A number of narratives are popping up all over the economy right now. A looming recession is hanging over all of our heads, businesses like Meta (Facebook) are burning billions of dollars a year on some Virtual Reality vision of the world, startups and recently IPO'd tech companies have lost 99%+ of their valuations, crypto markets are in disarray as we quickly entered a risk-off environment.

A driving narrative as investors look at businesses to buy in 2023 is Free Cash Flow - that is, investors are no longer giving crazy valuations to tech companies that promise some future payoff. They're looking at your cash burn. They're looking at your ability to generate revenue... TODAY. They aren't interested in the stories you tell about tomorrow.

This comes as a big shock to a lot of entrepreneurs who got quite comfortable with 20x valuations, negative cash flows but multi-billion dollar fundraising rounds. We exited the era of funny money and now we are in a risk-off, shrewd world of who's got the best cash flow.

What is Free Cash Flow (FCF)?

Free Cash Flow is "the amount by which a business's operating cash flow exceeds its working capital needs and expenditures on fixed assets". You can also see the definition of "Cash Flow" here on LeoGlossary.

Edit: Shoutout to @taskmaster4450le who added a LeoGlossary entry for FCF today! See it here.

What Drives Value for Shareholders and Makes Price Go Up?

Everyone and their mother wants to hear the answer for this question:

wen number go up?

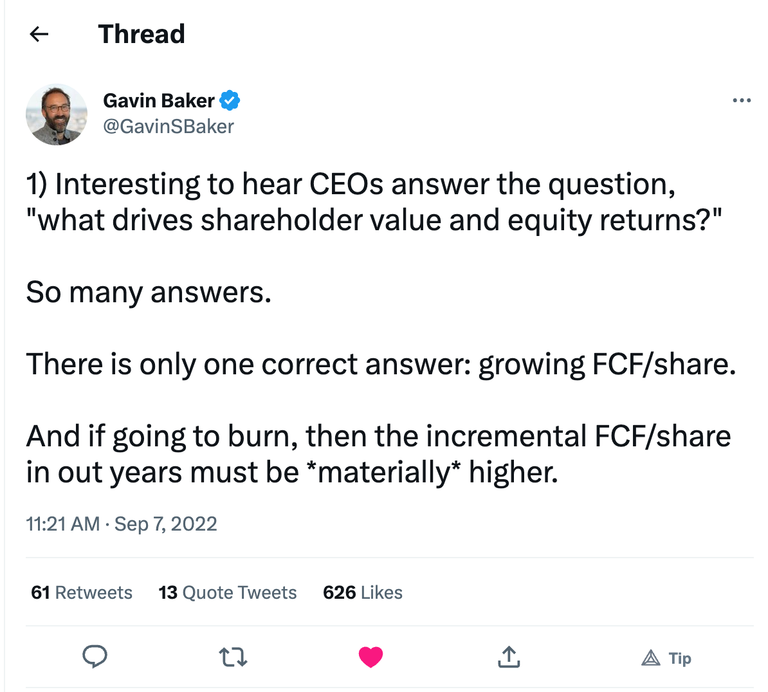

A lot of CEOs are talking about what they believe drives value back to shareholders. "Why do we, as shareholders, want to keep holding XYZ stock... What kind of value appreciation should we expect?".

In the current environment of both risk-off and super high interest rates, everyone is becoming extremely tight with their capital deployment. Contrast this to just 1-2 years ago, and you'll see a very different story.

Low (0) interest rates led to funny money being deployed to the dumbest of startups and companies. People did not care about cash flow. There was so much money being dumped into the system that all people cared about was the idea that someone else would come in and pay for an expensive round after you did, or buy those shares more expensive than you did or buy crypto after you did.

In the end, Free Cash Flow has always been around. People like Warren Buffett - yes, a skeptical figure in the crypto space - know what the hell they are talking about when it comes to investing in FCF-positive businesses.

He looks at a business and evaluates its ability to:

- Earn cash flow TODAY... Not promise to earn it tomorrow

- Be discounted against that ability to generate cash flow (cheap to buy, relative to various metrics)

- Will be around for a long time to keep paying him with that cash flow

Utilizing this approach, we can look at this risk-off environment and evaluate healthy businesses, startups and crypto projects alike. The ability to understand the importance of FCF and the ability to actually build a business around generating it has never been more important.

Meta - The Counter-Example

Meta is the counter-example to all of this. Reality Labs - a the virtual reality team within Meta (Facebook) - reported a $4.28 billion operating loss in Q4 2022.

