With the dust settling on PolyCUB's initial launch, it's time to dive head first into what's coming.

What we've built with POLYCUB is nothing short of incredible. We've built the first-ever DeFi 2.0 Yield Optimizing platform.

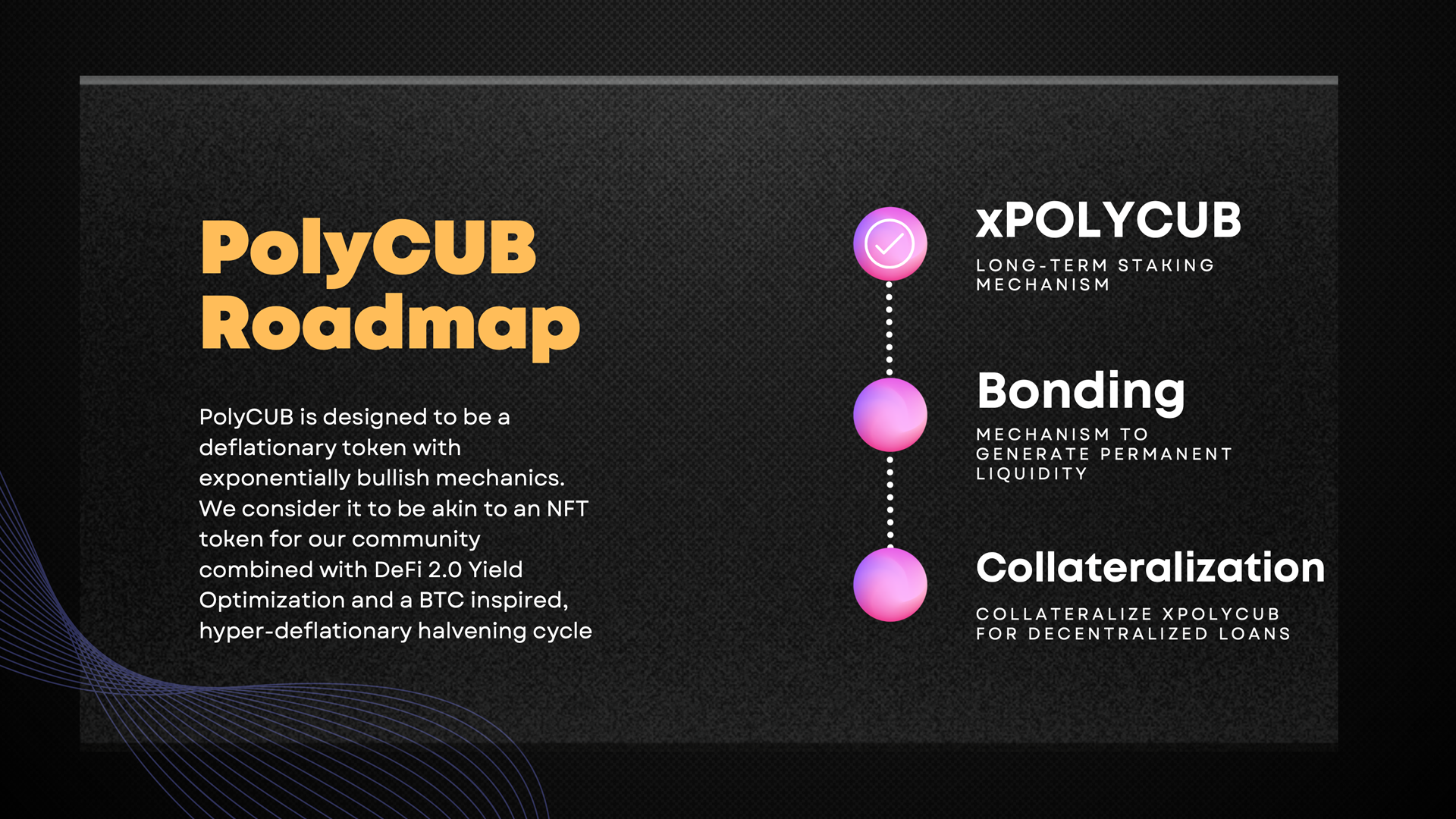

At launch, we've built-in the xPOLYCUB mechanism which acts as a black hole for POLYCUB's circulating supply.

POLYCUB is being driven into this xPOLYCUB vault at a ridiculous rate. This comes from two places:

- Ongoing Emissions

- Early Harvesting Penalties

There are a few key features of the xPOLYCUB mechanism that make it so powerful for the long-term value proposition of the POLYCUB ecosystem.

Namely, we're redistributing wealth to the diamond paws of the LeoFinance community. What we saw unfold with CubFinance (CUB on BSC) was truly eye opening.

CUB has shown us through the CUB Kingdom that our community is a bunch of die hard hodlers. Our community will hodl CUB and POLYCUB till the end of time and that is truly something special.

The key with POLYCUB is to create a much deeper incentive structure for hodlers who single-stake POLYCUB as xPOLYCUB on https://polycub.com/staking.

In this post, we'll briefly overview the near-term roadmap for PolyCUB. With Bonding and PoL kicking in this week, we've got some exciting stuff on the horizon for PolyCUB.

The entire mission behind POLYCUB is to create an extremely limited supply token with forever number go up mechanics. Right now, we're in DeFi 1.0 landscape (high inflationary rate = high APY).

