As avid users of the Hive ecosystem, we are all always watching the HIVE price like hawks. Right now, the entire Crypto market is being dragged to the dirt on news that FTX - the second largest exchange in all of crypto - was on the verge of bankruptcy and is (potentially) being bought out by Binance.

This has widespread effects. Some of the biggest industry players in crypto (TradFi players, who started dipping their toes in) were using FTX and were investors in various seed stages of the company.

Alongside this, SBF - Sam Bankman Fried - holds a lot of various crypto assets. It's very possible he's dumping many of these assets to try and save his business (see: SOL, etc.).

Is Now A Good Time to Buy HIVE ($0.35)?

We're not here to talk about the rest of the market though. We're here wondering if HIVE is a good buy right now.

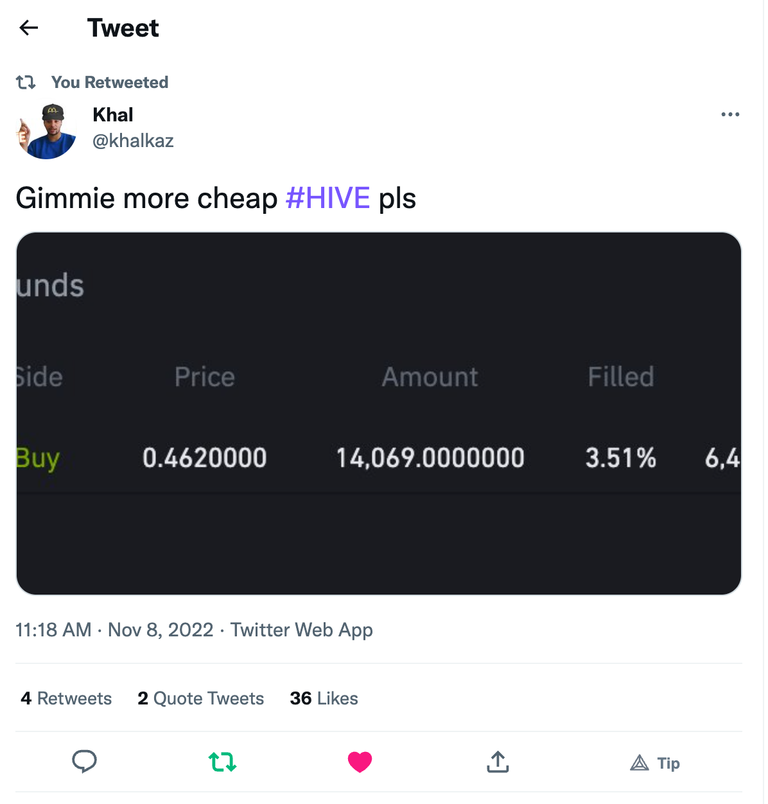

HIVE was hovering around the $0.50 range for a very long time as the whole crypto market traded sideways for weeks and weeks on end.

Personally, I've been buying HIVE for the past several weeks around $0.50. As you may have heard in various podcast clips from the LeoFinance weekly podcasts, I have grown very bullish on HIVE lately and love the changes that we're seeing on-chain. Especially surrounding HBD.

Additionally, I've had to buy tons of HIVE for the bHIVE & bHBD protocol on https://cubdefi.com/farms (I also love earning 37% APY for pooling HIVE and HBD over there). But that's a story for another day.

Key Metrics I Look At for HIVE

If you're reading this, you're likely an avid user of the Hive ecosystem. I don't need to tell you about the dozens of applications like Splinterlands, 3Speak and LeoFinance that have chosen to build Web3 on top of the Hive blockchain technology stack.

Instead, I'll tell you a bit about some less known metrics. A few places that I keep my eyes on.

