitcoin is further along in its history than all other cryptocurrencies. It has already experienced and come face-to-face with many challenges that other blockchains have yet to experience. I’m a big fan of Ethereum, but recently many ETH enthusiasts have called it “Ultra Sound Money.” While it’s inflation rate has dropped significantly due to EIP 1559 and the ETH merge. The truth is that what makes money strong and sound is that the principles and tokenomics are never changing. With Bitcoin, you know exactly how many there are, how many there will be tomorrow, and so on.

Bitcoiners know how valuable the base chain is and are extremely careful about changing it in any way. If the base layer of Bitcoin was never changed, it would still be able to achieve its purpose. Not many other protocols can say that. Bitcoiners have learned that in order to survive, be successful, and be trusted in the future. The most important thing is that the base layer is the most decentralized and has the best security possible. This is why it hasn’t been scaled to achieve faster and cheaper transactions. The Bitcoin base layer is sacred and shouldn’t be risked. Instead, everything that is needed can be built on layers on top of Bitcoin. Do you need faster and cheaper transactions? That is solved with Lightning, where over 1 million TPS is possible in the future. Do you need stablecoins, DeFi, and smart contracts? That is coming with Taro and on Layer 3s.

While all other blockchains are in a battle to overtake each other and therefore adopt tech at a blistering pace that often breaks. Bitcoin is playing a different game. A much longer game. While there were real concerns about whether Ethereum would be able to successfully merge, real concerns about Solana being able to stay online, and real concerns about hacks and rug pulls on bridges or new tokens. Bitcoin is on the left, just chugging along. It is the crypto that can be depended on and is most trusted. There was once a meme that Ethereum is just a testnet for Bitcoin. That anything useful from it, or any other chain will eventually find its way to Bitcoin. It will, but just not like we originally expected. Instead, it will come to Layer 2s and 3s on Bitcoin.

Decentralization, Security, Permissionless, Dependability, Compatibility, Being the strongest form of money, solving the Byzantine general's problem, and anyone being able to run a node. These are the key ethos of Bitcoin. It doesn’t need to be fast. It doesn’t need to have smart contracts. But, all of that will still be possible on top of Bitcoin.

How about you? Would you rather have Bitcoin’s dependability or the flashy tech of other Blockchains?

Support my work on Substack

https://johnwege.substack.com

Follow me on Twitter

https://twitter.com/johnwege

Follow me on Medium

https://medium.com/@johnwege

As always, thank you for reading!

Posted Using LeoFinance Beta