Despite this, Facebook is actually a super profitable business. It sits on an absolute gold mine of data, advertising revenue and network effect.

That being said, it loses money every single quarter. It's investing billions of dollars into this moonshot bet on virtual reality basically taking over the world.

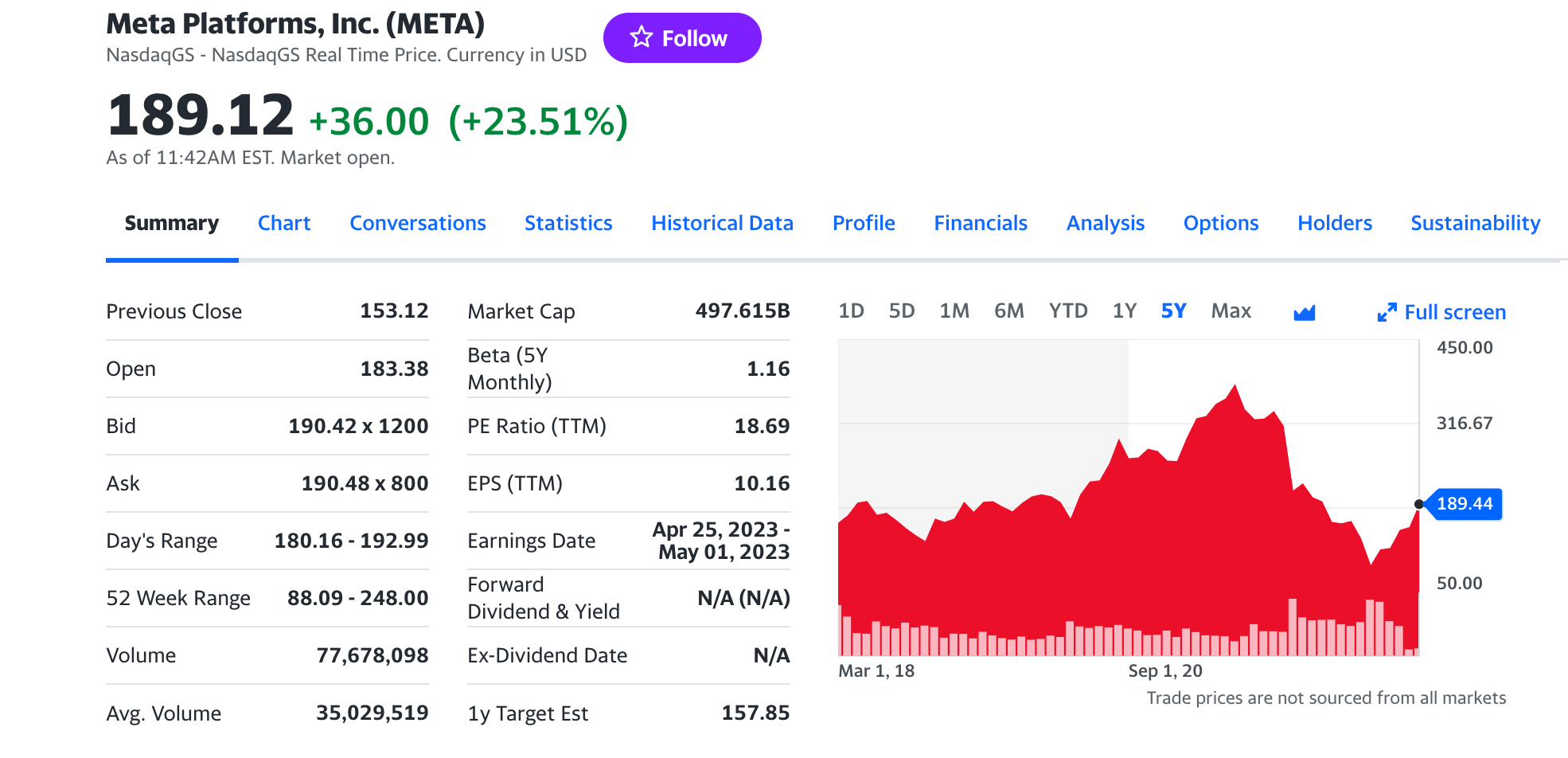

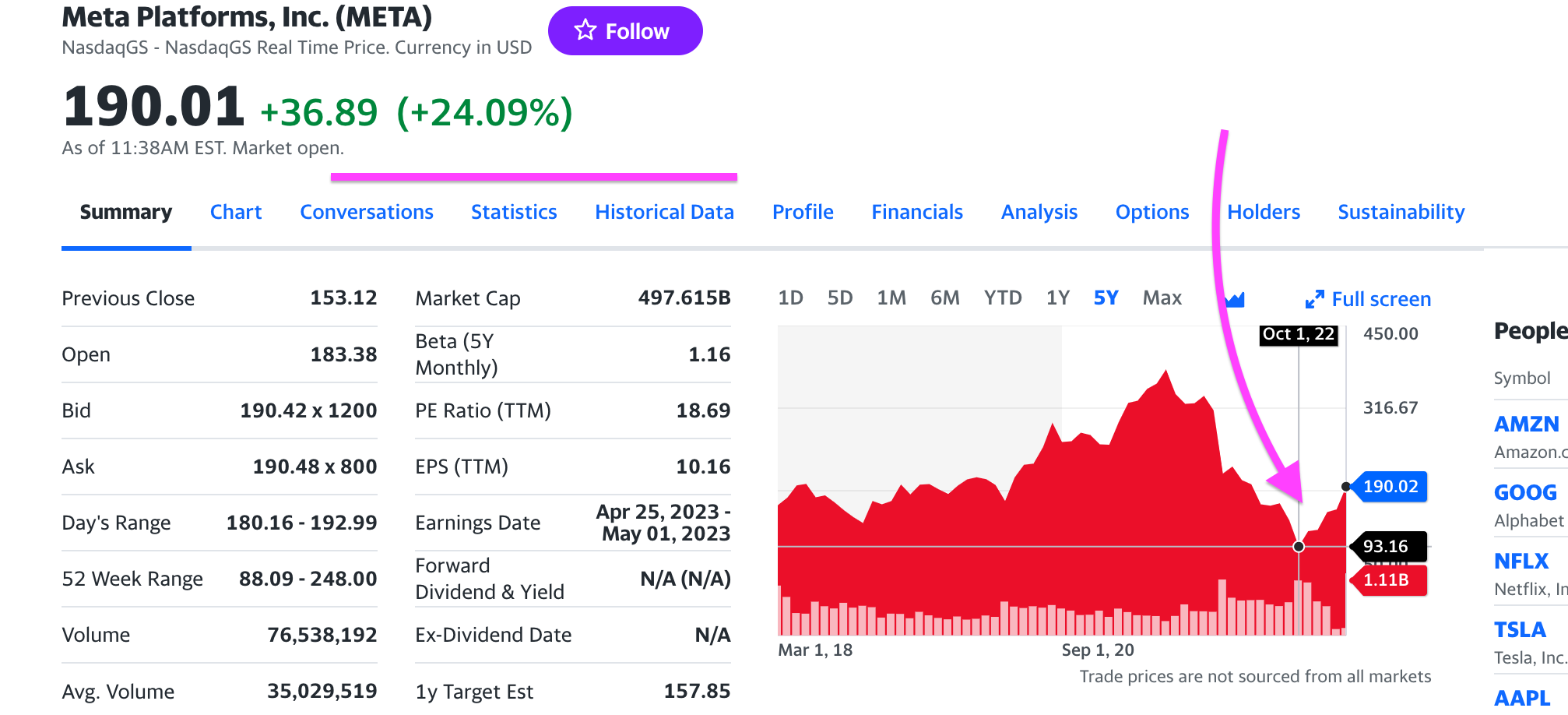

How did their stock perform? It absolutely nose-dived the past year as investors looked at their ability to capture free cash flow versus what they're wasting on this Metaverse bet.

Today, the stock is up 24%. Guess why? They're cutting costs and starting to reverse out of these misgivings related to free cash flow.

This is probably one of the best examples of how heavily weighted free cash flow is in the current market environment. Investors are looking at this metric more than anything else.

Conclusion

How can you carry this into your personal investments?

What crypto projects are you invested in? Do any of them have a model for free cash flow? Has it already been implemented? Is it generating cash flow? Is a model for FCF even on the table?

We've seen a lot of crypto projects start to cut staff. The ones who are cutting staff are the ones who have been bleeding money and can't sustain it in the bear market.

Now look to the projects who aren't cutting staff. Who are the ones that are actually hiring more staff? These ones likely have models for generating cash flow. Real business sense underpinning what they're building.

Personally, I've started to look at crypto startups, businesses and stocks much differently. Free Cash Flow both today and in the future is becoming a core metric.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta