If you've been keeping up with the latest LeoFinance content - both written posts and video clips from the weekly AMAs - we've been talking disproportionately more about HIVE lately.

It's become clear that there are going to be a few winners in the coming bull market. We believe that decentralized protocols with real-world utility are going to make their ultimate debut on the stage of this next bear-bull cycle. We're seeing it take place right now with air tokens like FTT going poof.

This is an important time to focus on building real utility for tokens. BTC, naturally, is chief among the "real utility" aspect of cryptocurrencies. HIVE is a close second for us. We've always held a strong belief in the long-term value and mission of Hive - making this obvious by building our entire project with Hive as the central pillar - but recent changes to HBD and the Hive ecosystem have drastically improved our outlook (even more bullish than it already was).

One issue in the crypto space is decentralized liquidity. It's an issue for many cryptocurrencies. BTC has solved it by being the big dog in the space - almost every crypto asset has a pair to BTC on one exchange or another. This has a natural effect of spreading BTC out onto as many exchanges as possible.

It's one of the many reasons why BTC is least affected by things like the FTX Exchange meltdown. If all of the BTC in circulation was concentrated to FTX, then we would see an even greater plummet in the BTC price as FTX would sell off all that BTC they're holding and scare the market even more than they already have.

Hive is one of the most decentralized blockchains in the space... but liquidity is highly centralized to Upbit and Binance... it's time to change that!

Great efforts are being made on the internal market and with Hive-Engine. These efforts cannot go understated. It's so ridiculously important that we build as many outlets for HIVE & HBD trading as possible.

This is not about competing with each other. It's about building multi-variate exchanges to spread out the liquidity and trading volume of HIVE & HBD. That's how we - as a blockchain ecosystem - become anti-fragile.

Our Vision to Build a Deeply Liquid Derivatives Exchange for Hive & HBD

It is no secret that CUB has not performed well over the last several months (the last year, actually). CUB's previous model was inefficient. It lacked real utility - the main source of revenue was from autocompounding vaults (kingdoms) but these didn't generate enough revenue to outpace inflationary pressures.

We spent so much time trying to figure this out and crack the code on generating revenue for a DeFi protocol. Little did we know that the answer was right in front of us the entire time: Hive.

Hive - with no surprise - is the solution to our revenue problem and we can be a solution for the Hive liquidity problem.

Make no mistake: we are not the end-all-be-all. There needs to be many different projects - Hive-Engine, the Internal Market, etc. - that all spread out liquidity. We believe CUB will become a key player in this with the bHIVE and bHBD derivatives.

Our mission is to deepen the liquidity. It helps Hive and it also helps CUB through real utility: generating disproportionate revenue on the Multi-Token Bridge. Last month, we generated $8,000 in revenue from the Multi-Token Bridge (HIVE/HBD wrapping fees, arbitrage revenue and on-chain oracle staking).

Where CUB is Headed

CUB has done a complete 180 to change direction here. We are now focused on growing the use case of the derivatives: bHBD and bHIVE.

Our focus is on adding more utility to these derivatives and ultimately deepening the liquidity of them on the BSC Blockchain. This is just another way to decentralize the liquidity and trading volume of HIVE & HBD.

Now that you know the broad-based vision of CUB, below you'll find some pieces of the new roadmap. We're actively working on these now and our efforts are all aimed at building more utility and liquidity for bHBD & bHIVE.

CUB Variable Staking

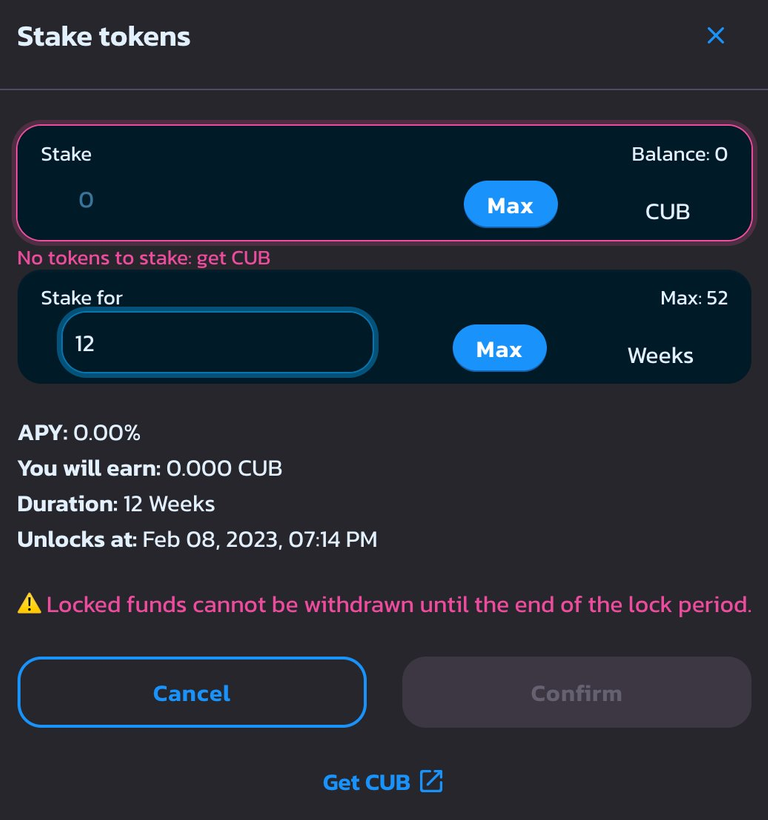

The newest feature release on CUB should land this week (if testing goes according to plan). This will replace the current CUB Kingdom and allow anyone to stake CUB for a preset amount of time.

You can flex stake CUB for a low APY with instant liquidity or you can lock your CUB for anywhere from 1 week - 52 weeks. This will allow you to earn more APY the longer you stake.

This development adds utility to CUB as you tap into the MTB Earnings Potential + More APY the longer you stake as opposed to people who want to keep their CUB liquid to sell. #GameTheory has arrived to CUB Staking.

... This development also seeds to ground for the next idea on our roadmap:

HIVE & HBD Bonds

Hive & HBD bonds are something that a few key players on Hive have talked about. @taskmaster4450 wrote a number of posts talking about this idea.

With the development of our CUB Variable Staking contract, we believe we can port this over into a bHIVE & bHBD bond contract.

This would allow you to single-sided stake HIVE & HBD.

How many of us are worried about Impermanent Loss? The number is actually quite high. We've seen many people saying that this is one of the reasons they don't like liquidity pools.

They would much rather stake HIVE by itself and/or HBD by itself than be exposed to potential impermanent loss in a liquidity pool.

Single-Sided staking was just released on Thorchain for native coins like BTC, ETH, etc.

This has inspired us to release a HIVE & HBD single-sided stake in the form of a variable staking bond. We are going to test this on CUB first and then roll it out for bHIVE & bHBD if everything goes well.

Imagine if you could stake your HIVE or HBD for anywhere from 1 week to 52 weeks and earn high yields for doing so.

But What About Productive Liquidity?

Thorchain is using Synths to allow their single-sided staking pools to generate productive Liquidity Pool capital. Deploying these bonds for HIVE & HBD will allow us to do a similar model and deepen the liquidity of bHBD & bHIVE while allowing users to single-sided stake the assets.

CUB DAO

The CUB DAO has been growing. Revenue continues to grow month-to-month and burn activity has grown exponentially. Yesterday, we just crossed 1.5M in total CUB burned with 400k burned in the month of October and likely the same (or higher) burned in November.

This is a great thing for CUB. It turns out that building a HIVE & HBD derivatives smart contract can be highly profitable. Who woulda thought!

At the same time, buybacks and burns of CUB has been increasing the APY (accordingly with price) for the bHBD and bHIVE Liquidity Pools.

This creates a pinwheel effect for bHBD and bHIVE liquidity: as more liquidity enters the pools, more revenue is generated by the DAO, more CUB is bought and burned, CUB APYs increase, more liquidity enters the pools 🔂

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta