Web3 is an evolving industry that is constantly taking on new shapes and forms. Being on the bleeding edge of this industry means that we are also evolving and constantly looking for ways to capture the most value for the LeoFinance Web3 Ecosystem.

LeoAds is a concept we developed at the very beginning of LeoFinance - nearly 3 years ago.

This concept was simple: content creators on LeoFinance.io would create content that would drive traffic. This traffic comes from:

- Within our own ecosystem (engagement from existing users)

- Outside of our ecosystem (engagement from google traffic, social media shares, evergeen content, etc.)

Over time, we expanded the project and found bigger fish to fry, so to speak. The LeoAds revenue was great but it was small and we figured out that a focus on expanding our core user-base and building a larger following was necessary.

So LeoAds slowly hit the back burner while other projects took the core focus. With our team expanding over the past 6-12 months, we've been able to accomplish a lot more things in shorter time spans.

The team is still rapidly expanding with our most recent hires:

- New Head of Growth (Growing Social Media)

- New Head of Business Development (Growing LeoPartnerships & Traditional Marketing)

- Another Solidity Developer (CUB)

- Another Flutter Developer (LeoMobile & ProjectBlank)

These are hires we just made in the past 30-60ish days and we had many more hires throughout the ladder part of 2021. My primary focus right now is building more hierarchy and organization into the LeoTeam. So far, this has allowed us to accomplish a lot more in the past 60 days than in the prior 6 months. Much of this development has been around PolyCUB, DeFi, LeoMobile and ProjectBlank.

We've also picked up the code that we had to put on the backburner in early December.

What code is that?

The new LeoAds Distribution model.

Going Back to Early December

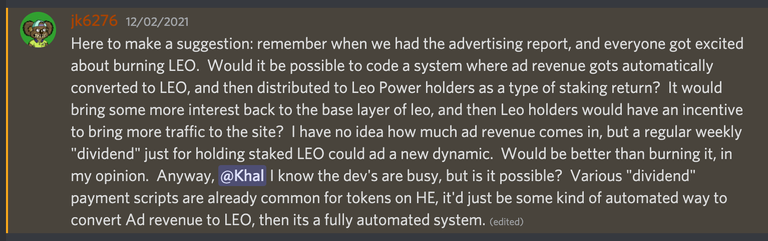

In early December, a few of us in the LeoGrowth-Team Chat on Discord were talking about LeoAds and a better way to utilize the revenue generated by ads displayed on https://leofinance.io.

The idea that Jk laid out was a great one: have the automated LeoAds system take the ad revenue each month (it's paid in BTC), buy LEO on one of the 4 exchanges it is listed - whichever has the cheapest arbitrage price (wLEO, bLEO, pLEO or LEO) - then stake it all as LEO POWER into the accounts of everyone already holding LEO POWER.

