Bitcoin rallied sharply last night to hit a level above 44k. That was quite a jump, given that other risk assets weren't necessarily showing similar enthusiasm. Yesterday's rally helped take Bitcoin comfortably above 50 DMA. The next step is, of course, 200 DMA but will it be possible anytime soon?

I don't think a lot has changed on the macro and geopolitical front. In fact, yesterday's volume doesn't excite me that much either.

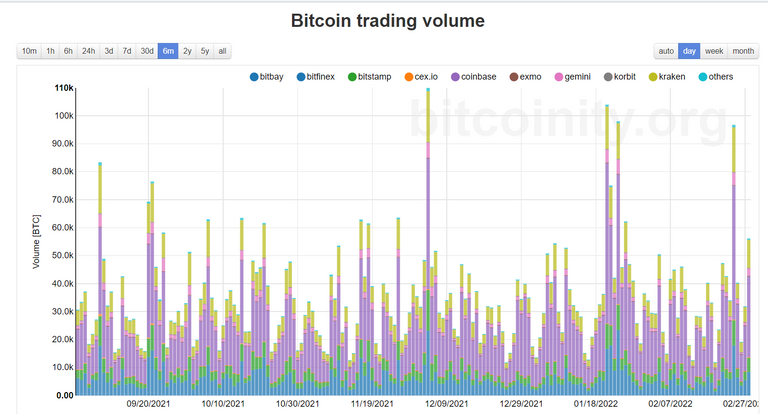

Volume was quite high on the 24th of Feb when Bitcoin formed a nice green hammer. Could have been the start of things changing to the upside but events around the globe made me skeptical. If one looks at aggregate volumes across all exchanges, then one can see an uptick yesterday. The majority of the increased volume was seen on Coinbase.

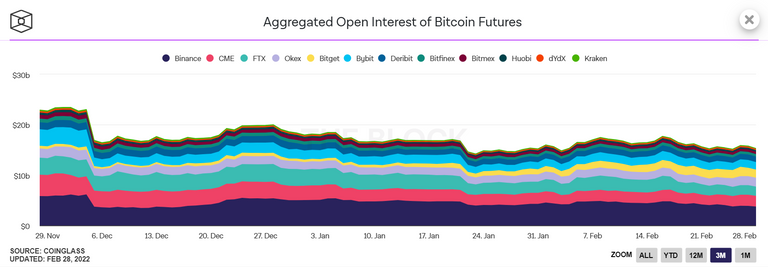

Open Interest did not budge at all yesterday - A strange contrast compared to the behavior in spot markets. Institutional players and speculators are not buying into yesterday's trends and may well see this as an opportunity to take further short positions. Volatility is here to stay and one large green candle doesn't change much.

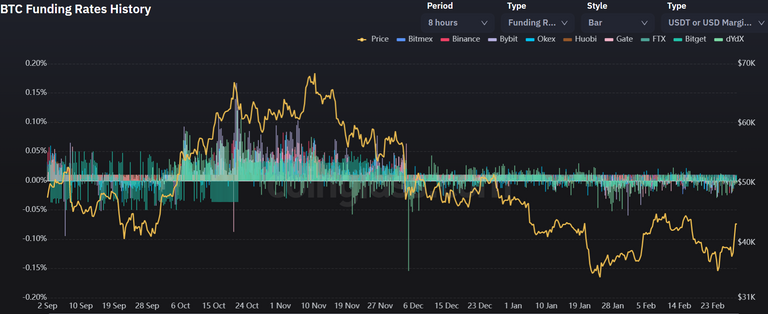

Funding rates have the scope to slide further. (If anyone knows a source to look at a longer-term funding rate chart, then please let me know). While the chart is not signaling crazy bullishness in the market, I think funding rates are perfectly positioned for traders to take advantage of a volatile sideways market. Neither is it hurting the bulls, nor the bears.

Bitcoin probably broke a number of near-term resistance levels yesterday. I doubt if anyone would have predicted such a sharp move on the upside. Possibly, the move in Bitcoin did take out some short positions and what we witnessed was a timid short squeeze.

In 2 weeks from now, Fed will hold its periodic meeting and I don't see any risk appetite returning to any markets till then. Whether Russia wins or loses, the important thing is that both parties or possibly all relevant parties come to the discussion table. Talks have started in Brussels. From what it looks like, no major Western power is joining the war, so this may become a localized issue, which does have the potential to reduce risk-averseness. Any which way, I don't see much change in markets till mid-March. Bitcoin breaching 200 DMA is possible though but that should be the upper limit.

Posted Using LeoFinance Beta