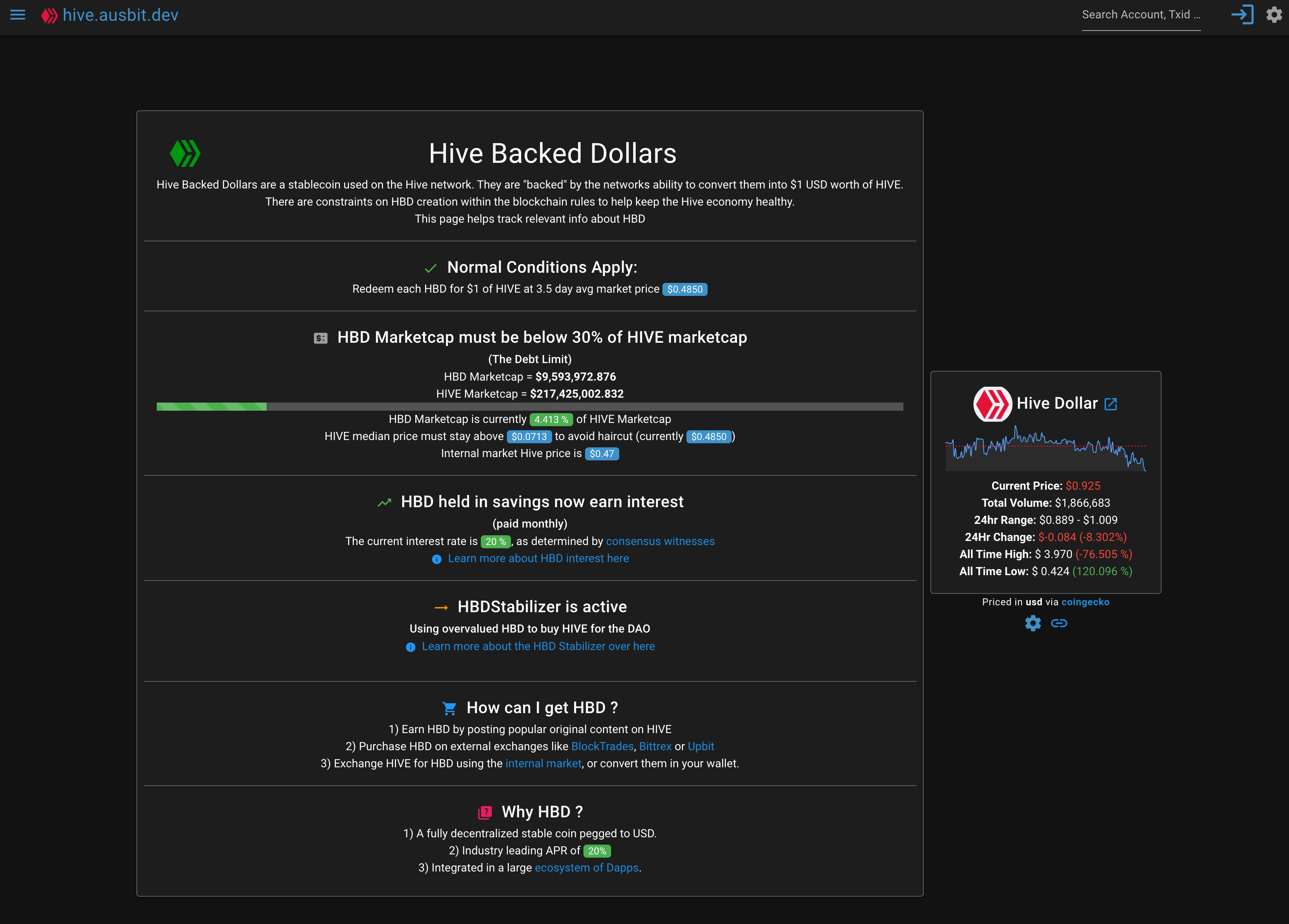

HBD Metrics By @ausbitdev

This is a fascinating dashboard created by @ausbitdev which shows us key metrics related to HBD. You can find it here.

Some of the key things I'm looking at:

- HBD Market Cap

- HIVE Market Cap

- Current Debt Ratio (HBD MCAP / HIVE MCAP)

- Hive Median Price

HIVE must stay above $0.0713 to avoid the HBD haircut rule being in place. We have seen the haircut rule take over a few times in the way distant past but this is a very unlikely event. I believe you could use this as a "Baseline" or absolute bottom for where HIVE could go.

This all being said, we've seen HIVE users and whales defend $0.10 before. I highly doubt we ever break that level. Not impossible, but highly doubtful.

Various Stats Reports by @dalz

There are way to many to cover but @dalz posts some sort of HIVE analysis at least 1x per week. These reports have shown me a lot about the inflows and outflows of HIVE. I'm excited to see how these metrics have grown more and more bullish.

- https://leofinance.io/@dalz/the-decentralized-hive-fund-dhf-keeps-growing-or-data-on-dhf-balance-and-payouts

- https://leofinance.io/@dalz/hive-inflation-for-october-2022-or-half-then-the-projected

Above are two of his most recent posts. Take a look at the Hive inflation metrics. It's giving "ETH Ultrasound Money" vibes.

Very bullish.

Arcange Daily Reports

@arcange has automated reports run daily on the Hive ecosystem. You can get an incredible sense of what is going on. Here's the latest report from him:

https://leofinance.io/@arcange/hive-finance-20221106-en

Some noteworthy things I look at:

- Supply

- HBD in Savings

- Exchanges (Inflows and outflows of HIVE to CEXes)

Conclusion

It's time to draw a conclusion to the question I posed in this post: is now the right time to buy HIVE?

Personally, I have been buying at $0.50. $0.45. $0.40. $0.35... I have been dollar cost averaging into HIVE for weeks now.

As I said, I have other motivations than just waiting for the price to go up. I'm pooling HIVE on https://cubdefi.com/farms for 37% APY and simultaneously benefiting some of the things that I have my paws in.

That being said, I still believe HIVE to be a great investment for the long-term.

If I had to sum it up in 3 broad-based categories:

- Community

- Technology

- Economics

The community on Hive is second-to-none. We rival the conviction of the Bitcoin community in this regard. Our core community is a group of a highly active, highly motivated users who tend to be rather sophisticated when it comes to crypto/technology. I've met some of the coolest people on this blockchain and 9 times out of 10, they are all doing something for the benefit of the chain. Like building a business or a dApp here.

The technology of Hive has always been light years ahead of other blockchains. We have fast (nearly instant) and free transactions with a very large degree of scalability.

Frankly, I think you'll be hard-pressed to find a chain with similar tech or even tech that comes close. As a builder of Hive dApps, I can't imagine using any other chain to get the results we get.

The economics of Hive have never been more bullish to me. Actually, I believe that in the past on of the main hesitations I would've had (even though I always bought and held a lot of Hive) about Hive is the economics. In the past, we saw a lot of undesirable things related to Hive tokenomics.

Today, things are radically different. The HIVE DHF is working incredibly well and if you take a look at those @dalz reports I pasted above, you'll see some other metrics that are working in Hive's favor.

I was bullish on Hive because of Community and Tech but now the Economics have caught up as well. Add that to the list of reasons to HODL hive long-term.

See the chart I posted above? $0.35 has held pretty well for HIVE recently.

I do thing it's possible we dip below that but in my honest opinion, $0.35 is a really nice level for HIVE in the near-term. I think the Crypto Market is slowly approaching a bottom-out phase and this $0.35 might be something that HIVE bounces off of.

I'm no technical analyst. In fact, I don't really even believe in technicals. This is a highly opinionated... opinion.

Take it with a grain of salt (and also with all the other natural disclaimers of not financial advice).

Personally, I'm a buyer! ✅

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta