In the latest from Russia-Ukraine conflict, Russia just shelled a Nuclear Power Plant in Ukraine (one of the largest) and there are reports of a fire at the station. There is enough risk from this as both countries involved in the conflict have reported that there is no increase in radiation levels in the area, yet. Source. There are also reports that Russia is not allowing firefighters and emergency staff to reach the area.

Anyway, the West has so far only resorted to sanctions. The ruble has plummeted versus the dollar and Russia's central bank has increased base rates to 20%. Many believe that this will lead to a lot of problems in Russia.

Back in 2014, when Russia annexed Crimea, USDRUB went up by 160%. Compared to that USDRUB has only gone up 75% this time.

This is not the first time Russia is dealing with high-interest rates - 2008, 2014, and now

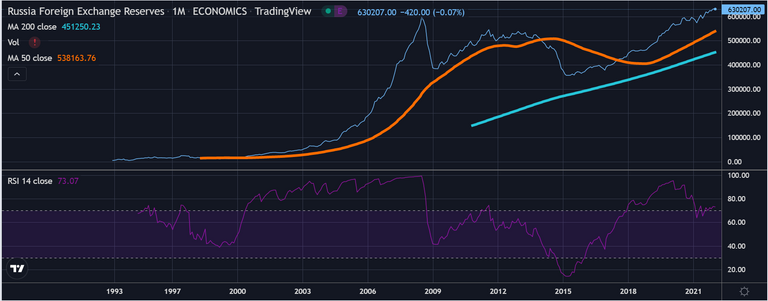

FX Reserves are at the high point in history

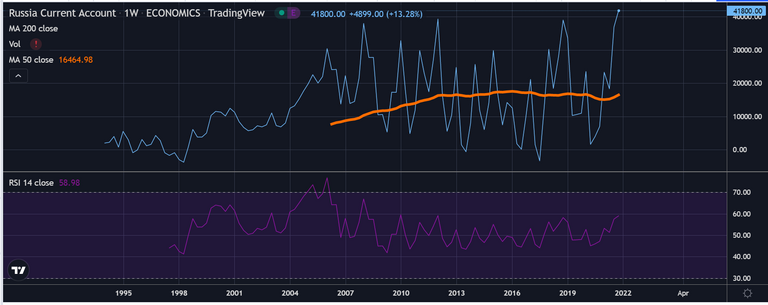

Current Account

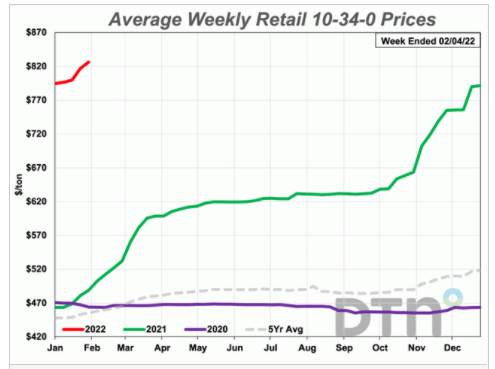

Now, despite sanctions, it's not as if all Russian Trade has come to a halt! Can the price spike cover the loss in volume?

Wheat

Corn

Crude Oil

Natural Gas

Nickel

Fertilizers

Source

Experts are talking about many Russian objectives from this war. Many have already stated that Russia has failed to achieve its objectives. Russia started this operation by first asking NATO to meet its demands. When NATO laughed it off, Russia decided to attack. I am no expert on Russia but while Russia may want to annex Ukraine, and is shelling Ukraine, there is a financial war at play from the West. It is like a Financial cold war right now.

The West is using its Financial Powers to pressure Russia and at the same time, Russia, by virtue of being rich in Natural Resources has attacked the West with inflation. Is Russia really not meeting its objective of pressurizing NATO to meet its demands? Looking at the commodity charts, I think it is meeting a lot of its objectives.

Posted Using LeoFinance Beta