Governance is an interesting word in the crypto space. If you go back about 12-18 months, then you'll see a large number of projects - many cultivating over a billion dollars in market cap at the time - claiming that they were "governance utility tokens".

The funny thing is, many of these tokens were months away from launching governance functionality. Some still don't even have it implemented. Many claimed to be Governance tokens but failed to deliver a governance structure.

xPOLYCUB: The Ultimate DeFi Utility Token

Over the many months that we spent developing PolyCUB, we thought of all the potential utility we could build into the platform. If you listened to yesterday's LeoFinance AMA, then you will have heard the plan: we roughed-in a lot of features for POLYCUB that were designed in rough form without polishing.

These features - in their rough form - were designed to have 90% of the work done so that we could polish and roll them out much more quickly post-launch than if we did 0 development on them upfront.

This is how we're delivering these features on such a fast timeline:

- xPOLYCUB Governance

- pHBD

- Bonding

- Collateralized Lending

- Variable Earn Rate

The utility for holding xPOLYCUB is about to skyrocket. Governance is at the core of these utilities and the time has come for our first governance vote.

xPOLYCUB Governance: What Will We "Govern"?

With xPOLYCUB governance, regularly scheduled proposals will take place to modify the platform. The only thing that is not able to be modified is the inflation rate. POLYCUB is designed to have similar tokenomic features to Bitcoin - it is highly scarce, has a predictable inflation rate and is designed to have massive utility on a small number of tokens.

Other platform mechanics are subject to governance:

- How much APY each vault earns

- Adding new vaults

- Changing the claim window for locked claims (currently 90 days)

- Prioritizing collateral

- Directing PoL

- etc.

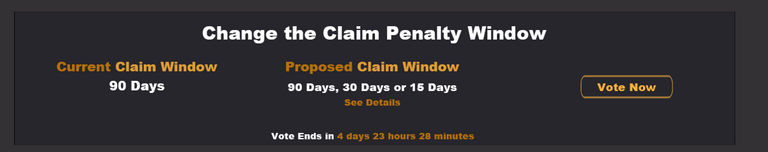

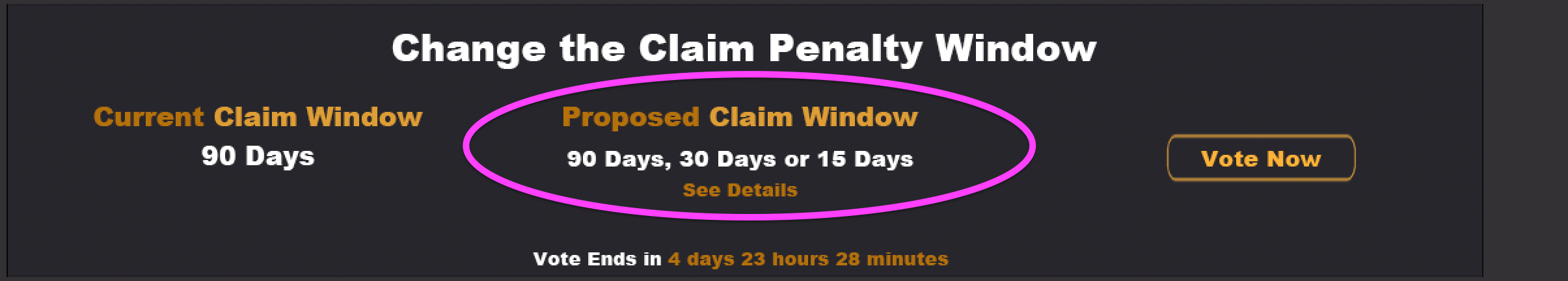

Our First Governance Vote: Proposal to Reduce the Locked Claim Window

After seeing a lot of feedback from the community since the launch of PolyCUB, many have said that the 90 day claim window is basically an eternity in crypto.

This is quite true. In 90 days, everything can change in crypto. This makes it quite difficult to earn predictable yield and impatience often gets the better of us.

With the launch of pHBD - USDC, many have said that more people on Hive would provide liquidity if they could earn the APY without waiting 90 days to claim their rewards.

Under all of this context, we want to launch the first xPOLYCUB Governance Proposal Vote to change the claim window. Also keep in mind that you can only claim HBD rewards 1x per 30 days when you stake directly on-chain on Hive.

90 Days, 30 Days or 15 Days?

This proposal has 3 voting options:

- Keep the claim window at 90 days

- Reduce to 30 Days

- Reduce to 15 Days

How to Vote - 2 Simple Steps

As mentioned above, the Governance system is built and "roughed-in" to the PolyCUB platform mechanics. We still need more work on the UI and we need to do some testing on the governance backend.

This first vote is a bit of a trial run to see how the backend performs. There will be no frontend to vote from... For this vote. Future votes will have our frontend in place.

With the launch of pHBD, we want to drive as much liquidity into pHBD-USDC as possible. This vote could potentially make it more attractive to LP assets on PolyCUB with a lower claim penalty window.

Step 1). Decide Which Window to Vote For

Look at the 3 window options. Think about what makes sense for your vision of the platform.

