If you do a google search for "Crypto Best Practices", you'll find a lot of wild articles talking about all sorts of different strategies for accumulating, trading and investing in crypto.

There's so many different things you can do in this industry. In my last two articles, I talked about investing in BTC as the path to financial freedom and leveraging sweat equity within the Hive ecosystem as a critical way to stack more crypto.

Regardless of how you choose to approach this industry, there are some best practices that I think everyone needs to know.

Let's say you do more of what I talked about in the first article above - that will leave you buying a lot of BTC at various prices. There are certain strategies that will help you dollar cost average into BTC more effectively.

Or let's say that you engage more in the second article above - stacking crypto by earning crypto on the Hive blockchain. There are certain strategies that will help you more effectively stack crypto / trade earnings into other assets.

In today's post, I'll talk about one of the most fundamental ways to improve your crypto portfolio: Limit Orders.

How to Accumulate More Crypto: Limit Orders Are Your Best Friend

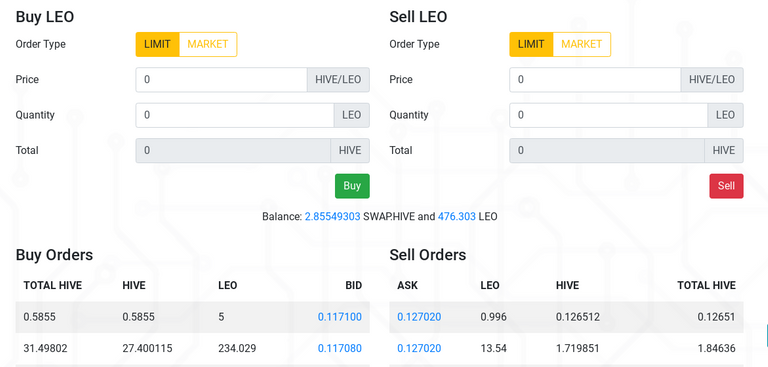

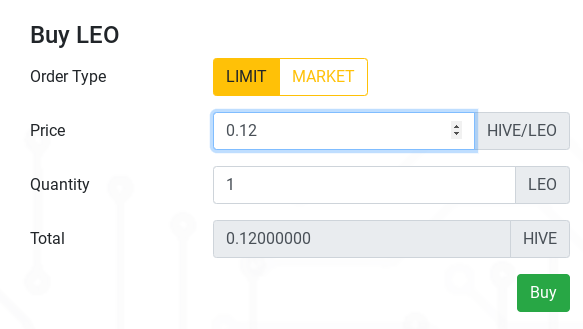

Accumulating crypto using Limit Orders is a fantastic way to stack more sats (or alts). I use limit orders all day, every day. There are plenty of ways to do this and plenty of meta strategies within this strategy.

I Dollar Cost Average into BTC every single day. Sometimes, BTC is up certain days more than others. This leaves you wondering if you should buy at the current price or "wait for the price to come down to a cheaper equilibrium."

The waiting to buy conundrum is something that I personally hate. I think deviating from your preset plan to stack is a great way to end up pissed off in a bull market.

After all, what if the price never comes down to a level you'd rather buy it at?

Price is Relative

Prices are all relative. It's crazy that people think of prices in such a human, emotional way.

Our brains are not wired to handle the emotionless complexities of "Mr. Market". Mr. Market will take you for a wild ride and whipsaw you this way and that.

What's an investor to do?

Limit orders. Learning how to use limit orders will forever change the way you invest in crypto or stocks or any other asset.

In or Out

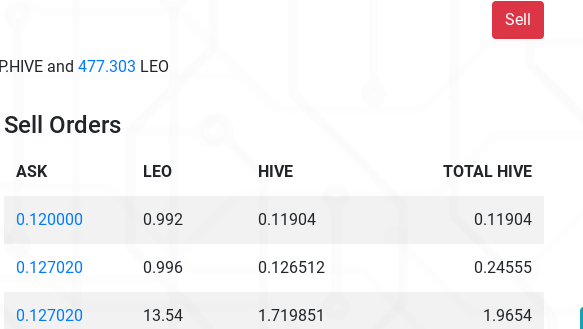

Limit orders can help you get in or out of an asset. They remove a lot of emotion out of the game of investing, which is the way I love to use them.

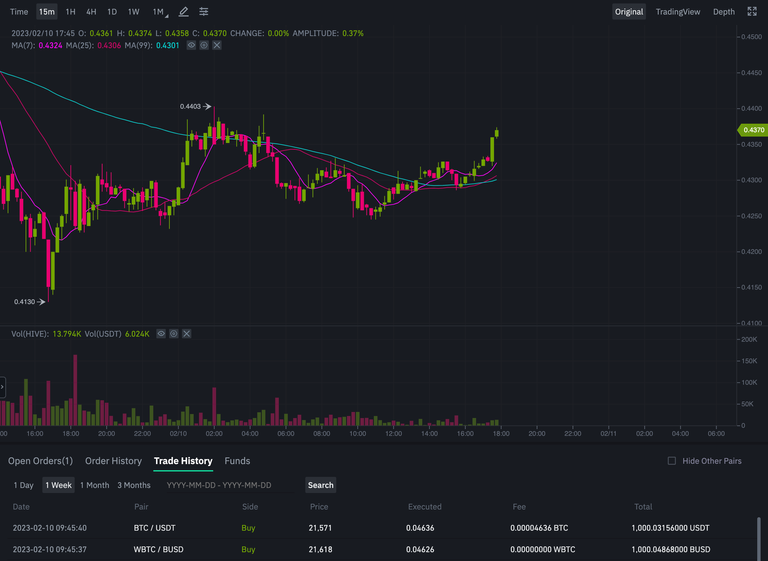

If you see one of my accounts above, I've got some Limit orders to buy BTC at $21,5 and $21,6. These two orders actually just got filled.

You can see that I am continuing my dollar cost averaging plan. I'm not deviating from that plan. I simply continue to set buy orders on a daily basis.

A huge key to this is maintaining the discipline. I could have easily chosen to just "wait" for the price to come down to $21,5... but what if I was asleep? What if I was busy with something else? What if we flashed down to $21,5 but then immediately went back up?

Limit orders save the day.

This applies to both buying and selling. My example above focuses on buying but selling in the bull market is easily done with Limit Orders.

In fact, I apply the same Dollar-Cost Averaging strategy to sell assets in the bull market.

Picture BTC going above $50k next week.. What would you do?

Emotions may tell you to wait to sell until it's over $100k.

Wits will tell you to set ladder limit orders starting at $50k... $52k... $54k... $60k...

Setting these orders will take all of the emotions and guess work out of it!

Comment Below - Do You Use Limit Orders? Why or Why Not?

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta