When it comes to building on the bleeding edge of technology, step function changes are often needed. There are times when things chug along, exactly as planned. Most of the time however, we're in a constant state of evolution: developing, releasing, testing, re-iterating, re-releasing, etc.

PolyCUB was designed from the beginning to be a sustainable DeFi economic engine. Our mission? Build a long-term yield platform that is focused on safe, reliable and growing cash flow for our Web3 Ecosystem and the users on it.

PolyCUB V1 is the model we had at launch. It was based around building Protocol Owned Liquidity through deposit fees and Kingdoms Management Fees. This is a good model but we realized that the yield POLYCUB paid out was disproportionate to the revenue it generated as a protocol. We needed a step function change in how POLYCUB pays yield and generates revenue in order to build a platform that fulfilled our mission of safe, reliable and growing yield. All of this changed after the launch of pHBD - where we realized that a far superior method of value creation was possible.

PolyCUB V2 is the rollout of a wide range of features. Instead of having soons for all your wens, we developed quietly and quickly in the background. What you see today is the culmination of all that work. We rolled out the POLYCUB V2 vaults and that had a significant impact on the sustainability of POLYCUB. We realized that the revenue generation of the Multi-Token Bridge should become the focus.

Last month, the Multi-Token Bridge generated over $4,000 in wrapping fees and oracle staking. This month, we're on pace to beat that figure and release the arbitrage revenue figures which will blow everyone away.

Up to this point, all revenue (Kingdoms Management Fees, Multi-Token Bridge Revenue, Deposit Fees and PoL Earnings) has been auto-compounded into Protocol Owned Liquidity. PoL combined with the monthly revenue from Kingdoms Management Fees and Multi-Token Bridge revenue will now pay a fixed 20% APY to all vexPOLYCUB stakeholders. More on this below.

In this post, we'll focus on the entire POLYCUB V2 update. This is a radical change in the dynamics of POLYCUB. Some of these features have been rolled out into production already but the vast majority of the features were just rolled out today.

- Multi-Token Bridge

- vexPOLYCUB

- POLYCUB DAO

- PolyCUB Improvement Proposals (PIPs)

- Yield Governance

- Governance UI

- Buybacks & Surplus/Deficit Model

Head over to PolyCUB and deposit into vexPOLYCUB to amplify your Governance Power. Then use that Governance Power to vote on key proposals to govern the PolyCUB Ecosystem!

- https://polycub.com/staking to stake vexPOLYCUB

- https://polycub.com/governance to vote on key proposals

Multi-Token Bridge

We've talked extensively about the Multi-Token Bridge that we deployed. The release of pHBD changed our entire view of how revenue could be generated for the PolyCUB Protocol.

Up until the release of pHBD, the best source of revenue were deposit fees and Kingdoms Management Fees. Once pHBD was released, it quickly outpaced all the revenue generated from those methods and we realized that POLYCUB could become a much different ecosystem if we shifted gears and focused on releasing pHIVE and pSPS - and in the future, other assets.

Shortly after, we released pHIVE and pSPS. We now have pHBD, pHIVE, pSPS and pLEO operating on the Multi-Token Bridge.

The Multi-Token Bridge is focused around value accrual for the PolyCUB Protocol. Last month, it generated over $4,000 in wrapping fees and oracle staking. POLYCUB Improvement Proposal 2 (PIP2) will focus on increasing this revenue to a large degree. More on this in the DAO section below.

Multi-Token Bridge Value Accrual Methods

- insert_hive_asset (i.e. pHIVE or pSPS, etc.) - held as 1:1 collateral for the wrapped equivalent - staked on native platform (i.e. HIVE POWER or SPS staking on splinterlands.com) = value accrual for PolyCUB's PoL

- insert_hive_asset 0.25% wrap and unwrap fee = value accrual for PolyCUB's PoL

- insert_hive_asset cross-chain arbitrage = value accrual for PolyCUB's PoL

- insert_hive_asset-POLYCUB = utility for people to buy POLYCUB to LP against - their insert_hive_asset = value accrual for PolyCUB's PoL

- insert_hive_asset-POLYCUB holders need to buy more POLYCUB to stake as xPOLYCUB to control governance and drive insert_hive_asset-POLYCUB vault yield higher

On our long-term roadmap, we also plan to deploy assets external to the Hive Ecosystem - effectively creating a bridge between Hive, Polygon and whatever ecosystem we target. Consider pRUNE as an example.

vexPOLYCUB

vexPOLYCUB stands for Voting Escrow xPOLYCUB. This is something that we modeled directly after Curve.Fi and as of this post going live, is now released on https://polycub.com/staking.

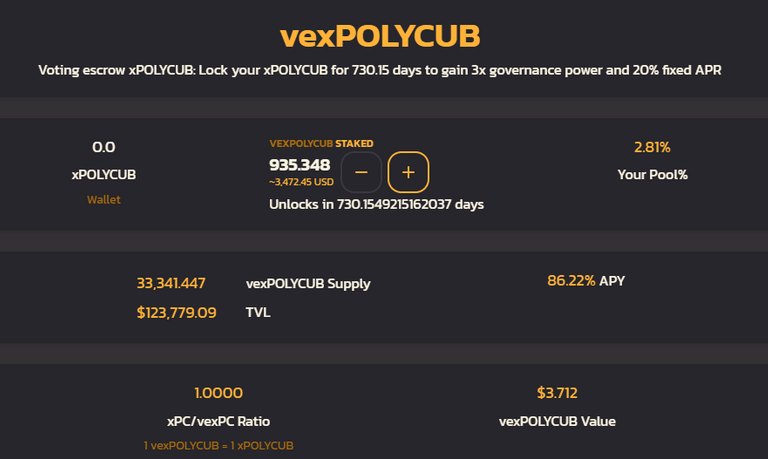

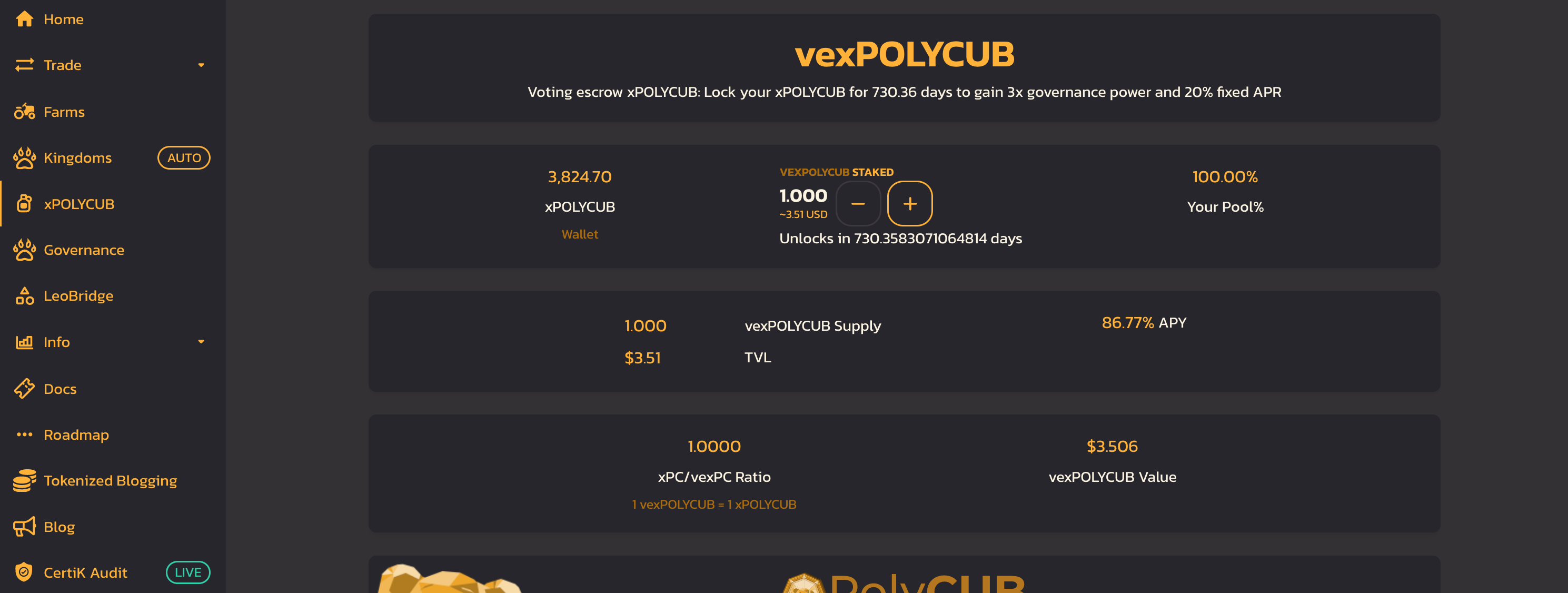

With vexPOLYCUB, users can signal long-term ownership in the PolyCUB Platform. A global countdown as started today - which you can see on the UI as "Unlocks in 730.3574989351852 days".

This countdown is global - it applies to all users equally - which means that at any time, you can stake your xPOLYCUB into vexPOLYCUB and it will unlock at that specific block. If you stake today, then you'll be able to unlock in 730 days. If you stake in 100 days, you'll be able to unlock in 630 days.

Why Stake xPOLYCUB into vexPOLYCUB?

There are 2 main reasons to stake xPOLYCUB into vexPOLYCUB:

- Fixed 20% APY

- 3x Governance Power

Note that the UI shows 86.77% APY on vexPOLYCUB staking. This is because you still earn your xPOLYCUB yield when you stake xPOLYCUB into vexPOLYCUB. The xPOLYCUB that you stake is always increasing but so is the vexPOLYCUB that you stake. That's how you get the stacked yield of 86.77% (66.77% xPOLYCUB yield + 20% fixed vexPOLYCUB yield).

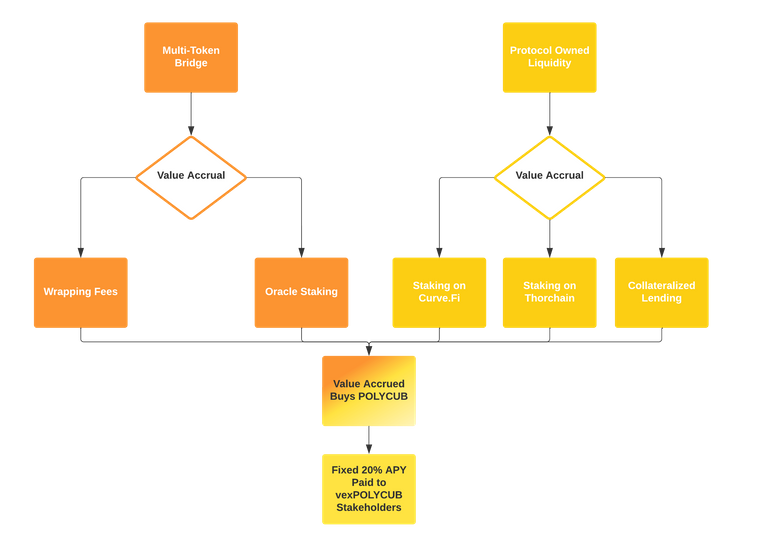

While xPOLYCUB yield is inflationary, vexPOLYCUB yield is not inflationary. Here's how it works:

The Multi-Token Bridge, Protocol Owned Liquidity and Kingdoms Fees all generate revenue for the protocol. That revenue is autonomously deposited into Protocol Owned Liquidity (PoL).

A % of that revenue is used to buyback POLYCUB and deposit it into the vexPOLYCUB Vault for all vexPOLYCUB stakers. The amount of that revenue that is used to buyback POLYCUB and deposit it in vexPOLYCUB is dependent on how much vexPOLYCUB is staked. For example, if $100,000 USD is staked in vexPOLYCUB, then $20,000 per year worth of POLYCUB will be bought regularly and deposited into the vault.

As of this writing, there is ~$780k staked in xPOLYCUB and $0 staked in vexPOLYCUB (since it is just going live with this post).

If we assume that a large % of xPOLYCUB moves to vexPOLYCUB, then we can also assume that the buybacks of POLYCUB to deposit the 20% fixed yield into vexPOLYCUB will be quite high. These buybacks happen through PoL autonomously and at randomized intervals throughout each month (to avoid front-running).

As of right now, the Multi-Token Bridge Revenue, PoL and Kingdoms Management Fees are generating a large surplus of revenue as compared to what we expect in the vexPOLYCUB vault. What happens to the surplus of revenue?

The surplus stays in Protocol Owned Liquidity and compounds itself. It deploys capital into the PoL's positions and generates more yield. This is how we achieve long-term, reliable and growing yield for vexPOLYCUB stakers. The PoL is continuously growing which means that the capacity for vexPOLYCUB stakeholders is continuously growing as well.

POLYCUB Inflation is still halvening and this means that we're well on our way to flippening the curve. Buybacks of POLYCUB in the vexPOLYCUB vault are very likely to flip the actual inflation distribution of POLYCUB in the near-future which means that POLYCUB will be one of the few DeFi platforms out there with sustainable tokenomics.

How vexPOLYCUB Works

You can read up on vexPOLYCUB in the docs https://docs.polycub.com/polycub-mechanics/vexpolycub but in short, it works identical to the POLYCUB-xPOLYCUB dynamic but instead, it has a xPOLYCUB-vexPOLYCUB dynamic.

The ratio starts at 1 xPOLYCUB per 1 vexPOLYCUB. As POLYCUB is bought on the market by PoL and deposited into the vexPOLYCUB vault, the 1:1 ratio will increase. 1 vexPOLYCUB will always be worth more than 1 xPOLYCUB.

Again, it has a global cooldown. As of this post, it started at 2 years (730 days) to unlock your vexPOLYCUB and receive your liquid xPOLYCUB back.

Governance

vexPOLYCUB is a key mechanic in the PolyCUB DAO. It gives 3x governance power over unstaked (regular xPOLYCUB).

1 xPOLYCUB = 1 governance power

1 vexPOLYCUB = 3 governance power

This dynamic gives more governance power to users who have skin in the game and signal long-term usage of the platform by locking xPOLYCUB into vexPOLYCUB.

PolyCUB DAO

Governance is the core utility of POLYCUB. The whole LeoFinance ecosystem has been caught up in Wens over this moment - especially Neal.

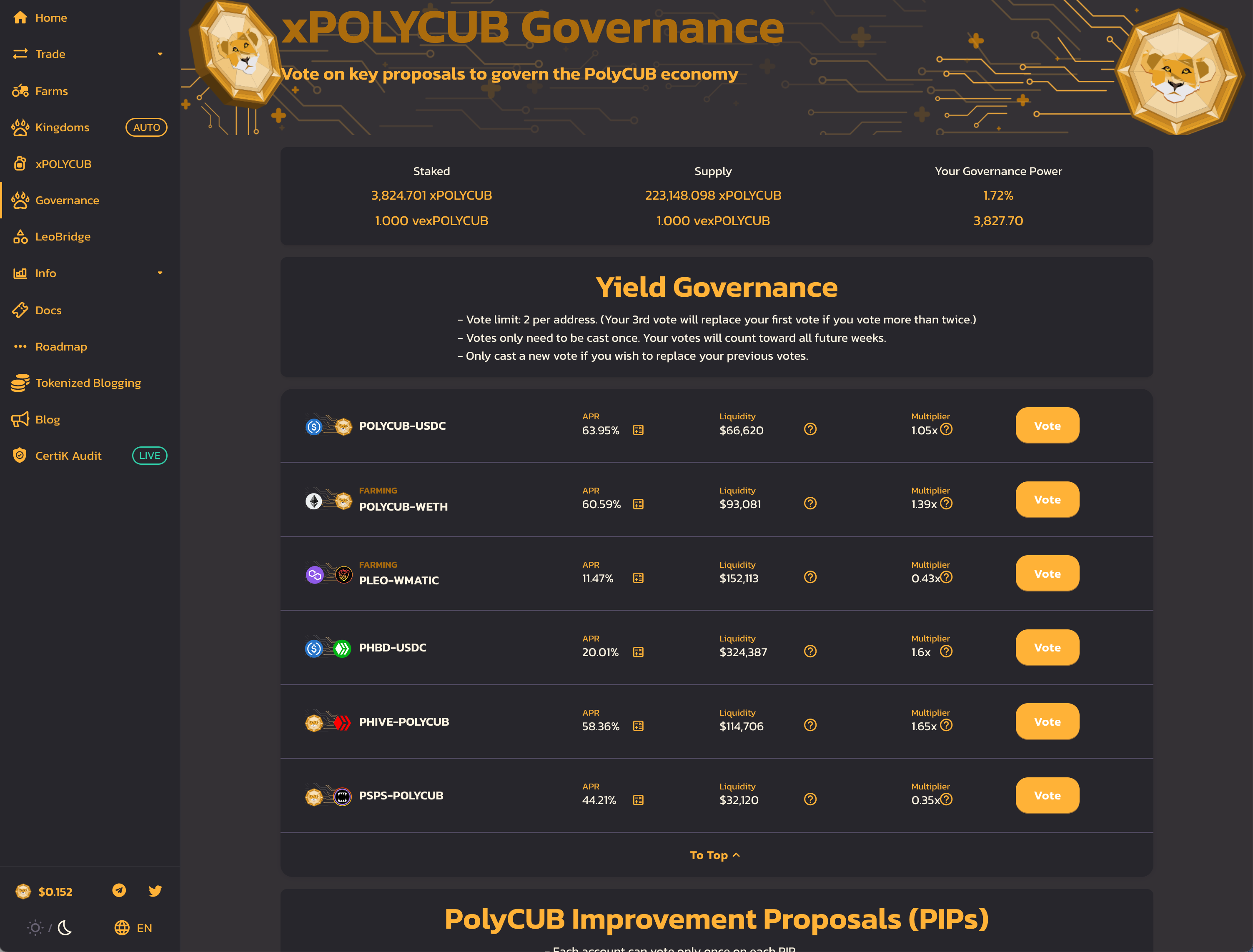

With Governance officially in place, the reason to hold and utilize POLYCUB has never been higher. Now, anyone stacking POLYCUB can watch their Governance Power increase on the https://polycub.com/governance UI.

Governance Power

If you login to POLYCUB and look at the top of the Governance page, you'll see your Governance Power and Governance Power %.

Your Governance Power is mathematically determined based on how much xPOLYCUB + vexPOLYCUB you have staked vs. the rest of the community.

The actual calculation is: xPOLYCUB Balance + (vexPOLYCUB Balance * 3) / Total xPOLYCUB + (Total vexPOLYCUB * 3) = Governance Power

From there, your Governance Power simply shows you how much of the total Governance you have control over.

For example, if your Governance Power = 1%, then you have 1% control over anything that happens on https://polycub.com.

If your Governance Power = 10%, then you have 10% control over anything that happens on https://polycub.com.

Weekly Yield Governance

Most importantly though, you can see and participate in the weekly Yield Governance voting for the vaults on PolyCUB.

NOTE in the last AMA we mentioned that we might reset the Weekly Yield Votes. While most wanted to leave it (so they didn't need to rebroadcast their vote) we decided to reset the DAO and start clean. This gives everyone an even chance to vote and starts the clock back from 0. If you have already participated in the Weekly Yield Governance Votes, then you need to update and vote again. You have 2 votes, choose wisely. PIP2 is also now live, go utilize that Governance Power!!

There is a weekly snapshot for Governance Voting and this weekly snapshot is what determines the yield dynamics on https://PolyCUB.com/farms.

If you want more yield to be driven into your favorite vault(s), then you'll need to acquire Governance Power and then vote for that vault.

Each week, a snapshot of all votes are taken by the DAO and then the DAO updates the yield Multipliers for each vault according to the weighted votes behind it.