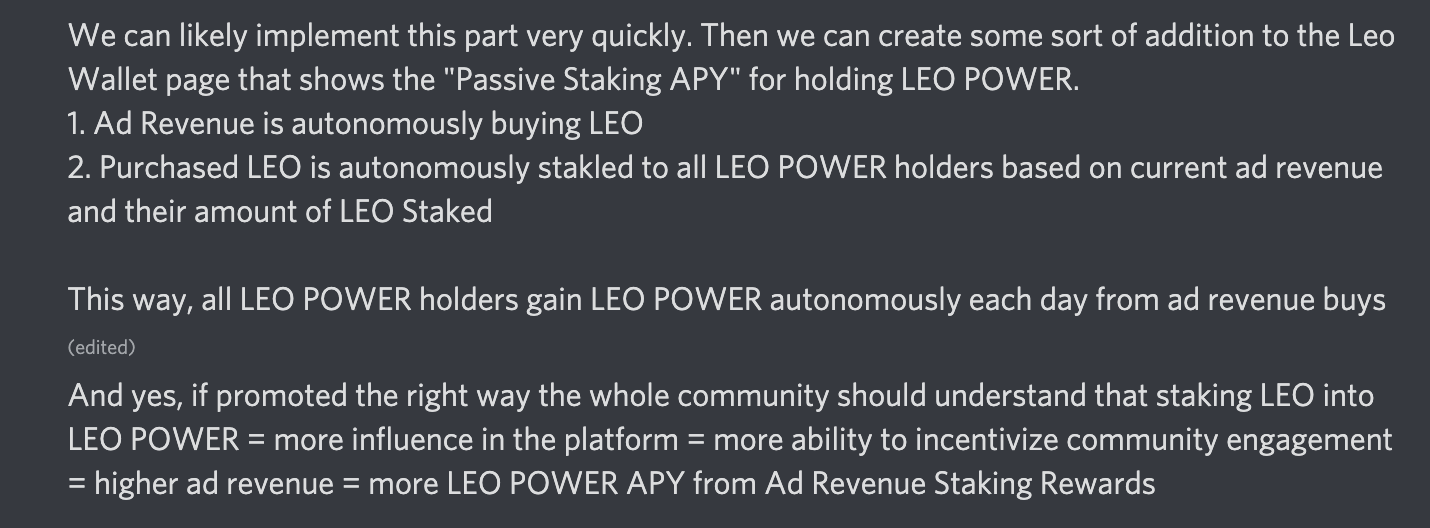

With this mechanism in place, users would just stake LEO POWER and that balance would automatically grow over time. Esentially like the CUB autocompounding Kingdom or the xPOLYCUB staking vault. The number goes up but this time it is going up from LeoAds revenue on LeoFinance.io.

This model is extremely exciting and we had something similar built. All it took was a few modifications to what was already there. We were ready to implement it but then put it on the backburner as we onboarded new team members and got closer to the launch of PolyCUB. We needed to expand the dev team - and the management hierarchy - to be able to handle all of these implementations simultaneously.

This expansion is continuously ongoing. We've even promoted a LeoTeam member into a more "CTO" role who's responsibility is to code, organize the developments of other devs on the team AND - importantly - serve as a head hunter for LeoTeam. Constantly interviewing and approving new devs to join our team.

My personal goal is to grow our dev team by at least 10 new members by year's end. We've already got 2 new devs working full-time, so we're making great progress on this goal.

How Much Would it Be?

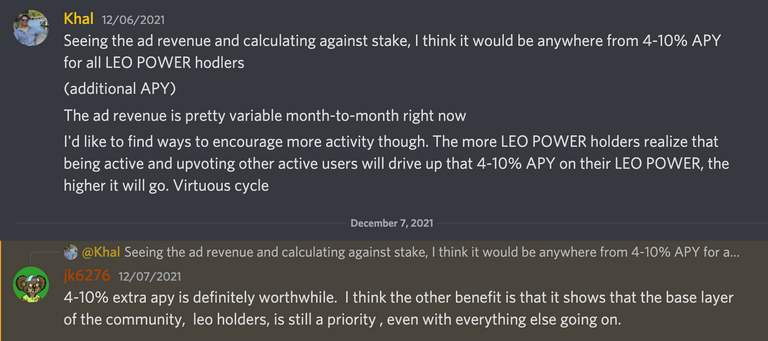

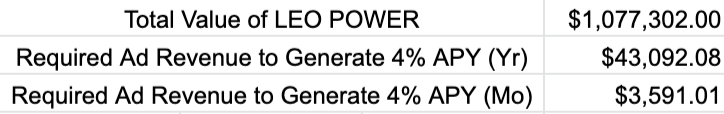

Back then I calculated it at roughly 4-10% APY to all LEO POWER holders. I did this by calculating the current value of LEO POWER staked against the monthly ad revenue that was being generated.

I ran some quick math again to see what this would look like. We're well on pace to fit into that 4-10% range (likely at the higher end of that range).

Ad revenue varies greatly month-to-month, but it almost always surpasses this $4,000 figure. This means that we're on track to bounce in this range - this is also without much focus on growing LeoFinance.io in terms of our core KPI. We need to focus on this more as a team and community and our recent hires for head of bizdev and head of growth are our full-time hires who will help make this a reality. More on this later in the post.

As many of you know, we've hired on a marketing company as well as Head of Growth on our internal team to grow LeoFinance.

Our Head of Business Development is also working hard to develop a model that can continuously drive new traffic, partnerships and collaboration to LeoFinance.

Our team of developers has grown significantly but so has our team of business leaders and marketers. All of this culminates into growing the LeoFinance Web3 Ecosystem in perpetuity. It still feels like we're taking baby steps even though we've accomplished so much in these first 3 years.

The point here is that between LeoTeam and LeoCommunity, this 4-10% figure is quite low.. we've gotten to this point without much focus on growing LeoFinance.io. We can bolster this and make it grow to be so much more than that. The cool thing is that as we build in the opportunity of this APY, we're also building in a deep incentive model for everyone that has LEO POWER to work harder to grow LeoFinance's community and engagement on https://leofinance.io.

Refocusing on LeoFinance Traffic, Content and Engagement - The LeoAds Incentive Model

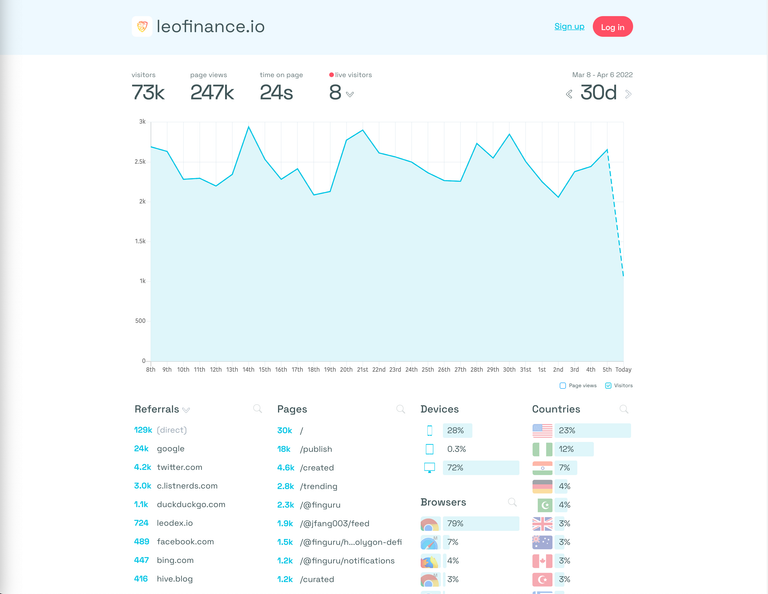

Engagement on LeoFinance.io took somewhat of a backseat since the launch of CUB in March 2021 - despite the growth of LeoFinance as a website since then.

This only goes to show how powerful LeoFinance is. Despite most of us getting into the trenches of DeFi and putting SocialFi on a bit of a backburner, we're still growing at a great pace. Evergreen content and a hardcore community that is dedicated will do that. We are now faced with an opportunity to expand this on all fronts.

Now that this organization is growing, our community has grown and the technical maturity of our dev team has expanded, it's time to get back to the core KPIs.

You'll recall a post we put out recently: LeoFinance's #1 Key Performance Indicator (KPI).

The KPI that we are most focused on is Monthly Active Users (MAUs) of both LeoFinance.io (LeoDesktop) and LeoMobile. Growing the MAUs is now the responsibility of every:

- LeoTeam Member

- LeoCommunity Member

- LeoPower Holder

We need to push forward and continue down the path that we started on. The new LeoAds model will bolster our efforts with a deeply-engrained incentive model.

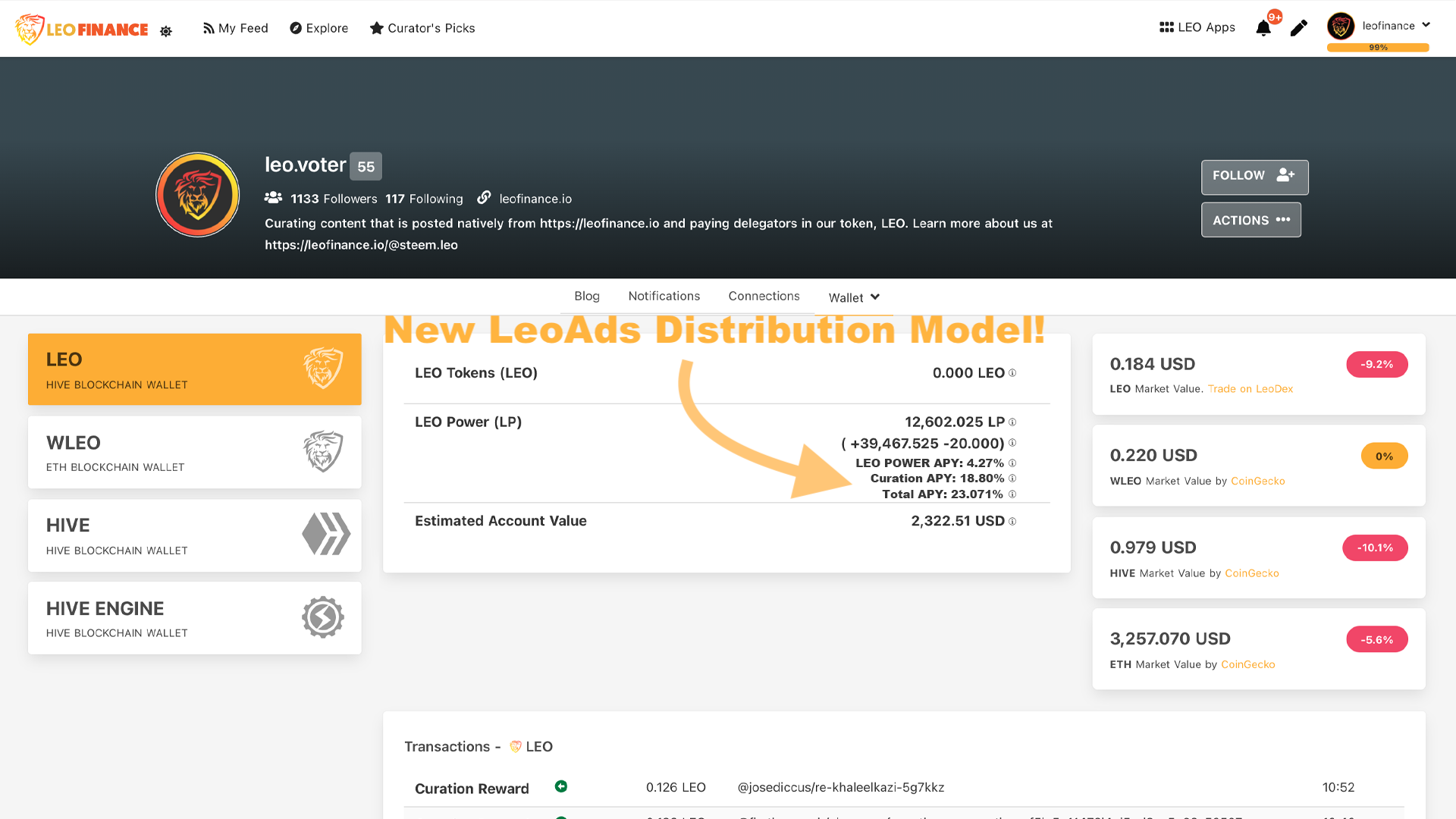

We've built the code back in December and are now running tests to ensure it works properly. Get ready to start tracking the growth of your LEO POWER staked on https://leofinance.io. Once implemented fully, we'll add a UI display that will track the on-going APY of staked LEO POWER (not including the curation APY that is already earned by curation).

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using LeoFinance Beta