Context

The past 12-24 months have been rough for a wide array of reasons. Let me begin by saying that the INLEO team has built a wide-range of different technologies in this space. Some have worked incredibly well - like our flourishing Microblogging Platform that brought scalable microblogging to the marketplace or our one-click onboarding protocol which has been vastly iterated and improved upon, allowing users to sign up to Hive in under 30 seconds.

That being said, we've also built some products and protocols that haven't flourished. We've worked hard to try and find ways to make them work, but in the process of iteration and building, you will fail sometimes and succeed other times. Failed launches are a part of the game. We must learn our lessons and continue to iterate.

Most startups go out of business because they fail and then quit. INLEO has never been like this. We hit roadblocks, we try different approaches but we ALWAYS get back onto the field and keep pushing forward.

The bear market that hit crypto right as POLYCUB was released into the wild took a massive swing at us. Combine that with the overall downturn of DeFi in general after the hot and heavy DeFi summer and it was nearly disastrous. We were on the verge of not making it as a community, ecosystem and project. The market downturn was enough to wipe out many small crypto projects. INLEO continued to build. We tightened our ship, sharpened our pencils and looked for ways to innovate throughout the bear market: launching the brand new inleo.io app, new onboarding protocols and dozens of iterations to both.

The LEO ecosystem expanded into DeFi with the goal of onboarding more users to Hive, bringing in new capital and ultimately growing toward an abundant ecosystem that we've long-been envisioning.

The goal with bHBD, bHIVE and other wrapped assets was to bring Hive to DeFi. Our aim was always to grow the capacity of Hive's reach into the DeFi world.

Some fundamental flaws in DeFi arose not only on CUB/POLYCUB but across the entire landscape. When you look to any liquidity mining protocols, nearly none of them still exist. Market research shows that over 99% of these platforms have gone completely to 0 and their founding teams have completely vanished.

Only a handful of the big dogs remain: Pancakeswap, Sushiswap, Uniswap. Outside of these, not much is still out there. We continued to develop and try to make CUB/POLYCUB work by any means possible. We tried so many iterations. Releasing new contracts, new interfaces, new vault pools.

Then we released the Multi-Token Bridge with bHBD, bHIVE, pHBD, pHIVE. The goal with these were two-fold:

- Bring the Hive Ecosystem to DeFi and expand the DEX listings for HIVE & HBD trading

- Create a sustainable revenue stream in the form of wrap/unwrap revenue on the bridge that could be used to generate value for the CUB/POLYCUB tokens

In the end, not enough capital flowed into these projects to really take them off the ground. The circulating liquidity of the wrapped tokens were so small that they were easily manipulated.

By the time we found out how these pegs were being manipulated, it was too late. Tens of thousands in value had been arbitraged away or otherwise manipulated via the wrap/unwrap protocol.

We looked for ways to prevent the bleeding of liquidity from the pools but when word started spreading about it, LPs began withdrawing liquidity. This created a cascading effect that only amplified the liquidity problems that were originating from the manipulation of the pegs.

The pegs de-pegged quickly and assets were quickly vampired out of oracles. As this happened, the wrap/unwrap protocol was exploited even more deeply.

The Reason For this Post

Now that some context has been laid, you probably have a sense for why this post is being made. This topic and nearly everything in this post have already been discussed by us in many places. If you keep up with INLEO team updates, blog posts, threads, comments, discord chatter and the weekly LIVE AMAs that we host, then you probably have heard everything mentioned in this post.

But it has recently come to our attention - namely because of the sunsetting of CUB/POLYCUB - that there are many people on Hive who have not heard of the full story. They haven't been watching, reading and engaging with our updates over the past 6-12 months about the inevitable unwind and sunsetting of CUB/POLYCUB.

The goal of this post is to concisely (as concisely as possible) explain the situation, why we're unwinding and how we're aiming to make the sunset as beneficial as possible to the core users. Our goal in all of this is always to take care of the end users. We hope that is clear and this post aims to clarify it all in one place.

Sunsetting bHBD, bHIVE, pHBD, pHIVE

If you've been keeping up with our regular updates, threads, blog posts, discord messages and LIVE AMA sessions each week, then you will know that we are sunsetting the CUB/POLYCUB platforms.

I'll allow you to dig into prior blog posts from this account on Hive @leofinance if you want the more intricate details on that sunset program for those two platforms and their respective tokens. This post will sit at a higher level than those granular, actionable posts.

What has been discussed within our community for the past several months is finding a positive path forward for bHBD and the other wrapped HIVE/HBD assets. As we've said over the past several months: we managed to stop the ongoing issues with bHBD but there was already a lot of bad debt that proliferated on the BSC side of the bridge.

We've been quietly unraveling bHBD over the past 6 months. Some of you already know this because you've opened tickets and worked with us one-on-one to unravel your bHBD back to on-chain HBD.

When I say "quietly" I simply mean that we didn't announce it continuously. It was still talked about in countless AMA clips, Threads, Blog posts, Comment Sections, etc.

We just purposefully kept the discussions localized to prevent everyone from running for the exits at the same time. This is an important part of the unraveling process. If everyone were to unravel on the same day we would see a severe bottleneck issue.

Instead, we tried to spread out the sunset program as much as possible. The goal of spreading this out is quite obvious: sunsetting all at once can create a massive upset, a ridiculous load of tickets in tech support and completely overwhelm our team from a resource perspective. We're trying to right the ship, but sometimes you can't just make a 180 degree turn. You have to take the turn in strides.

Nearing the Sunset

We are nearing the end of this unraveling process. Now is probably going to be the most turbulent of times. We are already seeing it as some random people are coming out of the woodwork and accusing LeoFinance of all sorts of things from theft to lying to misappropration.

These baseless claims have no basis in reality. What I've seen is that most of these people haven't kept up with our updates in any way, shape or form.

Instead, they've come back out of the woodwork because they see that CUB/POLYCUB are being sunsetted and instead of taking the time to read, listen and engage with us to learn more, they are coming out of the gates with accusations as if the information was never made public.

Let's be very clear: the information is public and on the blockchain. That's what Hive is all about. Just because you didn't see a piece of information, doesn't mean that info doesn't exist. To accuse our team of lying or manipulating without knowing these basic facts and proving your claim with evidence can be detrimental to our project, as much of it relies on community sentiment and engagement. The goal of this post is to have a singular link to send to people like this so they can see the context and workings of the sunset plan for these protocols.

Now many are wondering what to do with their bHBD. This is fine, we have protocols in place to handle this.

What isn't fine is that some people have decided to spread lies and FUD about our process of sunsetting these assets. We have put these plans into place to ensure that users are taken care of. Our #1 priority is ensuring that people are made whole on these wrapped assets to the best of our ability. We are not saying that it is going to be the smoothest journey ever and we'll all ride off into the sunset. This is an arduous process and our team is doing the best we can. If you have a dispute, we ask that you bring it up to us and provide some context (usually in the form of TX Links from block explorers) so that we can work the situation out with you.

99% of people have been amazing to work with. Helping us find transactions on-chain and resolve any misunderstandings that may arise. A select few, not so much.

The roadmap of sunsetting bHBD and the other wrapped assets is multi-fold:

- Implement a 13 week power down for unwrapping large quantities of bHBD

- Attempt to spread out unwraps (which we've done successfully) so that not everyone unwraps simultaneously and causes strain on our systems and our team

- Close the circulating supply gap of bHBD and the other wrapped assets

- Re-Peg the assets

- Sunset the assets completely

This process has been ongoing for 6 months now.

If you're wondering why there is a lot of noise about it - and a lot of complaints - all of the sudden, it can be pointed directly to the CUB/POLYCUB sunsetting. Now that we've publicly announced this all over the place, a lot of people are coming back and are not well informed of what has happened since they left.

Instead of catching themselves up to speed, we're hearing a lot of misinformation. Let's use this post as an opportunity to put everything in broad daylight (which again, has been discussed across dozens of blog posts, AMAs, comments, threads and discord chatter along with on-chain transaction links proving all of it).

Let's Be Clear

I want to make sure that a few things are crystal clear:

- No users will lose money on bHBD and the other wrapped assets

- All Unwraps are being honored and HBD is being sent on-chain

- bHBD and the other wrapped asset bridges were paused over 6 months ago

Some of the accusations circulating are that LeoFinance is somehow stealing funds by not honoring 1:1 unwraps.

This is simply not true. The program we instilled 6 months ago states that unwraps are honored based on what the user paid for the bHBD they bought. If the user wrapped HBD to bHBD, they are honored 1 HBD for 1 bHBD. A USER CANNOT LOSE MONEY in this scenario. If a user claims they are losing money, it is because they have not worked with us in a ticket to unwrap their bHBD properly. If you open a ticket, we will ask you for on-chain TX links/data. This helps us greatly. We even offer to find it for you if you can't.

Again, we're trying to work with everyone and make this sunset transition as smooth as possible. But I hope you can appreciate that every situation is unique and it can often take us several hours per ticket to find the hard data that we need to process a refund.

To keep this simple, I'll illustrate how this works with an example. There is bad debt in the system and we have been working to clear it out. bHBD was de-pegged on BSC from its $1 price.

This means that users are able to buy the bad debt and attempt to unwrap it. The initial stages of this are the reason for the liquidity crunch and further wrap manipulation.

So if a user buys 100 bHBD right now, they can do so for about $60. Spend $60 and get 100 bHBD.

How is this possible? Bad debt. They are able to buy this bHBD at a steep discount to what the intended peg price is.

When this user goes to unwrap, they will get 60 HBD on-chain for the 100 bHBD they unwrap.

But this is unfair!? How can this be?!? LeoFinance is stealing $40 from me!?

These statements are all untrue. If you spent $60 to get 100 bHBD and unwrap it to HBD, we are giving you 60 HBD ($60 worth of HBD) (again keeping other variables the same for a simple example).

This means that you are not losing a single penny if you were to buy bHBD and unwrap it. What you are losing is the opportunity to profit $40 on instant arbitrage.

There's a reason we paused the bridges and put a cap on this arbitrage. The bad debt that is circulating would drown us in payments to get back to 1:1. So instead, we are honoring unwraps at a $1 for $1 basis. This prevents users from losing money but it also prevents users from profiting on other users through further de-pegging and bad debt.

So spend $60, get $60. Not spend $60 get $100. However some people haven't kept up with the updates and thus, haven't realized this is the case. So they buy, unwrap and expect to make some enormous profit. Then get mad when they are told otherwise and pointed to months worth of content explaining why/how the bridges were paused and the current status of sunsetting the protocol.

Back to the Sunset

You can see how messy this whole situation is and it's difficult to even write this post and explain it all concisely. I'm trying to keep us at a high level and inform but like I said: there is months worth of content on this whole situation. If you want the full historical breakdwon of all this happening, the content is all out there for you.

That being said, the goal is to sunset bHBD and the other wrapped assets alongside CUB & POLYCUB as platforms and tokens.

We're trying to do all of this in the most fair way possible. We are trying to make people as whole as possible. With the CUB/POLYCUB migration, we are allowing CUB/POLYCUB holders to burn their tokens in order to get LEO so that we can completely sunset CUB & POLYCUB as platforms and focus our team's resources and energy on making LEO a homerun success as an ecosystem.

Our mission from day 1. To build an incredible ecosystem. As part of that mission (and as a large HIVE stakeholder and investor in Hive-based developments) I also want to proliferate HIVE/HBD trading and bring Hive to the broader marketplace - that is the entire point of bHBD in the first place.

More on that last bit later in this post.

When Will the Sunset Be Complete?

CUB/POLYCUB have 3 more weeks of LEO airdrops until the sunset is complete. Users have these 3 weeks to burn their CUB/POLYCUB. In exchange, they're receiving LEO, liquid in their wallet.

After the next 3 weeks are over, the supply of CUB/POLYCUB should trend toward 0. The majority of these two tokens will get burned in this sunset event by all the current stakeholders.

bHBD, bHIVE and other MTB assets are also on a path to sunset. They have been on this path for about 6 months now as we have tried to slowly unwind them.

Now that the CUB/POLYCUB sunset has been announced, a lot has surfaced and a lot of people are now trying to unwrap and unstake all at once. This is totally fine and since we have already helped sunset most of the bHBD out there we are now prepared for the finality of this sunset program to take place.

The circulating supply of bHBD and the other MTB assets will also trend toward 0. You can track all of this on-chain.

I believe another ~18,000 bHBD will get unwrapped. That is our current estimate. After this 18,000 bHBD exits the circulating supply, we'll consider the sunset of the MTB to be complete.

This being said, some holders may not be active right now and may come to us later and open a support ticket to unwrap bHBD. We will still continue to honor these unwraps (as we always did) via support tickets and processing them manually. This is a time consuming process, but like I said - we are nearing the end of the sunset. The ticket volume after the CUB/POLYCUB/MTB sunset is complete (around 3 weeks from today) will decrease signifcantly and this will free our team up to continue focusing on bringing value to Hive through our developments of the INLEO ecosystem.

Can I Track the Status of the Sunset?

Yes, you can track all of what we're talking about on the blockchain. BSCscan is a great place to track the status of CUB and the BSC MTB assets. Polygonscan for PolyCUB and the Polygon MTB assets.

You can also look at the total circulating supply vs burned supply of CUB & POLYCUB. Around 23% of the CUB supply has now been burned. We'll continue to see this trend upwards as well as the POLYCUB supply. The MTB assets will continue to reduce their circulating supply (tokens not in the main cold wallet for the bridge). You can track all of this on-chain.

Our goal is to have the majority (if possible, all) of the pending tickets, unwraps and CUB/POLYCUB sunsets done in the next 3 weeks.

Like I said - don't just take our word for it. Track it all on-chain. We've been working so hard on this for 6 months and we're in the final stages of getting this completed so we can sunset failed projects and continue focusing on new and exciting innovations from our team.

If you have a ticket open, I ask that you please be patient with our team. We are doing the best we can and working through some insane ticket volumes since the CUB/POLYCUB sunset announcement. If you have an open ticket, we will get to you as soon as we physically can. Thank you.

Our Path Forward

Our path forward as an ecosystem is a bright and abundant future. Did LeoFinance tuck tail and run when things went south? No. We kept building, kept iterating, kept launching new contracts and updates. We kept trying to make the protocols successful.

We are now entering a new era of the INLEO ecosystem. We are consolidating these old and failed projects (CUB, PolyCUB, Multi-Token Bridge) and we are moving forward. We are bringing everything under our "Everything App" vision and building a thriving economy around the LEO token.

We've launched https://inleo.io last May and it was incredible. 2 years spent building "The Everything App" for Hive and I think many of you can agree that we've made some disproportionate progress toward our goal of building a thriving creator economy with microblogging and long-form content creation living at the heart of it all.

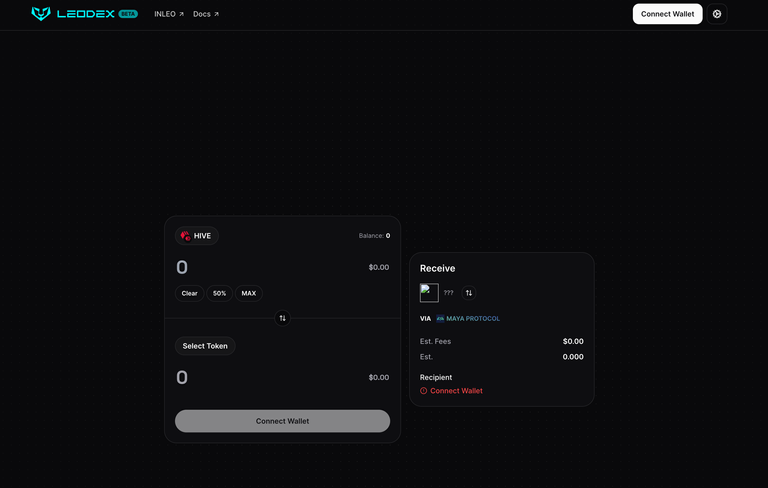

INLEO is about to launch LeoDex.

LeoDex is a multi-chain interface that is powered by Maya Protocol.

BUT... we've made some changes.

Bringing Hive to the Masses

Remember our goal of bringing Hive to DeFi? Onboarding new users and new capital to the ecosystem?

This goal hasn't changed but our approach to it has. We spent so much time, money and effort to make the Multi-Token Bridge (bHBD) wrapped assets work. They didn't work. We are sunsetting them in the best way possible.

With the launch of LeoDex, we've worked with the Maya Protocol team to launch LEO on Maya.

LEO on Maya marks some incredible things. Not only is it a major DEX listing for the LEO token, but it allowed us to build something truly amazing.

We built a HIVE aggregator (this will also work for HBD post-launch).

What is a HIVE Aggregator?

It allows for HIVE swaps to occur on L1 rails through Maya protocol by aggregating the swaps through the LEO token pool on Maya.

So with this aggregator, you can swap HIVE (native HIVE) for L1 BTC or swap L1 BTC into HIVE.

It's decentralized. It's permissionless. There are no wrapped tokens.

What we've learned from bHBD, CUB, POLYCUB and the entirety of the MTB developments is a great deal of lessons.

These lessons are the shoulders we stand on as we move into this next phase of the LEO Ecosystem.

- We learned that the wrapped asset model won't work

- We learned that liquidity mining doesn't work in the long-run

- We learned that native L1 swapping rails are where the future is

Taking these lessons and moving forward is an incredibly prosperous path.

We are sunsetting these protocols right at the time when we are launching LEO on Maya and the LeoDex interface. There is a reason that all of this is happening simultaneously.

Are you starting to see the vision yet?

Our goal is and has always been to bring Hive to DeFi. Now we are doing it in an L1, Native manner. No more HIVE bridges. Just LEO aggregation on Maya Protocol Swap rails.

We're leveraging the incredible technology and power of Maya to bring true, L1 HIVE to the world.

No Investing Needed

I saw some chatter about the new LeoDex launch and people asking what the new ticker symbol will be.

To clarify: we have built LeoDex as a simple User Interface for the Multi-Chain exchanging future that is arising. Thorchain and Maya Protocol are doing incredible things and we aim to bring HIVE to these places and make it accessible on these decentralized, permissionless L1 rails.

- there is no token to invest in

- you don't need to own any LEO or any LEO-based assets

- there is no liquidity farming through a new token

We're building some incredible aggregation technology here. It is a farcry from what we attempted to do with CUB/POLYCUB/MTB. We learned a lot of valuable lessons.

If you want to swap some L1 BTC for L1 HIVE, we are enabling that. We have learned a lot of hard lessons the past 2 years and we are taking these lessons to heart as we build this new technology.

I believe LeoDex will introduce HIVE to the world of decentralized trading. We tried to make this happen with bHBD and bHIVE but it was unsuccessful because of the wrapped tokens and bridge issues.

Now, we are building something that is completely L1. L1 BTC in, L1 HIVE out.

As Maya Protocol expands, more L1 assets will become available to trade with HIVE. Then we will add HBD.

The future of this is incredibly bright. Let's sunset the old and bring in the new. Lessons learned and valuable takeaways brought into the next iteration. As a startup, continually getting up when we get knocked down is at the core of our survival. Thank you for your patience and being a part of this journey every step of the way. 🦁

I hope this post put everything into clear, broad daylight. Again, there has been content about all of this for over 6 months now but with the CUB/POLYCUB sunset announcement, a lot of activity and old users have resurfaced. I hope this post helps clarify things for those who haven't been around for a while.

Posted Using InLeo Alpha