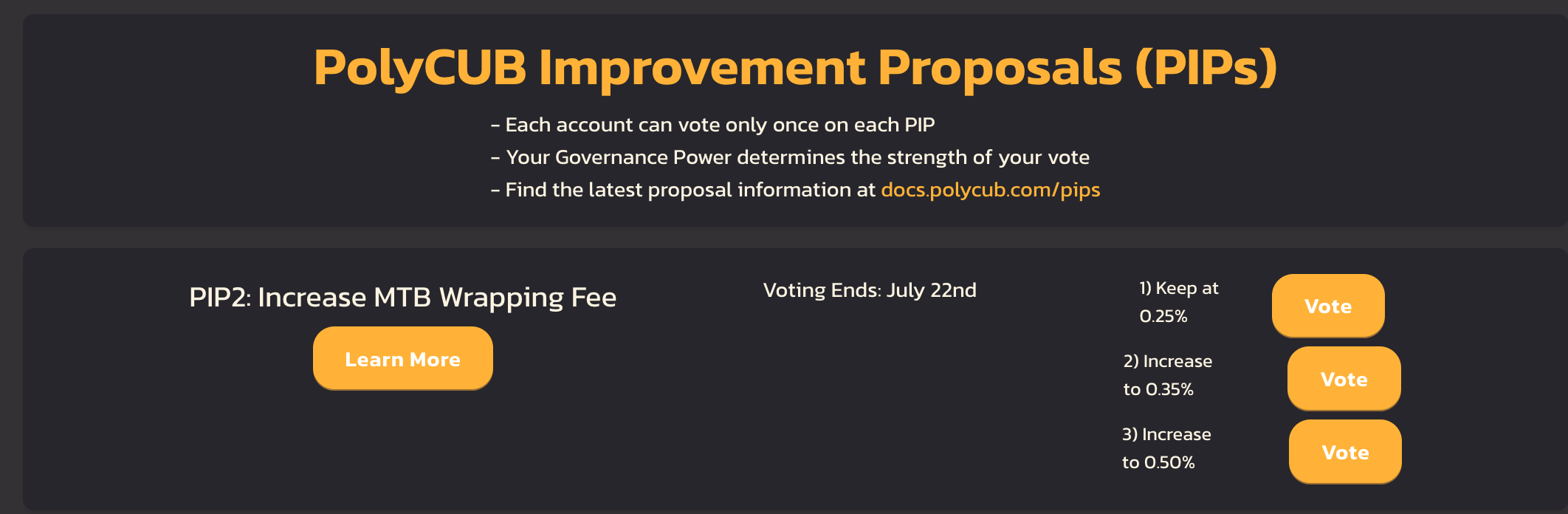

PolyCUB Improvement Proposals (PIPs)

We haven't talked about PIPs much yet. This is one of the features we developed quietly in the background.

The POLYCUB DAO is now in charge of governing how the PolyCUB Ecosystem operates. There are a lot of different improvement proposals to vote on. Each proposal is aimed at changing something on the PolyCUB platform. The goal of each PIP is to drive POLYCUB toward its mission statement. That power is now in the hands of all xPOLYCUB and vexPOLYCUB stakeholders.

PIP2: Increase MTB Wrapping Fee - the first PIP is a proposal to increase the Multi-Token Bridge Wrapping Fee.

For the first time, we talked about how much wrapping fee revenue was generated by the PolyCUB MTB Protocol. This wrapping revenue is used to buyback POLYCUB and deploy it into the vexPOLYCUB vault for the 20% fixed APY.

This means that the greater the MTB revenue, the greater the buybacks of POLYCUB. POLYCUB buybacks being deployed into vexPOLYCUB also means that we are effectively removing liquid POLYCUB from the market and depositing it into the vexPOLYCUB vault where it needs to wait until the unlock time has elapsed in order to be withdrawn and either re-staked or sold on the market.

POLYCUB is going to be removed from the liquid supply at a rapid pace each month.

PIP2 aims to increase MTB revenue by increasing the wrapping fees for pHBD, pSPS, pHIVE and pLEO. As of right now, the wrapping fee is 0.25%. The proposal has 3 voting options (as will almost all PIPs):

- Keep it the same (0.25%)

- Increase it to 0.35%

- Increase it to 0.50%

Buybacks & Surplus/Deficit Model

We're migrating POLYCUB to a surplus/deficit focused model. This means that we're focusing on generating revenue for the PolyCUB Protocol and we're keeping a close eye on how much inflation is paid out in order to make that happen.

A POLYCUB Improvement Proposal (PIP) is in the queue to be deployed (likely PIP4) which will discuss this in more detail.

Our mission to create sustainable, reliable and growing yield is contingent on paying yield efficiently. As many in the community have talked about, the days of paying outsized yield for low revenue generation are over.

We're now focused on having the POLYCUB DAO determine where yield should be paid. The total amount of yield is determined by the revenue that the MTB + PoL can generate each month.

- Total Yield available is determined by MTB Revenue, Protocol Owned Liquidity Revenue + Kingdoms Fee Revenue

- Where total yield is distributed is determined by the POLYCUB DAO Governance Votes

This means that more POLYCUB should be bought back by the protocol each mont than is sold by the userbase each month. Any surplus over that amount is autocompounded into PoL which increases the Protocol's capacity for future autonomous buybacks.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

Polygon HBD (pHBD): https://wleo.io/hbd

Polygon HIVE (pHIVE): https://wleo.io/hive

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

LEO Wrapping Bridge: https://wleo.io

Posted Using LeoFinance Beta