Maya Protocol

When you think of a way to move crypto around in a totally permissionless way, between blockchains... What is the first protocol that comes to mind? Well, here's my guess. Either you can't think of an answer, or your mind automatically goes to THORChain. This is because THORChain, up until recently, was the only decentralized cross-chain liquidity protocol.

If you're a total noob and have no idea what I mean when I say a "decentralized cross-chain liquidity protocol"... In simple terms, it allows users the ability to create liquidity pools between blockchains. This creates a system where users are able to swap between native blockchain assets like Bitcoin and RUNE. It just makes me think... If we had something like this that integrated the Hive blockchain, the amount of capital that could come into the Hive ecosystem is bonkers.

A couple months ago, I stumbled across Maya Protocol, while I was doing some swaps on THORSwap. I learned about the project after doing a little bit of research, and I knew immediately that I needed to get involved. The beautiful thing about crypto is that there doesn't need to just be one reliable service for each thing.

There is an inherent need for multiple protocols that are capable of the same thing for a number of reasons. Major reason being - decentralizing liquidity because if one get shut down, we can just use the other. It's no secret that the SEC in the US is very against crypto, and having "backups" of protocols that we can switch to at the drop of a hat is key to survival.

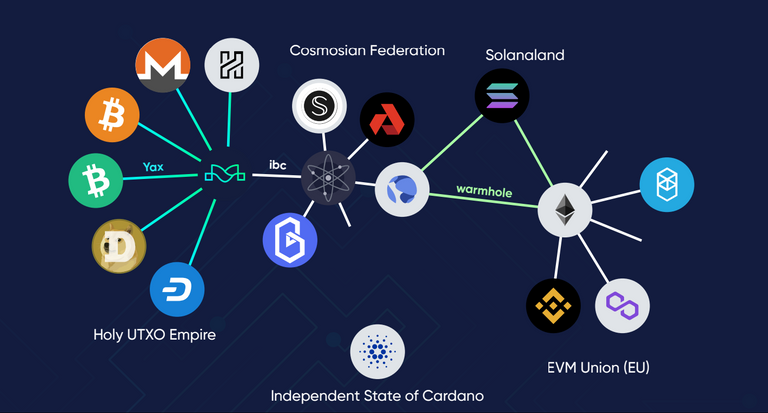

Maya Protocol can be thought of as a sort of "backup" of THORChain. It's capable of doing all of the same things, but adds its own flavor and token economy. It's a Cosmos SDK-based, replicated state machine to coordinate the movement of digital assets, swaps, or stakes without the need to wrap or peg them.

Why Maya?

There's a number of reasons outlined in the whitepaper that Maya was ultimately created. The most important, as I mentioned, is that there is a backup in place for emergency situations. THORChain will continue to grow as the only true decentralized cross-chain liquidity protocol, and it will eventually hit its limit.

As more and more people use the chain, it will get congested just like Ethereum. This will drive up transaction fees, and ultimately push users to use a different protocol as an alternative if there is one. Well, now there is. I won't dive into the others, but I do encourage you to dive into the whitepaper.

Maya Protocol operates with a dual-token economy consisting of $CACAO and $MAYA. Each token serves a different purpose, and it creates a very powerful economy. $CACAO is similar to $RUNE, in that it is the "fuel" for Maya. It's used for transaction fees, and has a very limited supply. All assets are paired against CACAO in liquidity pools, and liquidity nodes must bond assets to be included. CACAO serves at the incentive to secure the network.

The other token, $MAYA, is sort of like a share of the protocol. $MAYA tokens capture 10% of all the fees generated by users swapping in the protocol. Essentially, holding $MAYA means you own a share of the cash flow for the protocol. The more swaps, the more $MAYA will appreciate in value as it captures 10% of fees.

Why not just use derivatives?

There is nothing wrong with using derivative assets like SWAP.BTC, WBTC, and other pegged tokens. They exist for a number of reasons, and I use them regularly. The major issue that can come with using an asset like that is centralization. Someone controls that derivative asset, and facilitates the swap. Without a protocol like THORChain or Maya, there's not way to just natively swap BTC for BNB.

Instead, we have to rely on the wrapping oracle to facilitate the wrapping and unwrapping of that asset. This adds a lot of moving parts to the whole swapping of assets situation. So in order to swap BTC for BNB, we would need to first wrap the BTC onto BNB Chain. Now that we have our WBTC, we can continue swapping that asset and moving on with our day.

Maya Protocol eliminates the need for that extra wrapping step. We are able to take our native BTC that is sitting in a wallet, and swap it to BNB with no central party in the middle. This eliminates some of the risks that exist when using derivative assets. This also reduces overall fees as you won't have additional transactions to wrap/unwrap assets.

With ultra-secure technology that facilitates swaps between different blockchains with no custodian or man in the middle... We can imagine a world where we will eventually be able to swap BTC for XMR. Thinking about this even further out, being able to swap HIVE for BTC. We are already seeing some incredible integrations coming to the protocol such as DASH.

Fair Launch

Often times a project will launch and host an ICO or some kind of token sale. While this is a viable option to raise money for a project, it comes wit ha lot of caveats. The major issue is that usually ICOs and tokens are usually incredibly unfair. The project team members or founders will buy up a large stake prior to the token sale, and control a majority stake. Large groups will buy up insane amounts of the token supply, etc... I could go on.

The way Maya Protocol chose to do their launch was one of the most interesting I've seen, and honestly the most fair I've ever seen. Instead of a token sale, they hosted a Liquidity Auction. They set up pools for RUNE, BTC, USDC, USDT, and ETH. Users were able to deposit those singular assets into those pools, and at then end... $CACAO was donated to the pools to create the pairs.

The liquidity was locked for 30, 90, or 200 days and each tier had a different incentive curve. Obviously, I went full degen and locked all of my liquidity for 200 days to max out rewards. So in the end, I deposited BTC and RUNE. Now I have BTC/CACAO and RUNE/CACAO liquidity in the protocol earning revenue. They were able to raise over $11 million in liquidity for the protocol without even selling tokens with a goal of $5 million.

This is not financial advice, and I highly recommend you take the time to dive into the white paper. I'm no developer or expert of any kinds, I'm just a dude on the internet that's fascinated with crypto and blockchain technology.

If you have any thoughts on Maya Protocol, or anything to add, please drop a comment.

Have a GM

Are you posting on LeoFinance Threads every day? Check out @gmfrens, the cross-blockchain social NFT project that was born and raised on Threads. You can use the #gmfrens tag and mine 6.9 GM every single day. All you need is a WAX wallet.

Posted Using LeoFinance Alpha