We all want to see Bitcoin hit $1,000,000. I think that would solve quite a few problems for everyone in the industry. What does it actually take for BTC to reach this coveted $1M unit bias?

This is a question that I've seen repeated since my first day stepping into the world of crypto... Nearly 7 years ago.

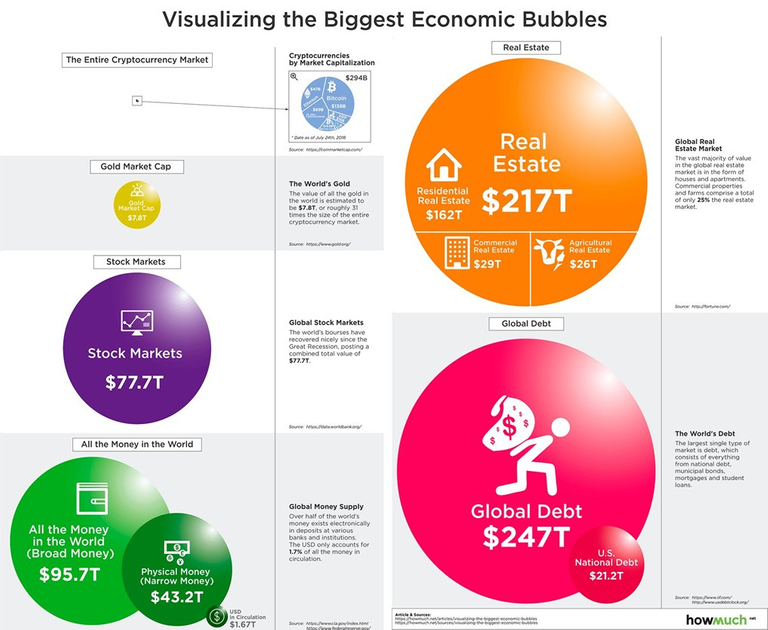

$21 Trillion might seem like a lot, but the global economy has quite a lot of money in it. This amount continues to grow, especially amidst high levels of inflation:

