The buy, borrow, die strategy is not a new thing. It's been around for as long as assets have existed. As technology has evolved and the means of holding and collateralizing assets has changed, the ability to buy, borrow and die is not only reserved for the super rich.

At its core, the strategy is quite simple:

- Buy assets with a long-time horizon that will succeed over long periods of time

- Borrow liquid capital against those assets by collateralizing them

- Die and have your heirs repeat the cycle

The first two steps are of more interest to me - crazy thought, but I'd rather not think about the dying part just yet - so let's focus on buying assets and borrowing against them. The dying part is more so to do with estate planning, taxes and passing over the assets to the next generation.

This strategy used to be employed only by the top wealthiest people in society. Why? Because it was gate-kept by financial institutions and the powers that be for so long.

Up to this point in time, the wealthiest in the world have been doing this with Real Estate, Stocks, Bonds, Businesses, etc.

Being that I am deeply entrenched in the crypto industry, I'll focus on the fact that now anyone can start their own Buy, Borrow, Die strategy with as little as $1,000 in NAV (Net Asset Value).

Buy

The buy part is extremely important here. You need to buy the right assets. These are assets that:

- hold long-term growth potential

- can be collateralized by an institution or protocol

You want to buy assets that you believe in and are happy to own for long periods of time. Picture Michael Saylor and his Bitcoin or Warren Buffett and Berkshire Hathaway or Jeff Bezos and Amazon stock.

These 3 people would gladly hold these assets in perpetuity. They can also leverage each of those 3 assets and get a collateralized loan against them for liquidity.

For me, the "Buy" part has been largely focused on two assets that I (as a rather small, retail investor) can collateralize at various protocols and institutions. The spectrum of assets where this will be possible is growing (more on this later). For now, these two assets are:

- Bitcoin

- Stocks

- Real Estate

A rather small list. Obviously there are more out there but as your average investor, you won't get access to liquidity at institutions with them just yet.

The protocols that are offering collateralization on smaller assets is growing but not all of the assets I own are available for collateralization (yet). I believe this will change in the next few months & years for:

- LEO

- HIVE

- RUNE

Back to focusing on the assets that I can collateralize, today, the strategy that I employ is one of dollar-cost averaging. Many of you know this. I've written about DCA for years on this blog.

I am a firm believer in Dollar-Cost Averaging into assets you believe in with long-time horizons. It's a great way to grow your stack without feeling the day-to-day "I should have done X instead!" emotional turmoil.

Borrow

You may need liquidity/cash flow to live. The ideal scenario is that you have a business or job that brings in cash flow and allows you to just keep buying more assets and accumulating wealth.

There may come a time where you need to pull some cash out against your assets though. In fact, for tax purposes - it can be an amazing thing.

Jeff Bezos has done this rather famously with his Amazon stock - opting to borrow against his shares to fund lifestyle purchases and other endeavors while paying little-to-no taxes.

Why Borrow?

Some people ask: why borrow at all? Why not just buy great assets and then sell them for a profit. It seems like that's the logical strategy and what most aim to do when they invest in something, right?

Not necessarily. Imagine that you own certain assets that you believe in for the next 25+ years. Why would you sell them at year 5 to fund some purchase or pay a bill or fund a new investment if you could instead borrow against that asset and then tap into liquidity tax-free.

- You don't pay taxes because there is no capital gain

- You retain upside exposure to your asset, since you're not selling it

I believe in the assets I'm buying (Bitcoin, Real Estate and soon those other assets that I mentioned as well). I want to hold them forever or for the forseeable future. That being said, I may still need liquidity to live, pay bills or invest in other opportunities.

Borrowing becomes a simple way to instantly tap into liquidity without paying any taxes and most importantly; without losing any upside exposure to those assets that I believe so strongly in.

Die

As I said, I won't focus too much on this part as I am no estate planning expert. When the time comes, that's who I would turn to if my aim was to die with this debt and then pass on the assets to my heirs. There is a lot of interesting tax law that comes into play with passing on the assets in a tax-advantaged way and dying with the debt you took during your lifetime.

There may come a time to pay off certain collateralized loans while you're still alive. This is a more important focus to me since it's something I can control now and don't need an estate planner to help with.

One of my biggest positions that I employ this strategy on is Bitcoin.

I have vaults where I have deploy BTC and taken loans against it. These loans pay my IRL bills and fund my lifestyle / allow me to invest in opportunities in a tax-free way without losing access to the future upside of BTC.

Since BTC is still so volatile, I often play the cycles with it.

For example, last cycle I sold my BTC and completely paid off the debt. I then sat in cash and waited for the ineveitable cycle to play out so I could buyback my BTC.

Obviously this is a taxable event. It also exposed me to the opportunity cost of no longer having the majority of my BTC in the markets.

But guess what happened? BTC crashed from $60k down to $18k. I was able to buy back more BTC than I originally had and now I could start over again with $0 in collateralized loan debt.

The cycles in crypto are unusual which means that using crypto for these collateralized loans may require a more tactical approach than if you were using stocks or real estate.

For example, I do this with Real Estate as well. Real Estate is the opposite of crypto when it comes to volatility. There is virtually no volatility and no risk of liquidation. I am also able to collateralize my real estate while simultaneously earning income (rental income) from it.

Perhaps this Real Estate strategy will be the subject of an entirely separate post, as there are a lot of layers to it.

Collateralized LEO Loans, Coming Soon

LEO is obviously one of my biggest portfolio positions. I also believe that it has more upside than anything else in my portfolio. A lot of this is because I believe in the team I've built, the products we're building and our community.

Typically, you don't have much "control" over the future of an asset you buy. LEO is a bit different for obvious reasons.

Accumulating a large position in LEO and betting on the future upside has been a staple in my strategy the past 5 years since we launched the ecosystem.

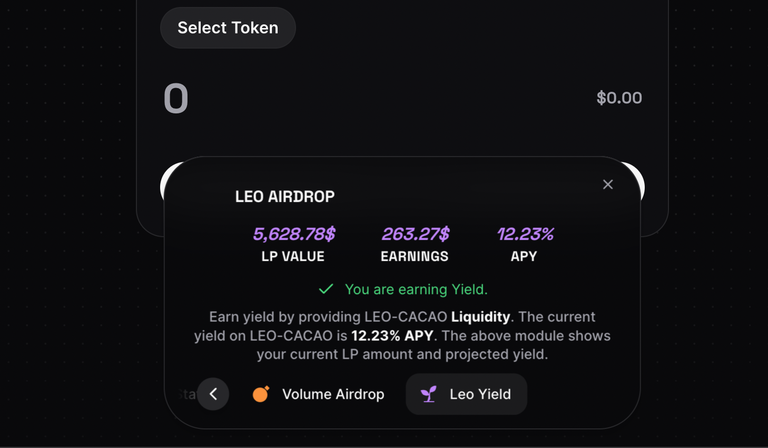

ICYMI: LEO Collateralized Lending is on the near-term horizon. I believe we could see it before the end of the year.

It's being built by Maya Protocol. Their team is building Collateralized Lending based on the LEO-CACAO Liquidity Pool.

This means that anyone who holds LEO will be able to collateralize it and take a loan against it.

This is a dream come true for many of us who want to hodl LEO forever, retain all of the upside but still tap into some short-term liquidity.

This is going to be an absolute game-changer for the LEO Token Economy. I'll be publishing a lot more content in the near future talking about how all of this will work.

Your Thoughts and Experience

Drop a comment below and let us know if you've ever tried the buy, borrow, die strategy or if you aim to try it in the future!

Posted Using InLeo Alpha