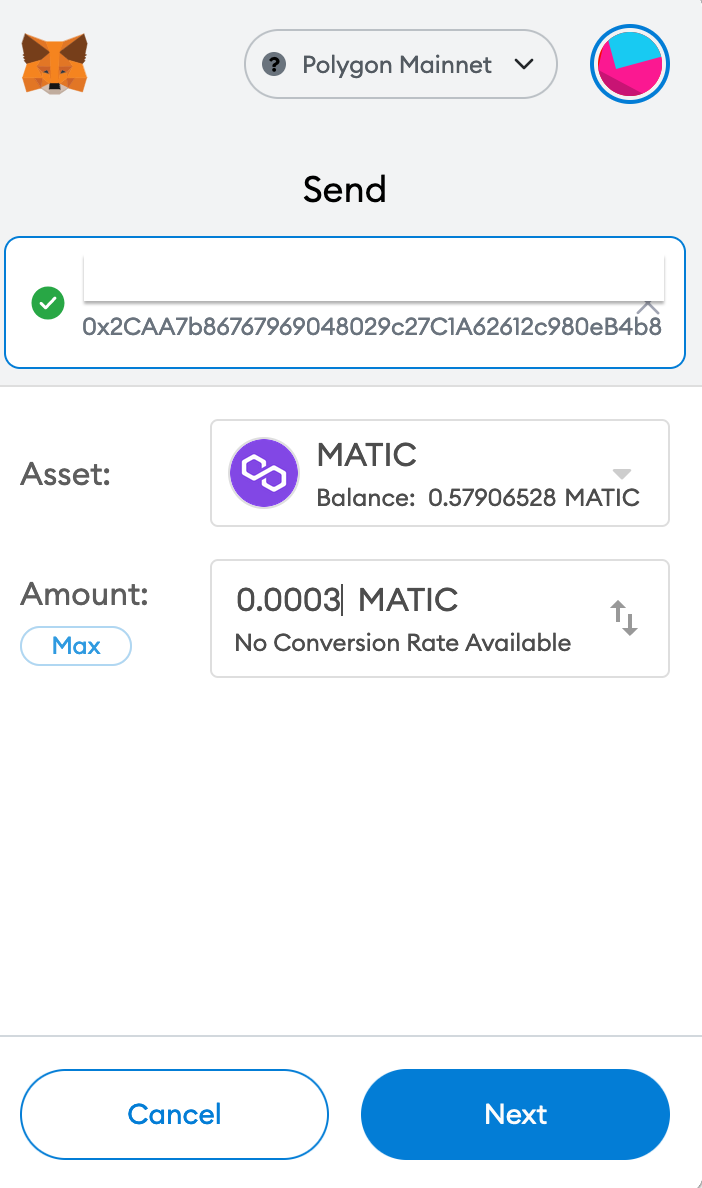

Step 2). Open Metamask (or whatever wallet you use for Polygon) and Cast Your Vote with a Simple Send TX

example TX to indicate voting for 30 day window

The voting system is designed to have minimal complexity. All you have to do is send a simple TX to the governance address to indicate which proposed window you'd like to vote for.

Again, future votes will have our Proposals UI in place. This one is just a quick and easy, 3 option vote

Send a TX to the governance address with the exact amount below:

- Send 0.0009 MATIC to keep the claim window at 90 days

- Send 0.0003 MATIC to reduce to 30 Days

- Send 0.00015 MATIC to reduce to 15 Days

Governance Address: 0x2CAA7b86767969048029c27C1A62612c980eB4b8

A few things to keep in mind:

- Make sure you cast your vote from your address holding xPOLYCUB tokens

- Each address can only vote once. Multiple votes will not count

- Once cast, you cannot change your vote. Ensure you double-check before broadcasting your TX

- Voting is stake-weighted based on how much xPOLYCUB you hold - the more xPOLYCUB in your wallet, the more valuable your vote will be

- The vote will close exactly 5 days from when this post goes live (April 25th at Noon EST)

The Future of xPOLYCUB Governance

We're polishing the UI and after this test of the backend, we'll be getting ready to release the Governance UI in time for the next Governance vote.

We talked with some people at Splinterlands and the 2nd governance vote will likely be to add an SPS vault. What's so exciting about this?

ICYMI: SPS doesn't have a bridge to Polygon and much of their cross-chain liquidity has been hurt since a bridge update that they made. Neal mentioned in the last AMA that having a PolyCUB operated oracle for the SPS token on the Polygon Network could be incredibly valuable both for Splinterlands and for PolyCUB.

Splinterlands (SPS) would get a vault to trade and LP SPS tokens and earn POLYCUB yield. PolyCUB's Protocol Owned Liquidity strategy would operate an oracle with a 0.25% wrapping and unwrapping fee along with internal arbitrage to maintain the SPS-peg.

This works identically to pHBD which is already generating a lot of revenue for PolyCUB's PoL and continues to grow each day.

The other amazing aspect of this - when combined with xPOLYCUB governance - is that we're taking a "Curve.Fi" approach to vault yields.

This means that there will be regularly scheduled proposal votes to change or keep yield the same across the platform. If SPS holders - the Splinterlands community - want SPS to get listed and gain more yield over time, then they'll need to buy POLYCUB and hold xPOLYCUB to ensure that their vault continues to stay within the vote.

Other communities - like the POSH token - have expressed some interest in a similar setup. If they want to get listed on PolyCUB, they can launch a proposal and then vote it up with xPOLYCUB to get listed. Continuous proposals on where yield should be directed will be governed by xPOLYCUB holders.

Community Whale Wars

The Curve Whale Wars are a continuous battle over the platform rewards for the largest DeFi platform in the world. xPOLYCUB governance is modeled after this. With pLEO, pHBD, SPS and potentially other Hive-based communities like POSH listed on PolyCUB and earning yield, can you imagine a fight for continuous control over vault yield through xPOLYCUB governance votes on a regular basis?

Let the xPOLYCUB Governance Wars begin.

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Posted Using LeoFinance Beta