Microstrategy is the largest public holder of Bitcoin. As someone who has stacked sats for ~7 years now, I am fascinated by the strategy that Michael Saylor has deployed to make his company relevant to the crypto industry and essentially change the entire direction of his software business.

Microstrategy was a simple enterprise software company just a few years ago before they started buying Bitcoin.

Today, they hold nearly $4 billion in Bitcoin and are the #1 public holder of it. We also constantly see headlines of them buying more Bitcoin and simply making one of the most public bets in history on innovation.

Their strategy has proven to be something of a "proxy ETF". That's the value that MSTR provides in the public markets. Since MSTR is a publicly traded stock and they now own almost $4b in Bitcoin with a MSTR market cap of $2.71 Billion, things are quite interesting.

For example, if you're in an IRA or maybe you are a company or hedge fund who wants BTC exposure but can't actual BTC due to complexity to custody or some regulatory impediment, MSTR becomes a viable way to expose yourself to the asset.

This is one of the many genius moves that Saylor made in turning around MSTR and making it worth billions of dollars once again.

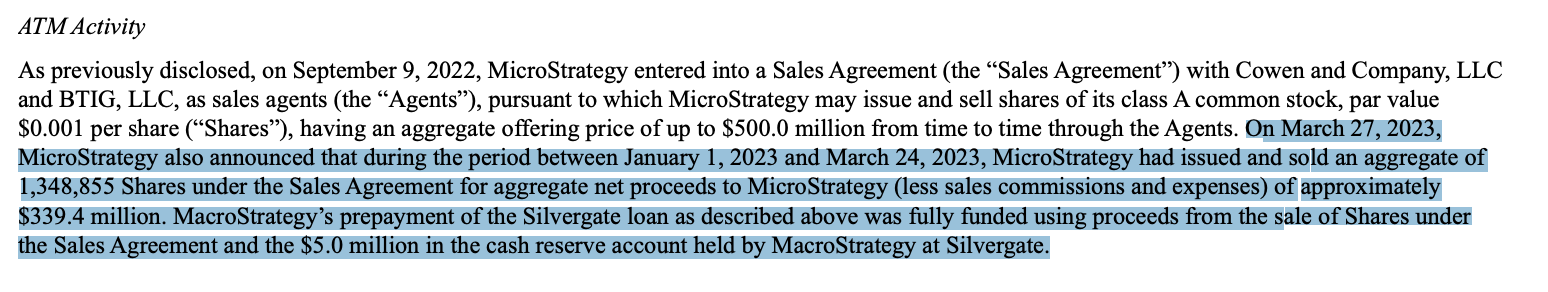

Microstrategy Repays $205M Loan at a 22% Discount to Silvergate

Microstrategy had a massive Bitcoin-Collateralized loan at Silvergate Bank. If you've been following along with the banking crisis that has so far tanked 5 major banks, then you'll know that Silvergate is among them.

Microstrategy repayed the loan in full at a 22% discount. The loan was $205M and they paid $160M to close it out due to the issues at Silvergate.

$45M ain't a bad payday to walk away with.

I read the filing and was curious how they paid the loan back:

They have various standing agreements and disclosures that allow them to issue stock and raise capital. It looks like this in addition to $5M in a cash account at Silvergate is where the $160M came from.

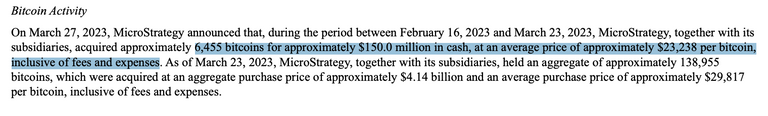

Microstrategy Buys 6,455 More Bitcoin

Also in the 8k is a disclosure that Microstrategy has bought 6,455 more Bitcoin for $150M in cash. Their average price was $23,238 - which is 16% below the current market value of Bitcoin. Not bad!

Microstrategy now owns 138,955 BTC which is worth $3.75B.

Microstrategy's Break Even Price

If you remember when Bitcoin crashed down to about $16k, a lot of people started raising the flags about Microstrategy potentially defaulting on their Bitcoin collateralized loans.

As the largest public holder of BTC, people were concerned that if MSTR went under, it would be yet another catastrophic blow to crypto after what we saw with FTX, hedge funds and other major players going belly up.

I wrote an article back around that time talking about it. I was unconvinced that this was the case. Some people said that MSTR's liquidation price on their loans was as high as $14k... I simply didn't buy into that news.

It later came out that MSTR's liquidation price was around $3-5k. I'm not sure where this stands today, but we do know that MSTR is close to their break even purchase price on $4b worth of Bitcoin.

"Business intelligence firm MicroStrategy held 132,500 bitcoins, as of Dec. 31. The original cost basis for the BTC pile was nearly $4 billion, reflecting an average cost per bitcoin of about $30,137." blockworks

With Microstrategy continuing to scoop up BTC and now hitting its breakeven price, I'm curious to see how sentiment can flip.

When everything was going down, people had major concerns about MSTR and if they would go under. Now that they are flipping their breakeven price, I think we could see MSTR hit major headlines about "$1B in unrealized profit, $2B, 2x their $4B... 10x their $4B"

Imagine the headlines when people are talking about this company that went from an irrelevant corner of the internet to suddenly posting multi-billion dollar profits from their Bitcoin bet. That could quickly get other companies and individuals to consider their greedy nature and jump into BTC.

As I said earlier in this post, I love following Microstrategy and Michael Saylor. At times, it does get a bit BTC-maxi, but it also is a great lens into making an asymmetric bet with unlimited upside and doing it in a public, audacious way.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta