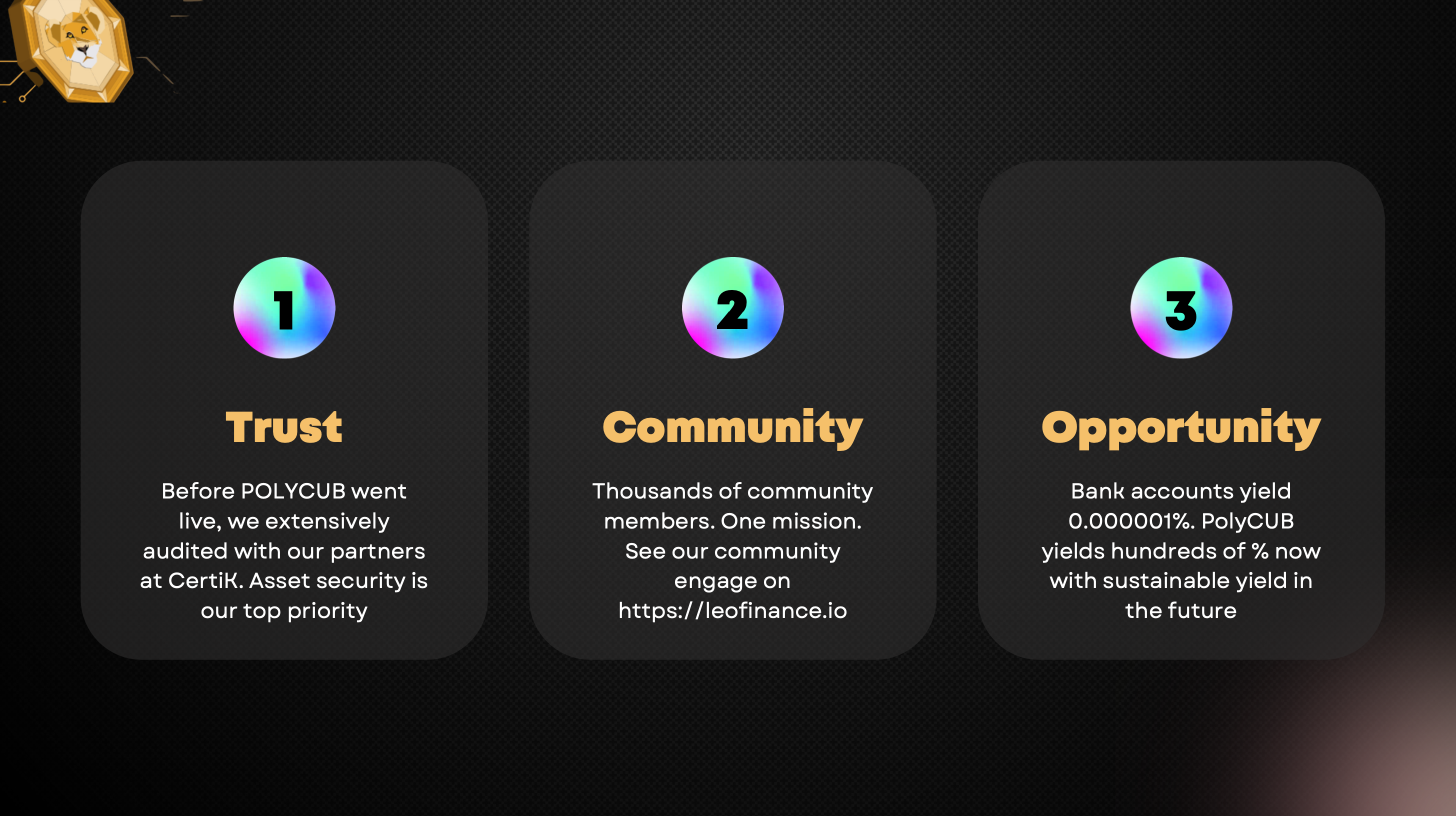

POLYCUB is undoubtedly one of the most interesting experiments in the entire DeFi space right now. What we've built is our attempt at the first DeFi 2.0 Yield Optimizer with a native asset (POLYCUB) that is a "hard asset" - much like BTC - which is designed to accrue value for its stakers (xPOLYCUB Hodlers) in the long-run.

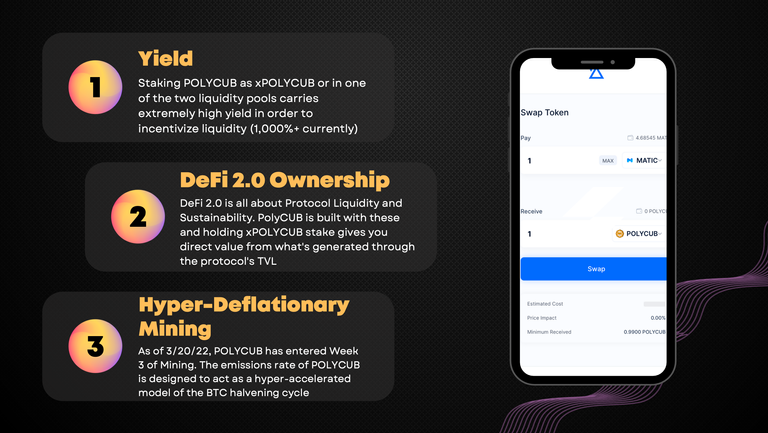

The hardcore mechanics of PolyCUB is what changes the entire game:

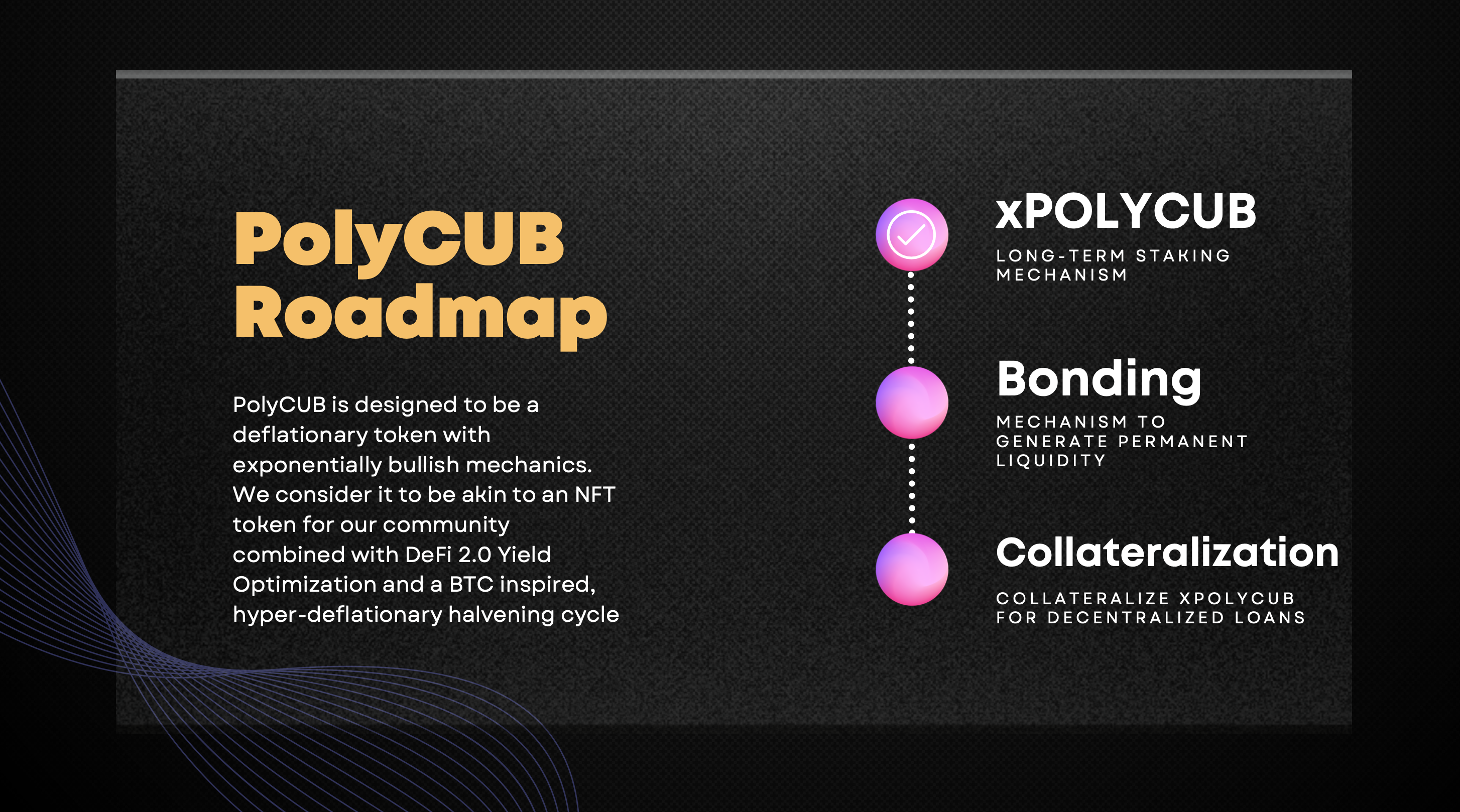

- xPOLYCUB

- Protocol Owned Liquidity

- Bonding

- Collateralized Lending

- xStaking Amplification

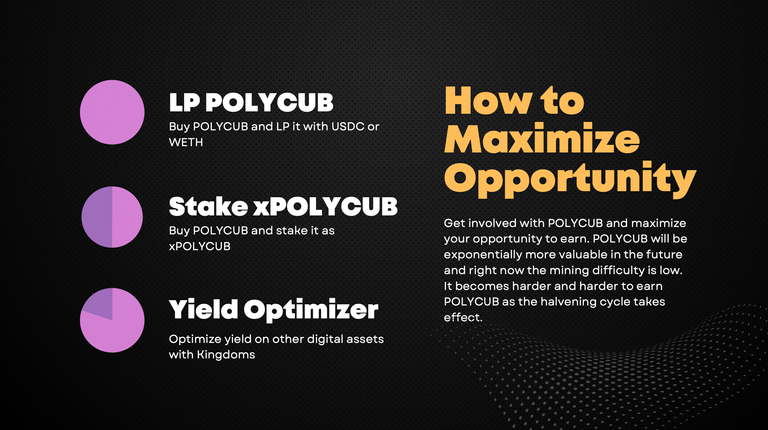

This post will focus on the basic overview of PolyCUB - as we have pitched it to VC groups, DeFi investors and many others. We've had our first round of meetings this week and have dozens of others lined up to get the POLYCUB platform in front of a wider group of our target demographic: people looking to LP assets and optimize yield on the Polygon Network.

The following is a Pitch Deck that we've been using in our showcase of PolyCUB to DeFi investor groups over Zoom calls. It outlines the value proposition of PolyCUB as a platform and gives a quick overview of the platform mechanics and how we're building POLYCUB to be a 3-10 year game-changer in the Polygon Ecosystem.

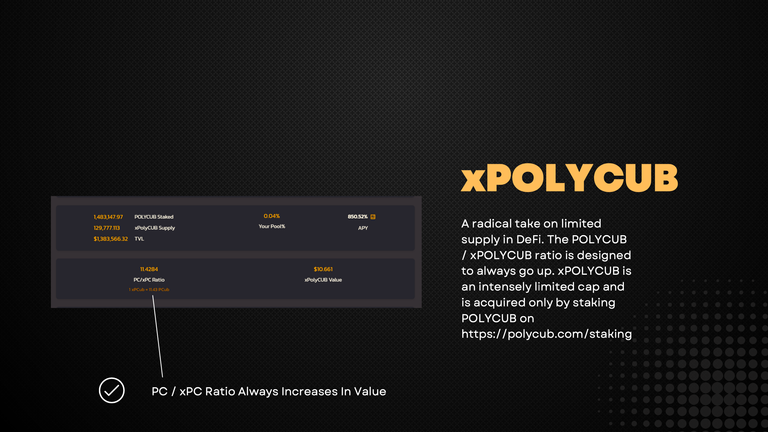

The ones who see PolyCUB in this way are stacking xPOLYCUB like there is no tomorrow. The bet that xPOLYCUB Diamond Paws are making is on the idea of POLYCUB as a scarce asset that will earn yield in perpetuity. This yield is driven right now by emissions rate - which is designed in the early days to spread the token out.

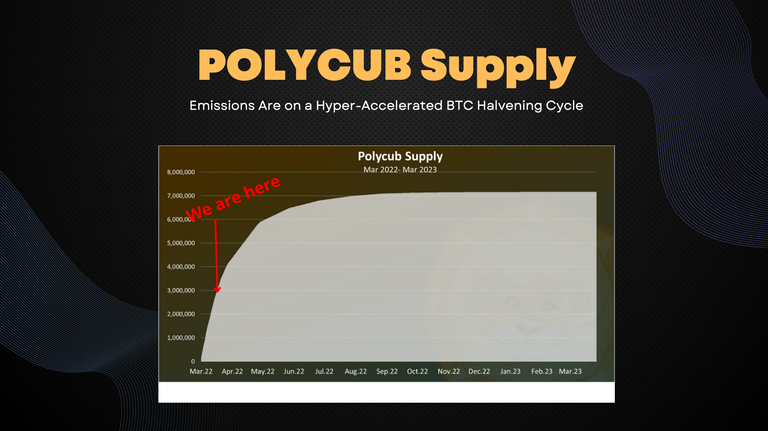

In the long-run the emissions cut off (as seen in some posts by @dalz.shorts). Once the emissions rate ends (or is near-zero) around July/August 2022, then the Protocol Liquidity flips on and starts buying POLYCUB to distribute it as LP Incentives on the platform.

The amazing thing about POLYCUB is that we're distributing a highly scarce asset into the hands of our diamond paw community. Then, we flip on the mechanics for PoL, Buyback and Distribute, Collateralized Lending and xSTAKING Amplification.

PolyCUB is the most unique yield optimizer on the planet. Right now, we're still in DeFi 1.0 mode: distributing the token as far and wide as possible. Over the coming weeks, the emissions curve flippens and we'll see the entrance of DeFi 2.0 and incredible levels of sustainable growth for the next 3-10 years. This is a long-term play, if you're looking for short-term gains, go back to DeFi 1.0!

This pitch deck is available in this post and also on the PolyCUB Docs. Please share it far and wide. Spread the message of POLYCUB and how it is changing the future of yield optimization on the Polygon Network 🦁

https://docs.polycub.com/polycub-pitch-deck

PolyCUB Pitch Deck

Get a quick overview of POLYCUB and the future of the first-ever DeFi 2.0 Yield Optimizer!

Posted Using LeoFinance Beta