Bitcoin continued to trade as a risk asset in the past week and dropped from ~45.5k to $37k, following other risk assets such as global equities. Stagflation is the talk of the town these days. Russia's standoff with Ukraine pushed Brent Crude to nearly $140 per barrel and the inflation risk posed by other commodities is causing investors to de-risk at a rapid pace.

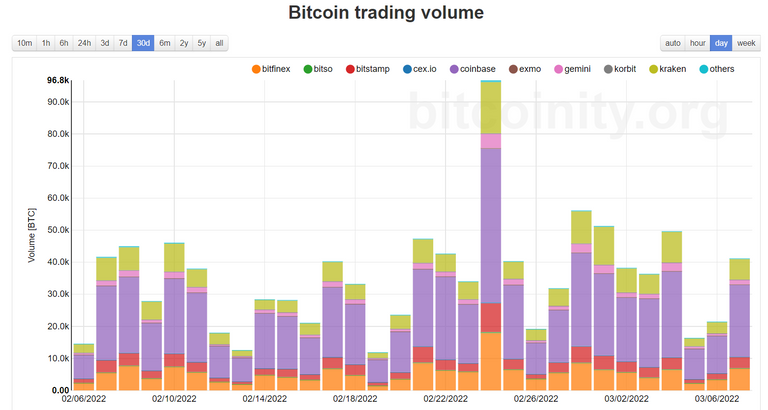

Bitcoin doesn't look good from a technical point of view. Volumes have been declining and Bitcoin has fallen below 50 DMA. Price action and Volume indicate that RSI is about to go lower. The geopolitical risk is too high to send RSI to overbought territory. In fact, Bitcoin isn't oversold as per RSI and should be headed lower.

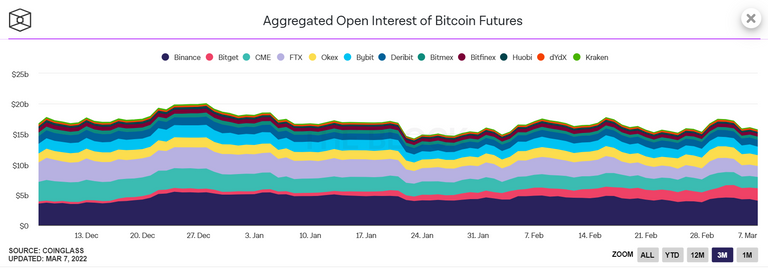

Open Interest continues to decline as expected. I am surprised that OI is higher today than where it was on Jan 24th. I would have expected a much lower level of Open Interest. The situation around the financial world is grim. I have a reason why I think OI is still at a respectable level. More on that later.

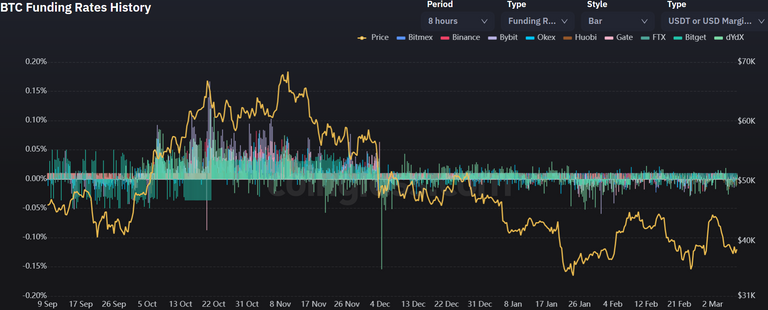

Funding rates are also staying steady. Both Open Interest and Funding rates suggest that there aren't many bears in the leveraged market. The answers to this low level of bearishness perhaps lie in the fundamentals of Bitcoin.

Technicals aren't looking good for Bitcoin. However, what are fundamentals saying?

I would like to reshare my post from yesterday. The sanctions imposed on Russian Oligarchs, Banks, and Companies are not a good sign for the world. The US$ is being used as a weapon in this war. The reason why I think Gold is rallying (besides inflation) is because there is a strong case for all Central Banks in the world to de-dollarize.

The US and UK have frozen assets of Russian banks and individuals in their respective jurisdictions. Russia's central bank has lost access to its dollar reserves. There is no trial in an international court to confirm the involvement of Russian Oligarchs in the war. Yet, their assets have been frozen. What does that imply about the ownership of centralized assets? Reminds me of "Not your keys, Not your crypto". Not your country, Not your assets.

While the process of de-dollarization will be expedited as a result of the sanctions on Russia, it will still be super slow. The world needs an alternative to settle global trade and it doesn't have one now. However, this entire situation of sanctions on Russia simply emphasizes the need for an asset that is owned by no one but is owned by everyone. I think China should rethink its ban on cryptocurrencies (China also has capital flight to worry about).

The second fundamental reason to be Long Bitcoin is inflation. I do not know when the situation in Ukraine settles but I hope that a settlement is reached soon. If a settlement is reached, Bitcoin rallies because all risk assets will rally. If the situation stretches or worsens, then commodity prices remain high and the world is looking at stagflation and a massive recession. In this scenario, Bitcoin's scarcity will be of value and at some point, it should stop trading as a risk asset altogether and start trading more like the way Gold is trading right now. In both situations, I see strong fundamental reasons to be long Bitcoin.

The fundamental reasons stated above are driving OI and funding rates in my opinion, and are also the reasons why Bitcoin hasn't dropped below $30k by now. Things can change anytime but if one ignores the price, there hasn't been a better time to be bullish on Bitcoin.

Posted Using LeoFinance Beta