There was anyway not much buying power to lift Bitcoin significantly above 50 DMA. However, Vladimir Putin and his antics have been enough to ensure that markets remain choppy. The choppiness is being seen in most markets. Bitcoin slid below 50 DMA last week and has not seen a green day since then.

RSI is slowly heading towards oversold territory but has some room left. That means, there is room for Bitcoin to slide further as well. Anyway, 50% drawdown level would have been support once, maybe twice but it is looking increasingly likely that we will see $30k Bitcoin soon.

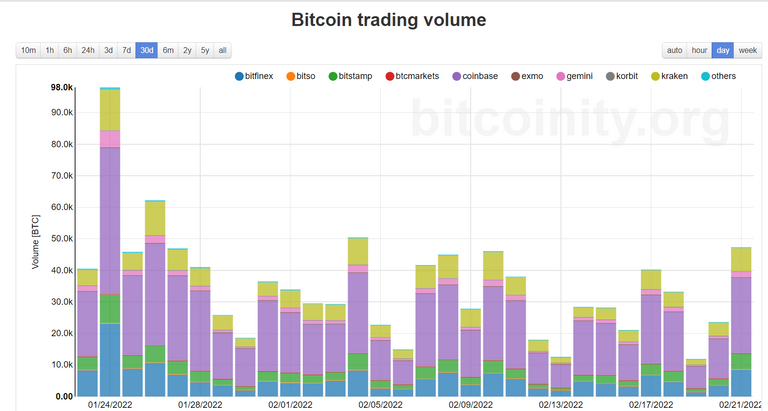

Volumes have stayed flat whether Bitcoin pushes up or down. Not much firepower on either side. I don't want to look at Open interest or funding rates here because what they will show will already be evident in the price. Open Interest will be down and funding rates would have fallen further. This activity is in stark contrast to gold.

Gold has been increasing in value - Possibly a good safe haven in a high inflation environment. Right now both major risks being faced by the market are working in Gold's favor. It would have been nice if Bitcoin could have shown this behavior. Over the long run, yes it may turn out to be a good store of value but right it is being looked at like a tech play. Why not - the adoption level of gold and bitcoin is the reason for that. Peter Schiff will have an orgasm looking at the chart below -

Gold is up 5.5% in the last 1 year, not really an inflation hedge I guess

Markets are going to remain choppy as long as the geopolitical chess game between the West and Russia continues. Post that we will have the Fed back in action. The Fed can use this crisis in Ukraine as an excuse for fewer rate hikes or blame the financial volatility on Russia. However, there is no way Bitcoin is making new All-time highs soon. Volatility could help you make some money trading a range though.

Posted Using LeoFinance Beta