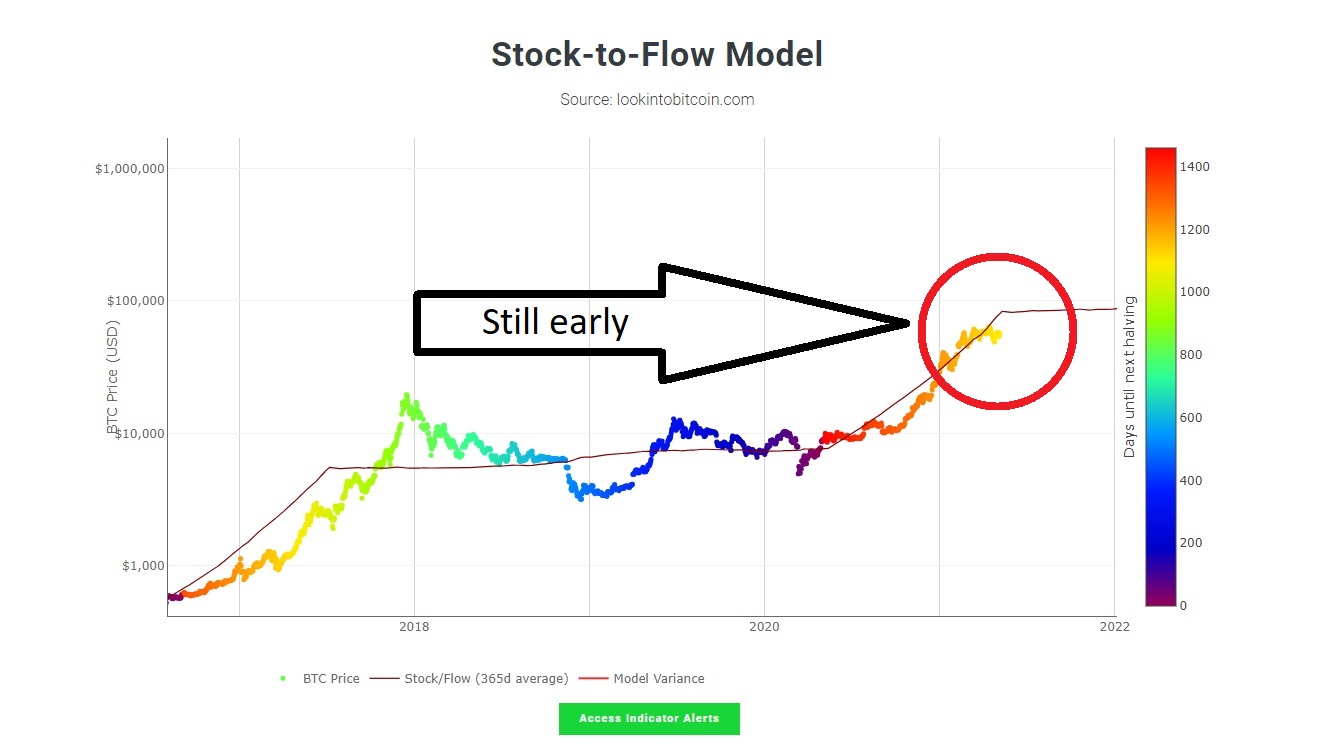

A few days ago we posted that we were going to stop buying crypto and start accumulating cash in the form of stablecoins in anticipation of the expected spike in crypto prices corresponding with the Bitcoin bull run. After reviewing Plan B's Stock-to-flow Model below:

It is clear that we are still early into the crypto bull run. We had previously thought that we were already in the greenish time frame, which is about the time when Bitcoin price rises above the 365 day Stock/Flow average line. Obviously, this was a mistake. We failed to check where we are on the model.

Our Investment Thesis

As the chart shows for the 2017 bull run, Bitcoin prices rose above the average to the all time high before settling back around the average. This is often referred to as reverting to the mean.

Once the price of Bitcoin reaches and passes above the 365 day Stock/Flow average, it tends to spike up, followed by price consolidation for a prolonged period until the next halving. The model shows this behavior repeatedly. Bitcoin price reaches bargain levels again between 600 to 200 days until the next halving.

We believe that we can sit out the spike in Bitcoin price, accumulate stablecoin, and then resume dollar cost averaging Bitcoin at around 600 days, until the next halving and into the next Bitcoin bull cycle.

Risks

One risk we face with this approach is that the often touted "wall of money" from financial institutions that is coming into Bitcoin will actually arrive, throwing off Plan B's Stock-to-Flow model. This would result in us missing out in some of the gains. This risk, however, is mitigated by our long time horizon, which takes into consideration additional halvings in the decades to come.

Another risk that we face is the threat of hyperinflation, which would render our stablecoin accumulation a loss in value despite the 10-12% interest rates being paid. If hyperinflation does present, we would be better served by a Bitcoin that is declining in price as it would eventually turn around and appreciate above the all time high price. Of course, in the case of hyperinflation, we may see a mob of investors flock to Bitcoin, which would drive up the price considerably. In short, if we are wrong and hyperinflation does present, our decision is not irreversible. We can always resume accumulating Bitcoin or other cryptocurrencies.

Bitcoin As A Proxy

Having presented all of that, we are using Bitcoin as a proxy to guesstimate the direction of another coin, CRO, which is the aim of our present accumulation. Our goal is to reach $40,000 worth of CRO so that we can upgrade to the next Crypto.com card tier. The next card tier has benefits that would assist us in growing our other crypto holdings. The CRO coin tends to correlate with Bitcoin price movements. Thus, it makes sense to accumulate as much CRO as possible in anticipation of the spike in prices so that we can reach the target dollar amount for the next card tier.

Ironically, this card tier goal is a roundabout approach to accumulating more Bitcoin. If you run the numbers, $40,000 in CRO, yielding 12% interest is $4,800 annually. That, in turn, is $13 daily, or $91 weekly. This interest income can then be traded for BTC week after week. This is a much more aggressive rate than we can reach with our earned income alone. We firmly believe in Bitcoin. However, in order to maximize our capacity, we are diverting our attention to a vehicle that will boost our purchasing power, CRO.

We will also employ leverage by borrowing against our Bitcoin holdings. However, we are currently paying off consumer debt before collateralizing our Bitcoin to mitigate the risk of liquidation should we become overextended, suddenly.

What do you think? Are we better off investing directly in BTC? Or, do you think it is smart to build a system that will buy Bitcoin for us? Let me know your thoughts.

Posted Using LeoFinance Beta