In a post 2 weeks ago, I had stated that Nomura has stated that India will be one of the worst-hit economies in Asia. I think things have escalated significantly since then and a re-look at the problems is needed. A lot more risks have surfaced and are being discussed online.

First, let's get the obvious out of the way - INR and Crude.

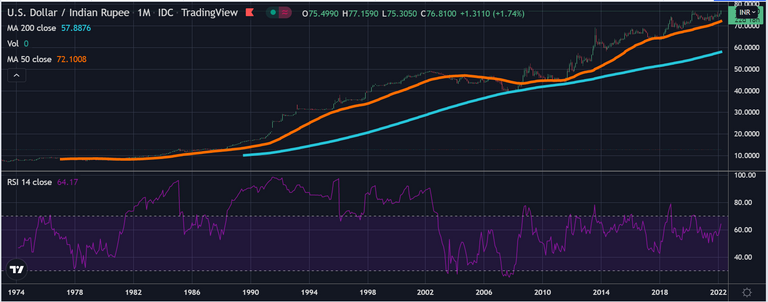

INR reached its worst level in the last 1 year. In fact, it is close to its all-time low.

For a net importer, a depreciating currency is not a good sign.

Brent Crude is near all-time highs. The last time Brent crude was around this level, fuel in India was less than INR 50 per liter. Now, costs double that. In fact, this rise in Crude Oil hasn't been priced in yet. With US and UK announcing a ban on Russian Oil, Oil is about to head higher. Moreover, will the US produce more Oil? Unlikely that they will allow fracking at a large scale.

Fuel is the backbone of logistics. A doubling on fuel price will increase prices of all goods by 5% to 10% (assuming fuel costs account for 2% to 5% of the cost of goods).

India is largely an agricultural economy. Anywhere between 50% to 65% of Indian households depend on agriculture for income. Of these, the majority have small to no landholdings. They rent land and then grow crops.

Currently, the Wheat season is ongoing in India. In March-April, Indian farmers will harvest Wheat.

Indian farmers are about to have a bumper harvest this season and will see their incomes double compared to what they earned from Wheat a year ago. I am sure that traders will take a huge cut of that. However, farmers will benefit.

The increase in incomes of farmers is the only thing that is positive for India in this whole situation. A boost to the rural economy is good for the GDP. However, farmers should prepare for a tough season ahead. First, fertilizers are about to become super expensive. The second fuel will add itself to the fire! Farmers have been agitating for a while now and next year is about to get very difficult for them.

I run a farming business. I am sure that small farmers will not be able to recoup their costs this year, and possibly the next. Vegetable prices are not going to rise with input costs.

Indian households were already facing serious inflationary pressures. However, this was not being witnessed in essentials. Yes, cooking oil and cooking gas prices had gone up. But that was it. Now, Indian households need to prepare for expensive transport, food, fuel, housing - almost everything. Raw material for all industries would have doubled thanks to this crisis and that is just for now. If things do not get resolved soon, as most experts are saying, then no one can estimate the inflationary damage this war will cause to households. It is the poorer households that will suffer the most. Even FMCG companies in India should be worried about sales during this year and the next.

The situation in Ukraine has the potential to really change the course of how India consumes energy. On the policy front, India could be seeing a lot more policy focus on renewables and rapid deployment of funds. One more thing I am looking forward to urban centers to have more and more electric transport - personal or government. Policy changes are slow and so is government action. However, a positive that may stem from the ongoing crisis is that capital may get deployed to increase the local capacity of products and also deploy capital towards clean-tech.

Posted Using LeoFinance Beta