The purpose of this is to create an "early days of Bitcoin mining" setup where early participants can earn a large amount of POLYCUB tokens so that we can distribute it as widely as possible.

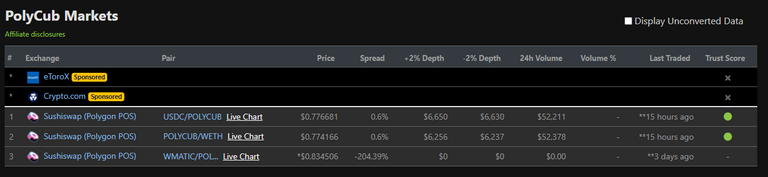

The emissions rate continues to decline. The latest drop happened just 48 hours ago and the next drop is about 5 days from today.

The halvenings of POLYCUB emissions are designed to create a hyper-accelerated version of the BTC Halvening cycle. Distributing POLYCUB widely and then capping the supply at about 7M POLYCUB tokens that will ever exist. The supply will never grow beyond that emissions rate.

In the long-run, Protocol Owned Liquidity which is built via management fees on Kingdoms TVL and Protocol Bonding (Releasing this week) will buyback POLYCUB on the open market and add it to the POLYCUB Rewards Pool. That PoL is how long-term LP APY is paid out.

Bonding and Protocol Owned Liquidity

Bonding is anticipated to be released this week. We're finalizing the UI and getting everything prepared with the treasury contracts.

Bonding is an absolute game changer. We're going to see permanent liquidity added to the protocol via POLYCUB-USDC and POLYCUB-WETH bonds.

Users will also be able to bond WBTC-WETH and other Kingdoms LP assets to the protocol liquidity.

All of these bonds are held by the PolyCUB protocol and will continually autocompound. Around July/August, the emissions rate of POLYCUB drops to nearly nothing and the Protocol Liquidity will begin to buyback POLYCUB from the market and then distribute it to the LPs across the entire PolyCUB platform.

Instead of earning from new POLYCUB emissions (since there will no longer be any past 7M POLYCUB), LPs will earn from this pool of Protocol Liquidity-driven buybacks.

It's an incredibly interesting ecosystem that we've built for POLYCUB. It ensures long-term, sustainable yields and a POLYCUB token price that goes up in perpetuity - very closely modeled after the scarcity dynamics built into BTC.

Collateralized Lending on xPOLYCUB Tokens

Many have asked what the point of hodling POLYCUB is after the emissions rate drops so low that yields are no longer hundreds (and thousands) of %.

POLYCUB is an extremely scarce token. What you're seeing today in terms of price action is the result of the early days of mining it. Similar to BTC's early days, it's extremely easy to mine POLYCUB right now.

People are buying POLYCUB and staking it as xPOLYCUB and earning 2,000%+ APY. That's insane and that is the result of these early days.

The key is where things end up in the next 3 months and further than that, the next 3 years.

POLYCUB has some interesting dynamics backing it up:

- xPOLYCUB is a long-term, forever number go up vault. The ratio of POLYCUB / xPOLYCUB will increase in perpetuity and this will drive value to all the diamond paws who buy and stake POLYCUB into xPOLYCUB. The sooner you stake, the bigger your future claim will be on POLYCUB

- Protocol Liquidity will drive continuous buying demand into the POLYCUB token and then distribute those tokens to LPs in the platform. This sends the vast majority of POLYCUB back into the xPOLYCUB vault. Eating away at the circulating supply and providing more black hole theory to xPOLYCUB Staking

- Collateralized Lending is a new feature we've been developing in the background. When it's released, users will be able to stake their xPOLYCUB tokens into the collateralized loan contract and take out a loan from the Protocol Liquidity in exchange

Collateralized Lending will come as a major surprise to everyone in the community. We haven't spent much time covering it but when we release it, it will blow your mind.

Remember that when you deposit POLYCUB into xPOLYCUB, you're given an "xPOLYCUB token". This xPOLYCUB is simply a claim on the POLYCUB in the vault.

Essentially, xPOLYCUB acts as an "LP Token" that claims your pool position on the https://polycub.com/staking page.

This is vital for the collateralized loan mechanism.

Modeled After ThorFi Self-Paying Loans

Who would we be if we didn't pull in some Thorchain inspiration?

We modeled these collateralized loans after the ThorFi whitepaper for collateralized LP lending.

Essentially, the protocol allows users to:

- Buy POLYCUB

- Stake POLYCUB into xPOLYCUB on https://polycub.com/staking

- Receive xPOLYCUB Tokens (representing their LP in the POLYCUB vault)

- Stake xPOLYCUB tokens into Collateralized Lending contract and take out an over-collateralized loan in USDC

- Loan interest is autonomously paid back via xPOLYCUB yield (self-paying)

The lending system we're building is fascinating and will require a white paper of its own. For now, this is a brief introduction to the concept before we release it.

For many reasons - namely stability - the lending infrastructure is currently set to release sometime during the Month 2 emissions halvening. The POLYCUB emissions rate will be far lower at that time and will allow the collateralized lending to take place in an environment where POLYCUB has already been widely distributed and we're in the number go up (BTC Scarce Asset) phase.

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using LeoFinance Beta