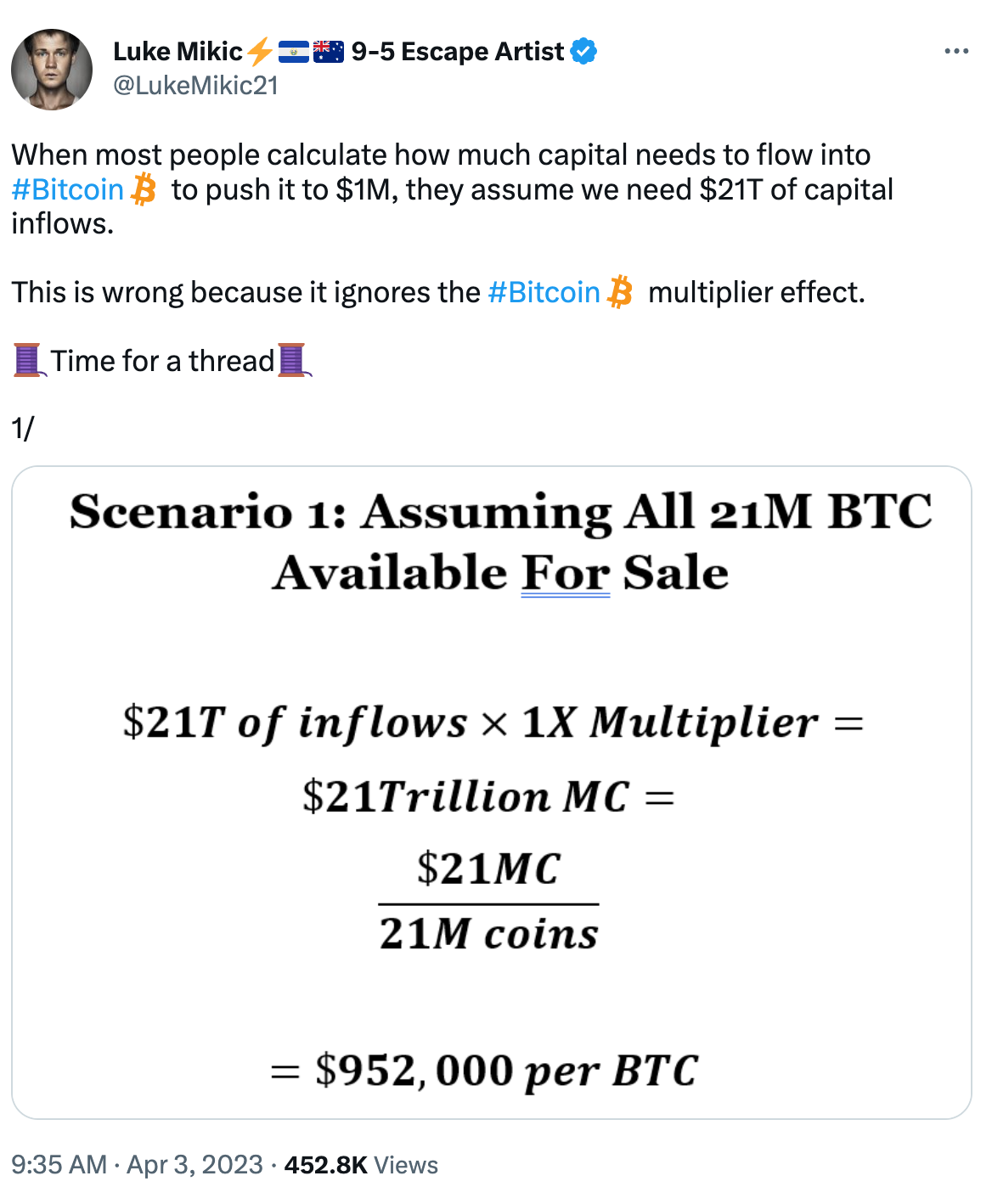

Although, many are saying that $21T isn't what is actually needed to push Bitcoin to $1M per coin. Let's unpack some math and consider if it's wishful thinking or perhaps a more realistic viewpoint.

What Does it Really Take for Bitcoin to Reach $1 Million?

