Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

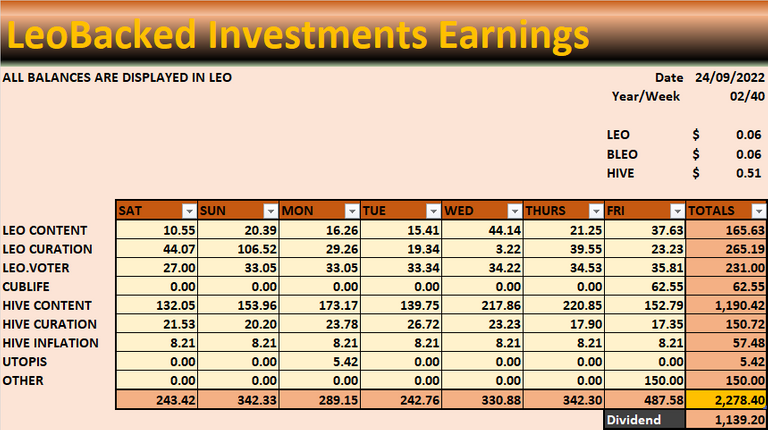

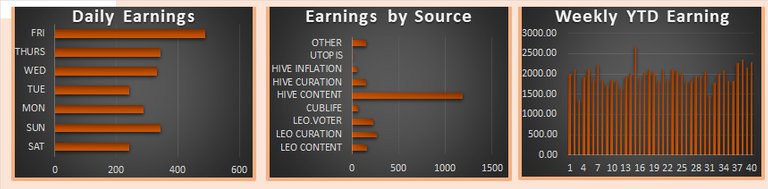

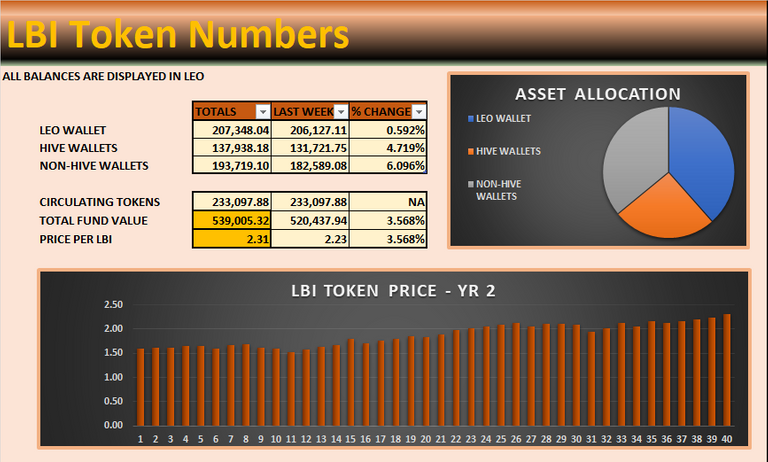

Another week of great earning, its seems to be lately that earning over 2000 LEO worths of rewards eachw eek is becoming easier. We can must of it comes from HIVE content and even our HIVE curation rewards are almost the same as our LEO curation rewards which is a little shocking considering we only have 10k HP vz 200k staked LEO.

CUBlife is doing ok for us and defi earnings brought back to LeoFinance are consistent, i think going forward i will just mark this as 150 LEO per week for the foreseeable future which plans to increase it as defi harvests increase. Anything else is ticking along nicely.

We finished the past 2 week with a negative LEO balance which has never happened to me on any project im part of so i was able to get that sorted this week. I take our defo earnings and converted them to LEO and this has dug us out of that hole for this week. This problem with LEO cashflow stems from most of our earning coming in the form of HIVE POWER and it taking 13 weeks to powerdown. We do have a 100 HIVE powerdown coming each week and this is split roughly 50/50 between LEO and HBD. We earning around 100 HP per week so we should; bebale to make this an ongoing thing and we are on our 2nd round of powering down since we started 14-15 weeks back.

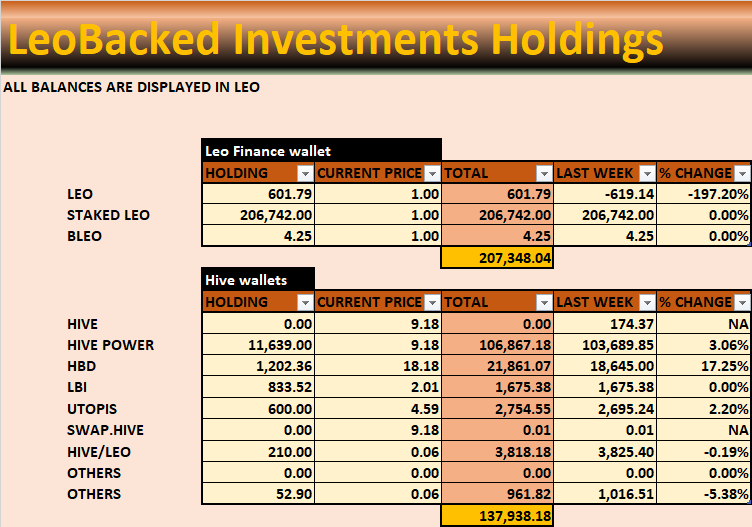

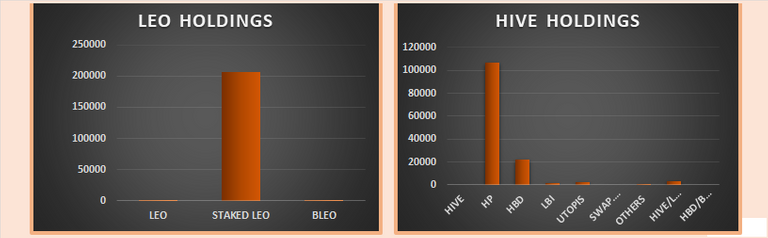

No chance with HE token holdings. UTOPIS is all over the place so im in 2 minds about what to do with it. Sell it at a huge loss or wait until it either recovers are going to 0. Its main source of income was coming from ETH mining im thinking going to 0 is more likely. I guess we gotta bite the bullet and take the hit. Our BEEswap LP is still floating around the $210 mark, it never seems to change that much so i we consider putting HIVE from UTOPIS into that.

x

x

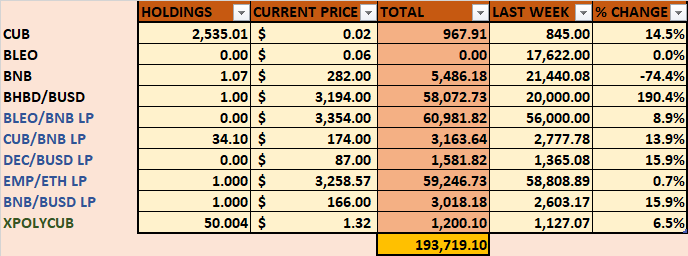

You'll notice that our bHBD/BUSD LP has increased from last week, i was able to convert the rest of our LEO/BNB into HBD/BUSD at a decent rate. There's not a bunch of liquidity for HBD so had to go at it in bitesize chunks of between $600-900 to save a slippage. Cashing out should be easier and cheaper using the CUBfinance HBD bridge to bring it back to the HIVE blockchain where liquidity is plentiful for HBD.

A few token holders suggested that I've sold LEO out at the bottom of the market. I act on what I see happening from week to week within the tracking spreadsheets. What I see is LEO dropping faster than everything else and stables not dropping, this is reflected in the LBI token price and why we have seen 5 straight weeks of new all-time high token prices, currently 2.31 LEO per LBI. People see me converting LEO into HBD and think im bearish on LEO but do they know that the same HBD will be converted back into LEO when we can get twice as many? To be blunt, I dont think the bottoms are in yet and converting to stables is preserving what little we have in the hope of increasing our overall bags at discount prices. It's a calculated risk.

EMP looks to have stopped declining as fast, the team have been fast to act and added a few things features/investments. It's still earning us good rewards which will be fed into the stable farm on CUBfinance going forward. Everything else is doing what's doing, not much change.

Overall it's been an ok week. Earnings are very nice, dividends are juicy and the price of the LBI token has hit another all-time high this week with the total fund now being valued at over 500k LEO.

I think im going to put out a proposal and vote for temporarily holding back on dividends and instead using these funds to increase our earnings and holdings. We are in a bear market, dividends are not worth that much to individual token holders and could be put to work so that when the next bull run comes, dividends will be worth something. I mean, would you miss not getting a few LEO each week? Working it out in my head, I think 1000 LBI tokens would pay out a div of 5 LEO worth 25 cents per week. Anyways, that post will be uploaded not this Monday but the following Monday. LBI could be missing out on growth opportunities that only come around once per cycle.

That's about all folks, thank you for taking the time to check out this week's report and have a great weekend.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Posted Using LeoFinance Beta