After days of struggle, Bitcoin finally broke above 50 DMA a week ago and retested the level day before yesterday to find support and a push-up. Bitcoin rose to $43k yesterday and is showing positive signs that can take it closer to the $50k mark. Volume wasn't exceptional during the whole of last week. RSI is inching up slowly and may rise to overbought levels around the 200 DMA level, from where a retreat is very likely.

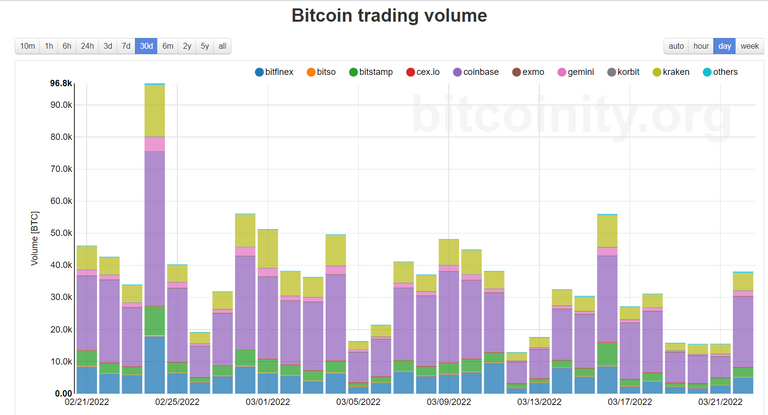

There was a marginal increase in volume yesterday and the increase in risk appetite came along with the overall increase in risk appetite in the global markets. Volumes across the board are still not bullish enough to say that Bitcoin is out of the woods.

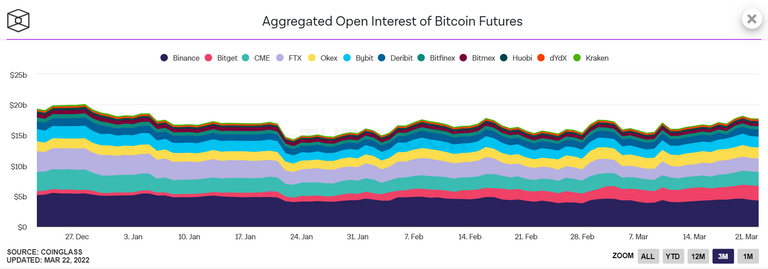

Open Interest rose for the whole of last week showing an increase in institutional interest. This is a good sign that indicates that there is the fuel to push Bitcoin closer to 200 DMA on the charts - between $48k and $50k. We are seeing the highest level of open interest in a month and we know what the whole of last month has been about. Long interest is surely rising in the markets as the Russia-Ukraine crisis gets extended.

Funding rates are also inching up as buying momentum builds in the crypto markets. While we are still far away from the neutral territory, negative rates mean that buying Bitcoin is more favorable. Combined with the other trends mentioned above, funding rates are also indicating that Bitcoin is likely to rise further till 200 DMA which will lead funding rates closer to 0 and then traders will re-assess.

Markets have shrugged off a hawkish stance from the Fed. As many as 6 rate hikes are being priced now and that is just the Fed pushing the economy towards a recession. An inflationary scenario caused by supply shocks will lead to slower economic growth. Add to that higher rates and even credit availability it reduced leading a second blow to economic growth. This will cause investors to become risk-averse. Volatility is here to stay. A "to-the-moon" exponential rise in Bitcoin price leading to new ATH is not on the cards in my opinion.

Posted Using LeoFinance Beta