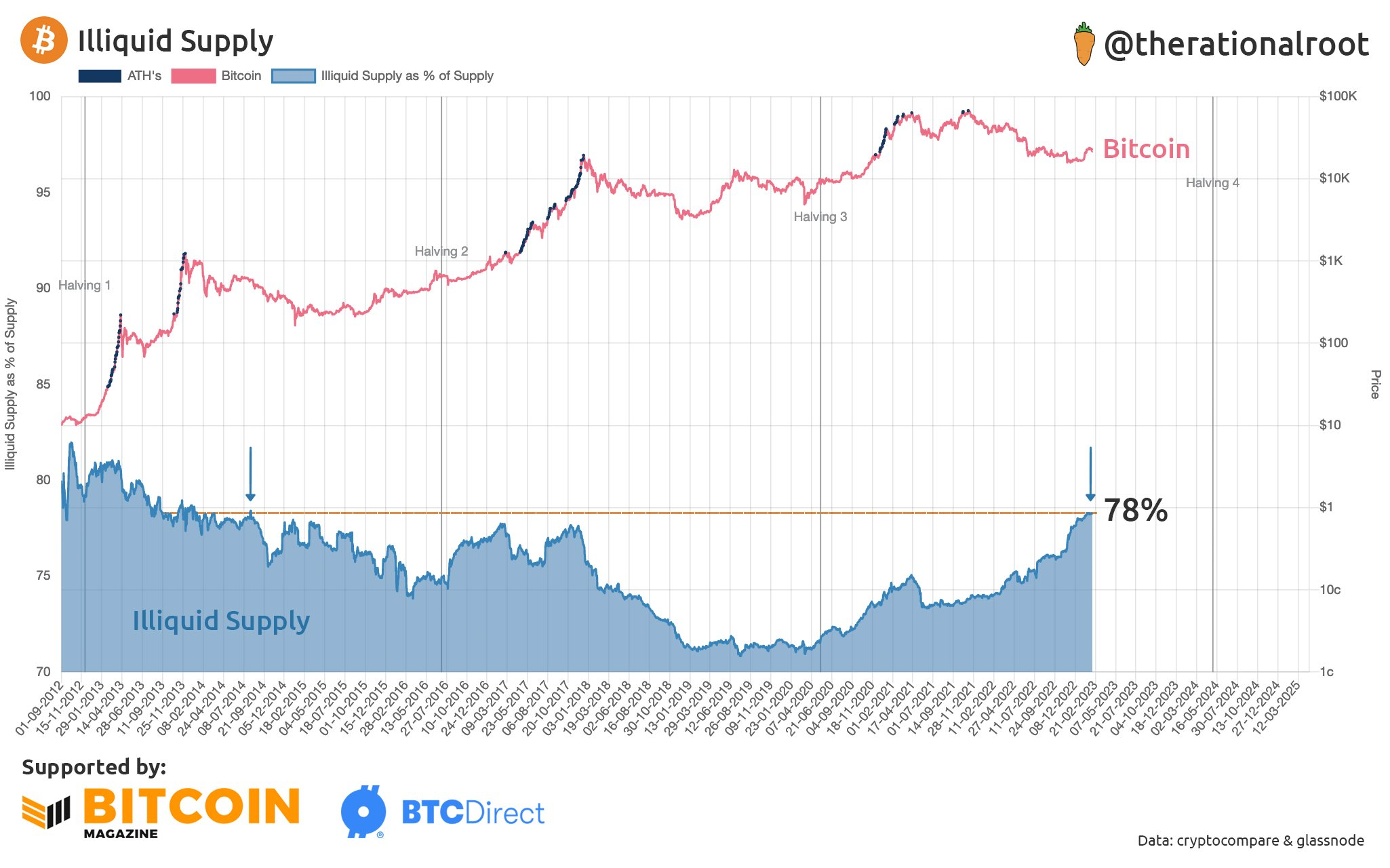

As it stands, only 22% of the circulating BTC supply is actually liquid and moving. This chart shows the supply of Bitcoin that hasn't moved in the past year.

It's been growing steadily since 2020, which is quite surprising since BTC has actually been skyrocketing. You'd think that illiquid coins would suddenly turn liquid in the face of massive price appreciation.

That definitely happens and you can see some wallets "awaken" when the BTC price goes up. On a macro trendline though, you can see that the illiquid supply continues to increase.

This tells us that BTC is consistently being moved to wallets and then HODL'd in those wallets for 1 year+.

Some other data I've read shows a lot of Bitcoin moving to smaller hands. The # of wallets holding a low, but non-zero BTC balance continues to increase. The network is growing and more and more people hodl BTC in their own wallets with each passing year.

This illiquid supply is relevant to our discussion here. To increase to a marketcap of $21T, we don't need to see every single Bitcoin catch a bid. Only the liquid coins need to be bought. If those coins are moved to wallets, then the liquid supply will dwindle.

Supply and demand continues to drive every market force.

Multiplier Effect

An interesting theory, seen in practice: for every $1 that bought BTC, the net market cap increase was an average of $2.6.

This can be seen in BTC and it can definitely be seen in smaller market cap coins. For example, if you put in a bid to buy $10,000 USD worth of LEO, you'll see the market cap of LEO increase by a helluva lot more than $10,000 USD. This has to do with the liquidity available and what price you'll get filled at.

BTC is no different. It's just a larger scale of the same phenomenon. When $1,000,000 goes out to buy BTC, it doesn't just add $1M proportionally to the market cap. The supply is simply not liquid enough to allow such a straightforward calculation.

With 78% of the BTC supply illiquid, exchanges will receive those bids and market makers start moving. Next thing you know, BTC's market cap might increase $2.6M from that $1M. At least, that's what this data tells us.

Luke used a 3x multiplier to give us a rough estimation that if $8T flowed into BTC, then we'd see BTC hit $1M per coin.

The market cap of gold is currently $13.193T. Might not seem as far fetched in that context.

Conclusion

I am obviously a huge BTC bull. I've been a net buyer for the past 7 years - each and every year, I end up with more BTC than the year prior.

Yes, I may sell some here and there but I always end up with more Bitcoin. I take advantage of DCA'ing in and DCA'ng out. My end goal is always more SATs.

While I love to buy into some of the wishful thinking out there, it's also easy to refute a lot of the explanations like this Twitter thread that I've shared from in this post.

I am an optimist but I am also a realist. I have often put my prediction in that Bitcoin will flip the Gold market cap.

Like I said, Gold is worth $13T right now. It's doing quite well amidst the current banking crisis.

To me, Bitcoin is superior gold. It's digital Gold for a digital era in humanity. Bitcoin offers us "easy" storage and the ability to transact globally, permissionlessly and without the need of Banking intermediaries. You can buy something from someone across the world using Bitcoin with no banks in between if you want. Obviously, there is also a need for TradFi in terms of cashing out BTC, but that's a whole other story.

The Bitcoin market is still a tiny little baby. The current market cap of BTC is $546B. For Bitcoin to flippen Gold, we would need a 26x in the current price. That would put BTC at $728k per coin.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha