BlockFi was always an interesting company to me. Before Coinbase started offering crypto-backed loans, BlockFi was one of the few centralized companies where you could store BTC and get a collateralized loan against it.

I have been using DeFi to do this for years on end - namely, MakerDAO - but there are other benefits that CEXes can give you for using their services as opposed to a DeFi one.

So, I did the wise investor thing and diversified my crypto loans. At one point I had:

- wBTC-backed loans on MakerDAO

- ETH-backed loans on MakerDAO

- BTC-backed loan on BlockFi

- BTC-backed loan on Coinbase

Today, I have only 3 out of these 4 and am currently considering a shut down of my activity on Coinbase as a precautionary measure.

Why Use Loans In the First Place?

I was telling a friend last night about the BTC-backed loan I used to have on BlockFi and how I withdrew my capital from BlockFi a mere few weeks ago... now in the wake of the news that they are going under today and the funds would no longer be accessible if I had kept them on the platform.

"Isn't that risky? Don't you have plenty of money? Why do you need a loan?"

All fantastic questions that they asked. My response is one that you might have heard if you listened to people who have hodl'd BTC for many years and plan to for many more years:

I don't want to sell my BTC. I want to hodl it for decades.

BTC is Property

Bitcoin is property to me. It's digital property. I plan to hodl my Bitcoin for decades to come and there are myriad reasons why.

Personally, I believe BTC will always appreciate over long enough time frames. Is that 20% yearly? 50% yearly? Who knows. So far, it has been a lot more than that since I got into the space and started buying BTC for ~$200 per coin.

Use Loans to Never Sell

So here's why I use loans: I can access liquidity without selling my BTC. Let me walk you back to the last bear market to illustrate.

It's January 2018. Bitcoin came all the way up to $20k and then suddenly the whole crypto market entered crypto winter. Prices fell and fell and fell.

Ultimately, I ended up buying a lot more Bitcoin in the sub $10k range and continued to dollar cost average on a daily basis.

I worked and invested to earn a living but I also started utilizing lending services (namely, MakerDAO at the time) to access liquidity without selling my BTC.

This is an important idea. Imagine taking 10 BTC at $10k per bitcoin ($100k in value) and taking a $35k loan against it.

This means that my $100k BTC is still mine. I just collateralized it to get access to $35k temporarily. I go out and I invest or spend that $35k.

2 years go by and then we re-emerge into a new BTC Bull Market.

What happens to my 10 BTC? Those suddenly go from being worth $100k to being worth $300k.

Now I can take a very tiny amount (1 BTC) and sell it to pay the entire $35k loan off and get access to my $300k.

- I benefited from the rise of BTC without selling any at low prices

- I was able to utilize liquidity in the meantime without selling any BTC at low prices

- I was able to pay off the loan entirely with profits at a future date

Other benefits also apply. Namely, being able to write-off interest payments for tax purposes (also, loaned capital is not a capital gain. So not selling BTC means no capital gain on the $35k).

The Benefits of Doing this Are Clear, Now What Happened to BlockFi?

So now we know what the purpose of using services like this can be. What happened to BlockFi?

During the LUNA crash, we saw a contagion of fake capital in the space. Companies like BlockFi had loaned companies like 3AC money and then 3AC and others blew up since they used that money to invest in LUNA and UST.

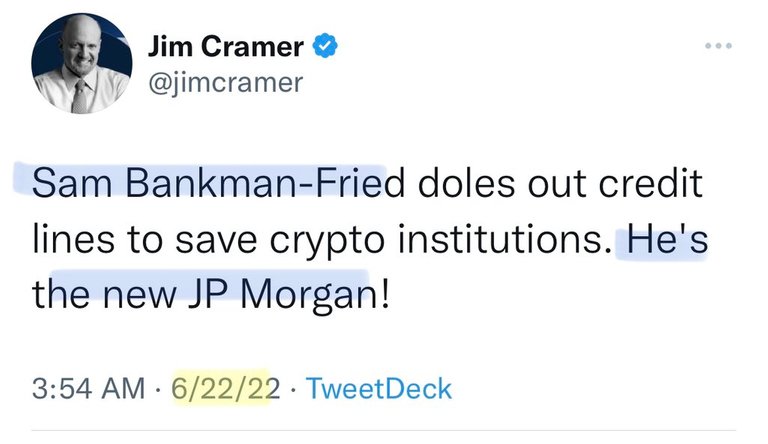

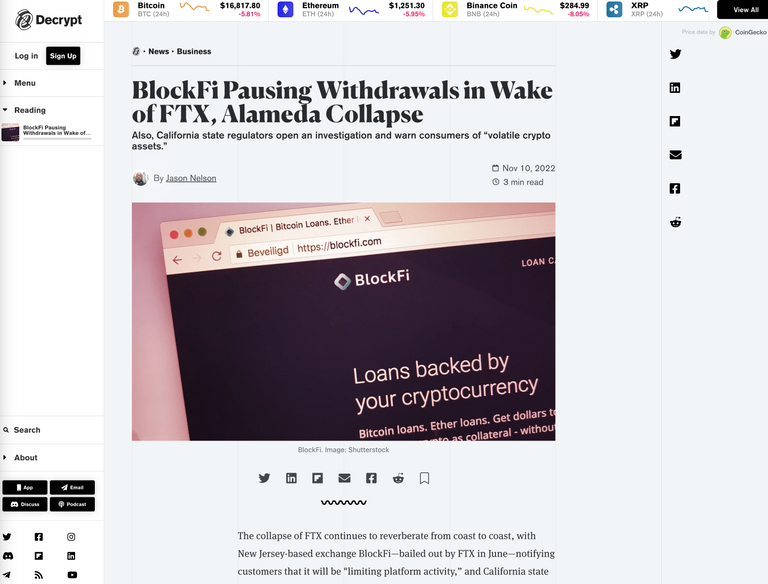

BlockFi suspended withdrawals and then eventually got saved by FTX with a $250M Line of Credit.

This was the one major favor done to me by FTX and SBF. I was unable to get my money out but then they got the Line of Credit and suddenly, I could withdraw.

I paid off the loan I had on BlockFi and withdrew all of my BTC collateral.

Fast forward a few weeks to today and boom...

I still know people personally who didn't withdraw from BlockFi. I feel deeply for them and am helping them stay on top of their options. Hopefully someone swoops in and saves BlockFi again for long-enough to get their capital out.

If you're affected in anyway from these events, I'm sorry (a more sincere apology than the one you'll get from SBF on Twitter). I truly hope everything works out for you and you find a way to come out of this smarter and more diligent in the future.

Not your keys, not your crypto has never applied more than it does now. Stay vigilant friends.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta