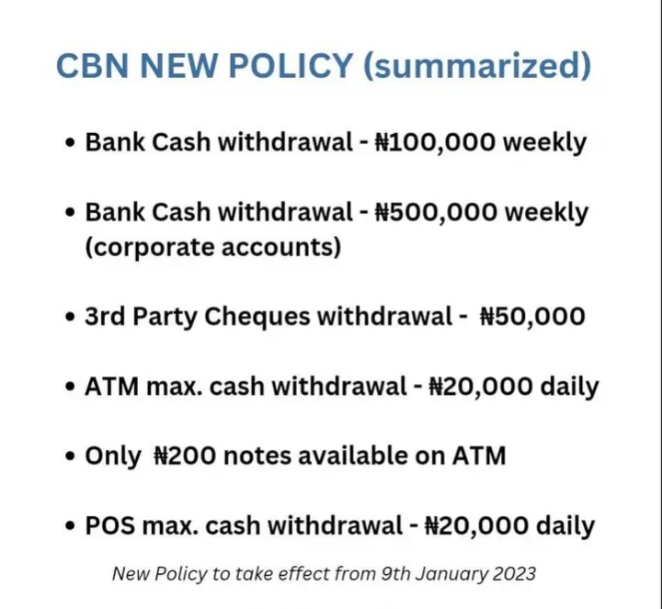

The central bank of Nigeria imposed cash limit on withdrawal with the intentions to boost digital payment, reduce corruption and other illegalities and as a result decrease hard currencies in circulation.

From a financial aspect, imposing cash limit is done by the governing financial body which in this case CBN. But an economy like Nigeria doesn’t needs the cash policy due to the fact that it is struggling having considered the sky rocketing prices of goods and services is not a suitable time impose withdrawal limit.

I will like to show case an instance of same situation that happened in India

In November 2016, the Indian government made a move to demonetize the amount of cash in circulation. With the issuing of new notes just similar to the central bank policy in a bid to increase digital transaction.

It was discovered that majority of citizens of India suffered going through lengthy queues at the bank, some died as a result of the process but the economy of India was depreciating even more instead.

The better side of CBN’s policy

The advantage of imposing transaction limit on cash withdrawal is to encourage digital banking and also prevent illegalities. Most business will opt in for digital banking system in order to trade with their customers as this will unveil cashless policy, there will be significant reduction in hard currency and increase in digital cash as it will reduce illegal activities which involves financial transaction such as kidnapping and terrorism.

The negative side

The negative side of this policy is that it will hinder economic growth. It is advised to set limit on withdrawal in a stable economy but a country like Nigeria where its economic status is very low isn’t the best time to implement this policy either.

The revenues internally generated will be on the reduction side because most enterprise might stop accepting old notes on the other hand there might be a decline in economic assessment for that week.

The Truth

The truth is that Nigerians have a better way of benefiting from policies whichever way they are been designed. The classes of people who will feel the impact are the politicians who have more hard currency secured in their position than in banks.

People who deal more with such category of currency will be mandated to exchange their naira for dollar. This will affect the naira to dollar rate because naira will be on the increasing side in the black market the dollar also will be on shortage.

Secondly I learnt the Nigerian bank has also adopted a system of checking their customers account to spot the ones will higher amount of cash which may lead to questioning by the EFCC. I have receive the complaints by two of my neighbors who stated you will have to submit your card for checking if it encounters a trap by the machine. It’s never a healthy practice though I haven’t seen such in my bank.