Once we complete some final testing, we're going to deploy the PolyCUB Bonding Protocol. The bonding protocol allows users to trade LP assets with PolyCUB's Protocol Owned Liquidity.

There are some large mechanisms at play here and many people have asked how bonding will work on PolyCUB in our recent AMAs.

The images in this post are screenshots of the UI for PolyCUB's New Bonding Protocol.

Bonding: The Future of PolyCUB

Bonding is without a doubt a key component of the sustainable future we have envisioned for POLYCUB.

The PolyCUB ecosystem is set to grow over time. That is, xPOLYCUB is designed as a number forever go up token - where the value of xPOLYCUB in POLYCUB terms is designed to always increase. Stake 1 POLYCUB in the xPOLYCUB vault and you know that tomorrow you can pull out more POLYCUB and 10 years from now, even more.

The POLYCUB token itself in USD terms is designed to accrue value as well. It accrues value primarily from Protocol Owned Liquidity.

We've designed Protocol Owned Liquidity to grow from 3 mechanisms:

- Management Fees on Kingdoms

- Bonding

- Collateralized Loans on xPOLYCUB Stake

Through these 3 mechanisms the amount of Protocol Owned Liquidity will also be a number forever go up vault. The amount of assets sitting in PoL will continually rise over time from these mechanics which bring about:

- A Higher Risk-Free Value on POLYCUB

- Exponentially Compounding Value in the PoL

- Value Accrual Forever

In a series of posts, we'll dive deeper into these mechanics. Today's post is focused on PolyCUB's Bonding Protocol, how the UI works and how it works behind the scenese. Let's dive in!

Bonding UI

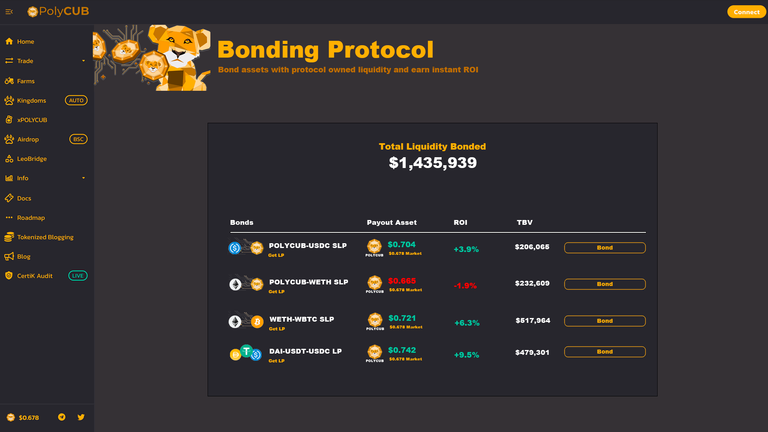

When you land on https://polycub.com/bonding (not live yet), you will see the currently available bonds and their respective metrics.

Let's run through the data points you see here:

- Total Liquidity Bonded - this is the total amount of liquidity that has been deposited in bonds (user deposits into the bonding contract)

- Bonds - the list of available bonds. You can see 4 bonds currently available here

- Payout Asset - the payout asset for PolyCUB Bonds is, unsurprisingly, POLYCUB tokens

- ROI - this is the current Return on Investment of each bond. Bonds can be positive or negative ROI (as seen above)

- TBV - this is the Total Bonded Value for each bond (simply, the USD value of LP Deposits into that bond)

- Bond Button - the bond button opens up a pop-up dialogue where users can interact with the bonding contract

Interacting With a Bond

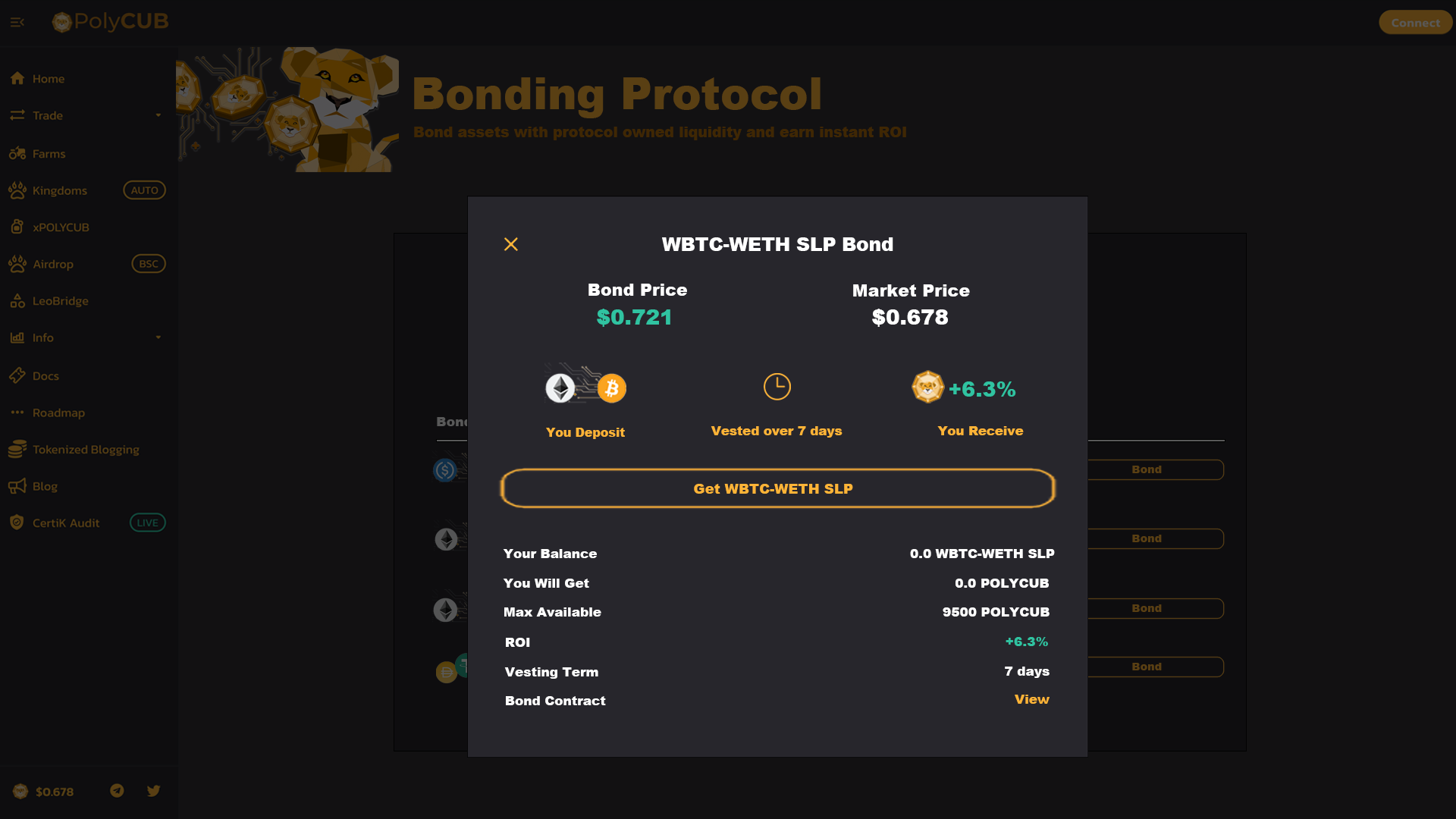

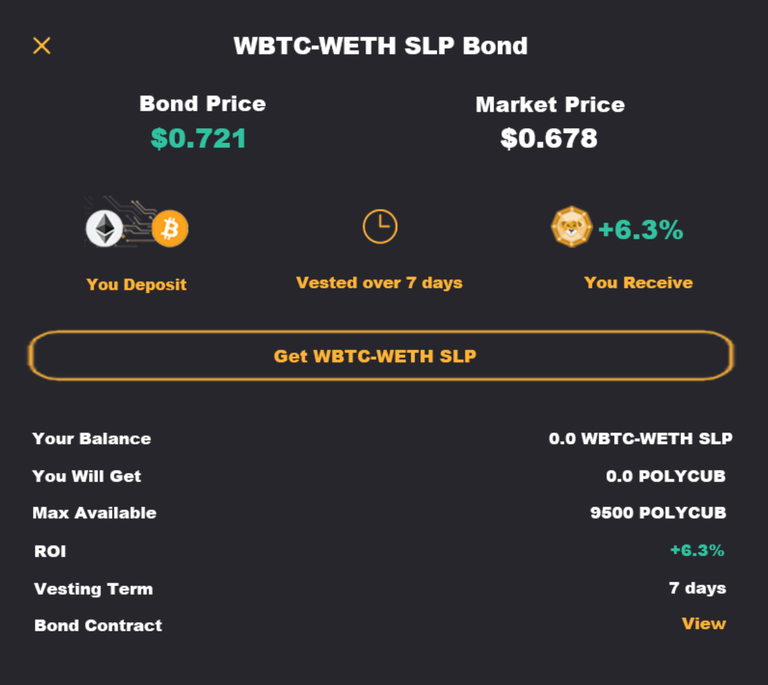

Much of this data is the same from the homepage of the Bonding Protocol UI. This data shows a specific bond (in this window, you see the WBTC-WETH SLP Bond).

Note: in testing, a few users asked what SLP stands for. SLP simply stands for "sushi liquidity pool" token. It's the LP Token you get to represent you position in any liquidity pool on Sushiswap. Note how the first 3 bonds are labeled "SLP" and the 4th is labeled "LP" since the 4th is on Curve and not Sushiswap.

Some other data points you may notice are the following:

- Vesting Term - this is the time it takes for the bond to 100% vest. Note that the bond vests continuously over time and you can partially claim the bond whenever you want, so after 24 hours, you'll be able to claim ~14.28% of the total POLYCUB you're owed from the bond

- Max Available - this is the maximum POLYCUB that can be received via this particular bond at this particular moment. Note that this amount is continuously increasing and then decreasing when any user bonds (think of it like a dynamic pool of POLYCUB that is available to be purchased via the bond. This pool increases/decreases in a variable manner)

Bonding Example

- User A deposits $300 worth of WETH-BTC SLP tokens into Bond #3

- $300 is added to PolyCUB's Protocol Owned Liquidity where it is utilized to autonomously stake, earn rewards and use those rewards to buyback POLYCUB and distribute back into the POLYCUB Rewards Pool

- User A locks in whatever ROI is currently available (+6.3%)

- User A is now owed $300 + 6.3% of their deposit, paid out in POLYCUB

- Over 7 days, User A is distributed POLYCUB tokens at whatever market prices they locked in ($318.9 worth of POLYCUB @ the market price of POLYCUB when they initiated their bond: $0.678 in the above case)

- User A can continuously claim their bond over the 7 days or wait the full 7 days and claim 100% in one click

Questions About Bonding?

Please drop a comment below, we'll be responding to your questions and may collect a few to discuss on the next Live LeoFinance Weekly AMA!

What's Next?

We're currently doing final testing on the bonding protocol and are hoping to have it released by the end of this week. Likely around the time of the next rewards "halvening" for POLYCUB, as that would be yet another bullish metric to coincide with for POLYCUB.

We built this protocol in parallel on both CUB and POLYCUB. We're releasing it on POLYCUB first - as it is more time sensitive with us being just weeks into the launch - once we deploy it on POLYCUB and have bonds rolling smoothly, we'll deploy it on CUB and begin building CUB-based Protocol Owned Liquidity as well.

The future of sustainable DeFi has arrived (🦁, 🦁)

Posted Using LeoFinance Beta